Microsoft: Example of Technology Sector’s Dividend Growth Leadership

Diversified Exposure to Dividend Growth

Although the technology sector is currently an over-weight, compared to the benchmark, the WisdomTree U.S. Dividend Growth Index is designed to provide a diversified exposure across all sectors. The Index rebalances annually in December, based on a defined set of fundamental metrics, and will tend to over-weight companies and, as a result, their sectors, which the Index methodology identifies as having the best potential for dividend growth.

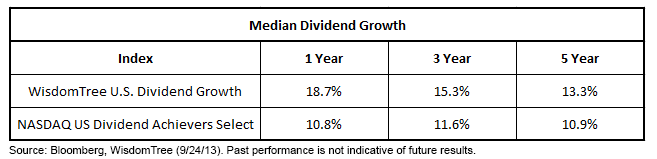

I believe this methodology provides a dynamic selection criteria designed to capture the current shifting trend in the U.S. dividend market. To represent the dividend market and capture its growth, we believe one must include these new up-and-coming dividend payers quickly within a dividend index methodology. The recent growth rates in dividends discussed above illustrate why this methodology difference in dividend indexes can have important implications.

For current holdings of the WisdomTree U.S. Dividend Growth Index, please click here.

1“Microsoft announces quarterly dividend increase and share repurchase program,” September 17, 2013. http://www.microsoft.com/investor

2Source: WisdomTree, Bloomberg.

Diversified Exposure to Dividend Growth

Although the technology sector is currently an over-weight, compared to the benchmark, the WisdomTree U.S. Dividend Growth Index is designed to provide a diversified exposure across all sectors. The Index rebalances annually in December, based on a defined set of fundamental metrics, and will tend to over-weight companies and, as a result, their sectors, which the Index methodology identifies as having the best potential for dividend growth.

I believe this methodology provides a dynamic selection criteria designed to capture the current shifting trend in the U.S. dividend market. To represent the dividend market and capture its growth, we believe one must include these new up-and-coming dividend payers quickly within a dividend index methodology. The recent growth rates in dividends discussed above illustrate why this methodology difference in dividend indexes can have important implications.

For current holdings of the WisdomTree U.S. Dividend Growth Index, please click here.

1“Microsoft announces quarterly dividend increase and share repurchase program,” September 17, 2013. http://www.microsoft.com/investor

2Source: WisdomTree, Bloomberg.Important Risks Related to this Article

You cannot invest directly in an index. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.