The Indian Rupee May Offer Relative Value

For definitions of terms in the chart, please visit our Glossary.

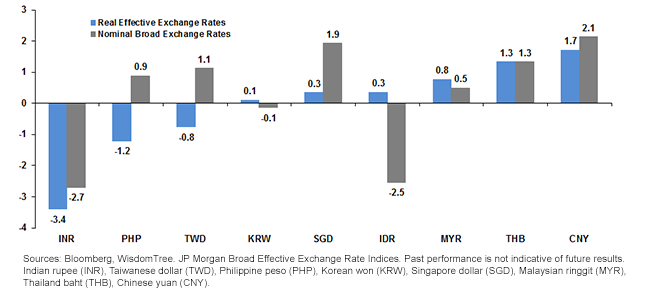

• We evaluated the current exchange rates in the context of their history over last 10 years and show, using a measure of standard deviation from its average rate over this period, how low or high the exchange rate values are compared to their own history.

• The real effective rupee exchange rate is approximately 3 standard deviations below its 10-year average. In other words, the rupee has traded at such inexpensive valuations relative to the U.S. dollar less than 0.1% of the time in the past 10 years!

• The broad nominal rupee, a measure of the currency versus its trading partners’ (without taking into account inflation), is also at historically cheap levels.

• The rupee has the most attractive valuations relative to its peers, as indicated by the largest negative bars in the chart above.

Conclusion

In our view, the rupee weakness should translate into improved exports over time, especially if some of the key trading partners such as Europe return to more positive growth. The European Union and North America together comprise almost 30% of India’s exports; improved growth in these regions combined with the rupee’s depreciation has the potential to be helpful to its exports. This could release pressure from the current account deficit situation and provide additional support for the currency.

For foreign investors, the Indian rupee has faced a substantial headwind in recent years. At current levels, we believe the rupee and rupee-denominated assets offer a comparatively attractive way to play a rebound in the Indian economy. With the recent appointment of Dr. Rajan as the head of the Reserve Bank of India, we believe that market sentiment has begun to turn. Although we acknowledge that a turnaround is far from certain, a combination of a historically cheap currency with attractively priced equities and bonds may pave the way for a rebound in the coming months.

1Source: Bloomberg

2Source: Reserve Bank of India (RBI), As of 9/20/2013

3Source: Bloomberg

For definitions of terms in the chart, please visit our Glossary.

• We evaluated the current exchange rates in the context of their history over last 10 years and show, using a measure of standard deviation from its average rate over this period, how low or high the exchange rate values are compared to their own history.

• The real effective rupee exchange rate is approximately 3 standard deviations below its 10-year average. In other words, the rupee has traded at such inexpensive valuations relative to the U.S. dollar less than 0.1% of the time in the past 10 years!

• The broad nominal rupee, a measure of the currency versus its trading partners’ (without taking into account inflation), is also at historically cheap levels.

• The rupee has the most attractive valuations relative to its peers, as indicated by the largest negative bars in the chart above.

Conclusion

In our view, the rupee weakness should translate into improved exports over time, especially if some of the key trading partners such as Europe return to more positive growth. The European Union and North America together comprise almost 30% of India’s exports; improved growth in these regions combined with the rupee’s depreciation has the potential to be helpful to its exports. This could release pressure from the current account deficit situation and provide additional support for the currency.

For foreign investors, the Indian rupee has faced a substantial headwind in recent years. At current levels, we believe the rupee and rupee-denominated assets offer a comparatively attractive way to play a rebound in the Indian economy. With the recent appointment of Dr. Rajan as the head of the Reserve Bank of India, we believe that market sentiment has begun to turn. Although we acknowledge that a turnaround is far from certain, a combination of a historically cheap currency with attractively priced equities and bonds may pave the way for a rebound in the coming months.

1Source: Bloomberg

2Source: Reserve Bank of India (RBI), As of 9/20/2013

3Source: BloombergImportant Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in China and/or India are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.