Differentiating Consumer Growth from Broad Emerging Markets

For definitions of terms in the charts, please visit our Glossary.

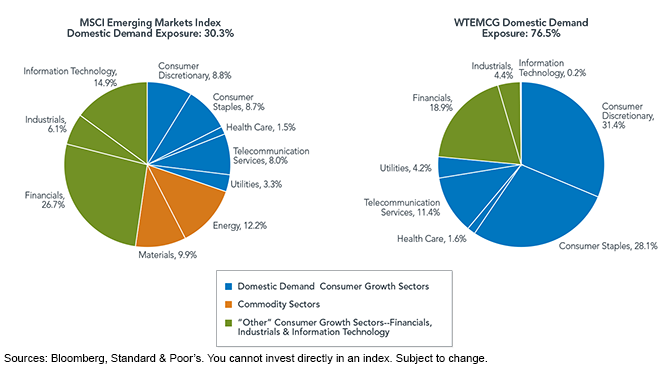

• Domestic Demand Consumer Growth Sectors: WTEMCG has over three-quarters of its exposure to this particular sector grouping, compared to the broader MSCI Emerging Markets Index, which has a mere 30% exposure. This shows a dramatic difference in the type of exposure between traditional indexes and WTEMCG, despite the broadly inclusive nature of WTEMCG, with stocks from eight of the 10 sectors.

• Commodity Sectors: We mentioned how these sectors (Energy and Materials) tend to be more globally sensitive. And while WTEMCG excludes them completely, the MSCI Emerging Markets Index has over 20% exposure to them. Many investors think of the emerging markets as being commodity driven, so one way to view WTEMCG is as broad-based exposure to emerging markets that takes away the exposure to the more commodity-sensitive sectors.

• Other Consumer Growth Sectors—Financials, Industrials and Information Technology: The most important element to remember about the firms within these particular sectors that qualify for WTEMCG is that they must pass the aforementioned geographic revenue screens. The MSCI Emerging Markets Index’s exposure to these sectors is approaching 50%, but these firms have not been subject to any geographic revenue screens and consist predominantly of large banks and global exporters—neither of which would be eligible for WTEMCG.

Conclusion

In creating WTEMCG, our overarching goal was fairly simple: to create an Index that provided a diversified exposure to the theme of consumer growth in emerging markets. To truly be successful in its execution, both our sector eligibility and further geographic revenue screens allowed us to more precisely hone in on the types of firms that we wanted to include—and veer away from those that we didn’t. Our sector mix was heavily tilted toward sectors that we classified as domestic demand consumer growth sectors—those that most logically would be associated with increased demand as per capita incomes in emerging markets increased. In the end, we don’t rely on any broad-based generalizations to say that WTEMCG’s constituents generate their revenues from within emerging markets, but on specific screens requiring them to do so.

For definitions of terms in the charts, please visit our Glossary.

• Domestic Demand Consumer Growth Sectors: WTEMCG has over three-quarters of its exposure to this particular sector grouping, compared to the broader MSCI Emerging Markets Index, which has a mere 30% exposure. This shows a dramatic difference in the type of exposure between traditional indexes and WTEMCG, despite the broadly inclusive nature of WTEMCG, with stocks from eight of the 10 sectors.

• Commodity Sectors: We mentioned how these sectors (Energy and Materials) tend to be more globally sensitive. And while WTEMCG excludes them completely, the MSCI Emerging Markets Index has over 20% exposure to them. Many investors think of the emerging markets as being commodity driven, so one way to view WTEMCG is as broad-based exposure to emerging markets that takes away the exposure to the more commodity-sensitive sectors.

• Other Consumer Growth Sectors—Financials, Industrials and Information Technology: The most important element to remember about the firms within these particular sectors that qualify for WTEMCG is that they must pass the aforementioned geographic revenue screens. The MSCI Emerging Markets Index’s exposure to these sectors is approaching 50%, but these firms have not been subject to any geographic revenue screens and consist predominantly of large banks and global exporters—neither of which would be eligible for WTEMCG.

Conclusion

In creating WTEMCG, our overarching goal was fairly simple: to create an Index that provided a diversified exposure to the theme of consumer growth in emerging markets. To truly be successful in its execution, both our sector eligibility and further geographic revenue screens allowed us to more precisely hone in on the types of firms that we wanted to include—and veer away from those that we didn’t. Our sector mix was heavily tilted toward sectors that we classified as domestic demand consumer growth sectors—those that most logically would be associated with increased demand as per capita incomes in emerging markets increased. In the end, we don’t rely on any broad-based generalizations to say that WTEMCG’s constituents generate their revenues from within emerging markets, but on specific screens requiring them to do so.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.