A Closer Look at Chinese Banks

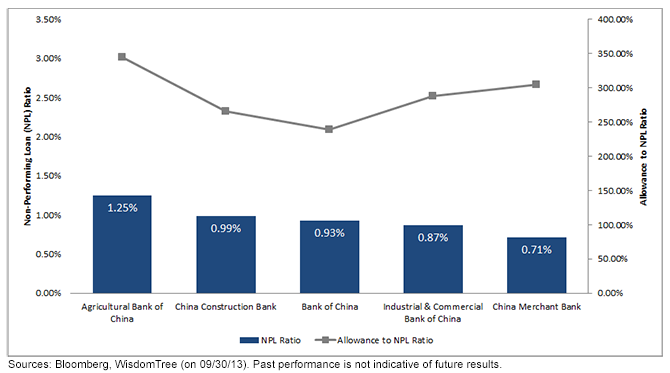

• Non-performing Loan Ratio Relatively Low: Many of the banks above have low non-performing loans relative to the size of their assets—many ratios are close to or below 1.00%. To put this in perspective, the five largest U.S. banks have an average NPL ratio of 1.78%.2

• Allowance to Loan Losses Relatively High: The Chinese banks also typically have a high amount of allowances, in the range of 3% of total loans—which is about 3x their NPL ratios. To put this in perspective, the five largest U.S. banks have an average allowance amount of just 1.65x.2 Chinese banks thus have a greater cushion in terms of already provisioning for larger loan losses.

• Asset Quality Discussion: I have discussed this asset quality question with Tracy Yu, a China financial analyst for Deutsche Bank. Her cash flow analysis of the Chinese banks suggests that NPLs are not being underreported. Her analysis showed:

o Cash Increase Matches Profit Increase: The increase in pre-tax profit of the H-Share-listed Chinese banks

from 2007 to 2012 was matched by their net increase in cash. This indicates that the loans performed as

expected and the Chinese banking profits were not accomplished through accounting gimmicks. If NPLs were

underreported, one would expect net profits to be higher than increases in cash.

o Another piece of evidence Tracy pointed to was the amount of interest income that comes from accruals

instead of cash payments: only 46 basis points of assets—which is better than comparable ratios in other

emerging markets such as India or Indonesia.

o Wealth management products (WMPs) are a source of concern, yet recent disclosure suggests that two-

thirds of the WMPs are invested in fairly conservative assets that are liquid. Only one-third of WMPs are

invested in riskier, less liquid assets, and these represent only 2.2% of total banking assets.

Chinese Banks Potentially Offer Attractive Valuations

Jiang Jianqing, chairman of the Industrial and Commercial Bank of China (ICBC), commented on the valuations of Chinese banks: “Since last year the market has been extremely suspicious of the Chinese banking sector. They’ve pressured our [price-to-earnings] and [price-to-book] ratios to low levels. Such good profits, such good returns, such good quality. We think it’s a little bit unfair”.4

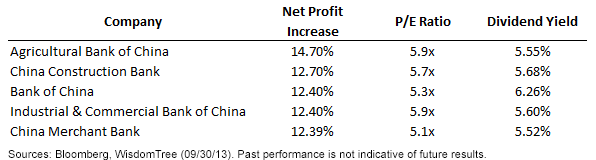

The chart below displays the most recent reported profitability (1H 2013) increase compared to the same period the year before and other valuation metrics for a few Chinese financials:

Fundamental Metrics

• Non-performing Loan Ratio Relatively Low: Many of the banks above have low non-performing loans relative to the size of their assets—many ratios are close to or below 1.00%. To put this in perspective, the five largest U.S. banks have an average NPL ratio of 1.78%.2

• Allowance to Loan Losses Relatively High: The Chinese banks also typically have a high amount of allowances, in the range of 3% of total loans—which is about 3x their NPL ratios. To put this in perspective, the five largest U.S. banks have an average allowance amount of just 1.65x.2 Chinese banks thus have a greater cushion in terms of already provisioning for larger loan losses.

• Asset Quality Discussion: I have discussed this asset quality question with Tracy Yu, a China financial analyst for Deutsche Bank. Her cash flow analysis of the Chinese banks suggests that NPLs are not being underreported. Her analysis showed:

o Cash Increase Matches Profit Increase: The increase in pre-tax profit of the H-Share-listed Chinese banks

from 2007 to 2012 was matched by their net increase in cash. This indicates that the loans performed as

expected and the Chinese banking profits were not accomplished through accounting gimmicks. If NPLs were

underreported, one would expect net profits to be higher than increases in cash.

o Another piece of evidence Tracy pointed to was the amount of interest income that comes from accruals

instead of cash payments: only 46 basis points of assets—which is better than comparable ratios in other

emerging markets such as India or Indonesia.

o Wealth management products (WMPs) are a source of concern, yet recent disclosure suggests that two-

thirds of the WMPs are invested in fairly conservative assets that are liquid. Only one-third of WMPs are

invested in riskier, less liquid assets, and these represent only 2.2% of total banking assets.

Chinese Banks Potentially Offer Attractive Valuations

Jiang Jianqing, chairman of the Industrial and Commercial Bank of China (ICBC), commented on the valuations of Chinese banks: “Since last year the market has been extremely suspicious of the Chinese banking sector. They’ve pressured our [price-to-earnings] and [price-to-book] ratios to low levels. Such good profits, such good returns, such good quality. We think it’s a little bit unfair”.4

The chart below displays the most recent reported profitability (1H 2013) increase compared to the same period the year before and other valuation metrics for a few Chinese financials:

Fundamental Metrics

Conclusion

It is impossible to know what the future will hold, but it is important to consider current valuations. Only very rarely do we find companies with dividend yields that are approximately equal to their price-to-earnings ratios. The market has a fundamental mistrust of the Chinese banking system—yet cash flow analysis suggests the asset quality of Chinese banks is better than many think. The Chinese banks receive much of their funding from strong deposit bases and are unlikely to need to raise more equity capital to fund their operations. I believe these companies’ high dividend yields make them attractive for income-oriented emerging market strategies.

1China Banking Regulatory Commission 2013 Half-year Work Conference on National Banking Supervision & Economic and Financial Situation Analysis Conference

2Source: Bloomberg, 9/30/2013.

3Source: Bloomberg, 9/30/2013.

4Gabriel Wildau and Lawrence White, “Investor Doubts Linger as China’s ‘Big Four’ Banks Top Forecasts,” Reuters, 8/30/2013.

Conclusion

It is impossible to know what the future will hold, but it is important to consider current valuations. Only very rarely do we find companies with dividend yields that are approximately equal to their price-to-earnings ratios. The market has a fundamental mistrust of the Chinese banking system—yet cash flow analysis suggests the asset quality of Chinese banks is better than many think. The Chinese banks receive much of their funding from strong deposit bases and are unlikely to need to raise more equity capital to fund their operations. I believe these companies’ high dividend yields make them attractive for income-oriented emerging market strategies.

1China Banking Regulatory Commission 2013 Half-year Work Conference on National Banking Supervision & Economic and Financial Situation Analysis Conference

2Source: Bloomberg, 9/30/2013.

3Source: Bloomberg, 9/30/2013.

4Gabriel Wildau and Lawrence White, “Investor Doubts Linger as China’s ‘Big Four’ Banks Top Forecasts,” Reuters, 8/30/2013.Important Risks Related to this Article

ALPS Distributors, Inc. is not affiliated with Deutsche Bank. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in China are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.