Currency Trading Volume Soars: What Does It Mean for Your Portfolio?

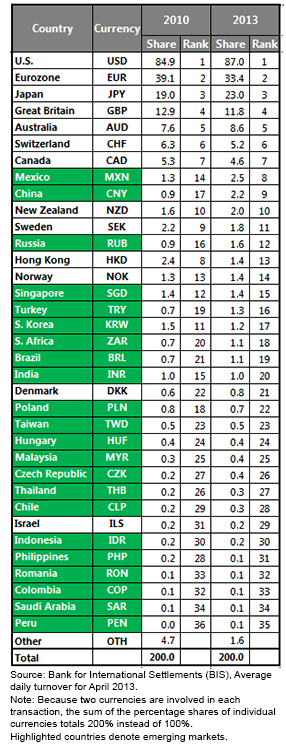

Outside emerging markets, while the U.S. dollar has maintained its standing as the world’s reserve currency, the eurozone’s share of global forex trading fell markedly. However, this decrease in volume is not singularly attributable to a rise in trade of the U.S. dollar. Looking at the data more closely, the increases in trading have actually been more widely distributed. In 2010, only 15 currencies accounted for more than 1% of overall total trading volume each; today the top 20 most traded currencies account for at least 1% of total volume each. In notional terms, these 20 currencies now trade in excess of $50 billion, on average, each day. When compared to trading volumes of other asset classes such as stock and bonds, this level of interest and liquidity is remarkable.

Although recent performance against the U.S. dollar has resulted in losses for many emerging market currencies, the rise in their importance to global trade is continuing. As many of these countries continue along the path of market liberalization and development, we expect the current trend of financial market globalization to continue. Commensurate with this rise in prominence, currency fluctuations are continuing to be a significant driver of total returns not only in emerging markets but also in the developed world. For many investors, this creates an additional element of complexity when assessing investment opportunities around the world. In our view, it may make sense for investors to take a more proactive, tactical approach in managing their exposure to foreign currencies.

As liquidity continues to increase and investors become more informed, the ability to efficiently access non-traditional asset classes expands their opportunity set. With government policy still having a significant impact on many economies’ future growth trajectories, policy makers are carefully weighing the impact of their decisions on their currencies compared to their trading partners’. In our opinion, investors should be undertaking the same type of analysis when managing exposures in their portfolio.

Outside emerging markets, while the U.S. dollar has maintained its standing as the world’s reserve currency, the eurozone’s share of global forex trading fell markedly. However, this decrease in volume is not singularly attributable to a rise in trade of the U.S. dollar. Looking at the data more closely, the increases in trading have actually been more widely distributed. In 2010, only 15 currencies accounted for more than 1% of overall total trading volume each; today the top 20 most traded currencies account for at least 1% of total volume each. In notional terms, these 20 currencies now trade in excess of $50 billion, on average, each day. When compared to trading volumes of other asset classes such as stock and bonds, this level of interest and liquidity is remarkable.

Although recent performance against the U.S. dollar has resulted in losses for many emerging market currencies, the rise in their importance to global trade is continuing. As many of these countries continue along the path of market liberalization and development, we expect the current trend of financial market globalization to continue. Commensurate with this rise in prominence, currency fluctuations are continuing to be a significant driver of total returns not only in emerging markets but also in the developed world. For many investors, this creates an additional element of complexity when assessing investment opportunities around the world. In our view, it may make sense for investors to take a more proactive, tactical approach in managing their exposure to foreign currencies.

As liquidity continues to increase and investors become more informed, the ability to efficiently access non-traditional asset classes expands their opportunity set. With government policy still having a significant impact on many economies’ future growth trajectories, policy makers are carefully weighing the impact of their decisions on their currencies compared to their trading partners’. In our opinion, investors should be undertaking the same type of analysis when managing exposures in their portfolio.

Important Risks Related to this Article

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.