Where We See the Greatest Opportunities in Emerging Market Fixed Income: Part II

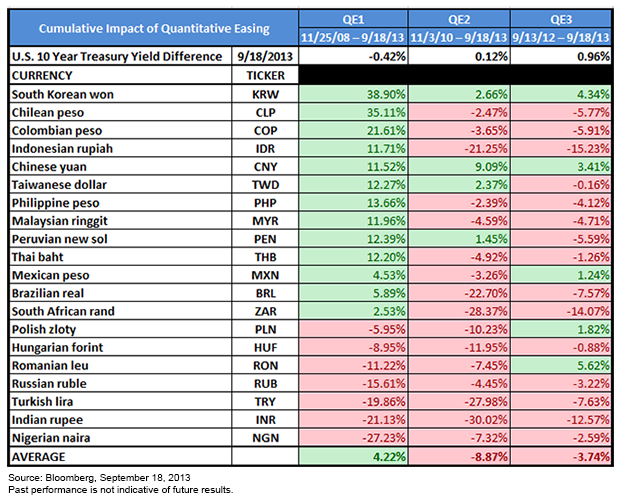

As shown in the table above, EM currencies, on average, are only modestly positive on a net basis since the depths of the global financial crisis. All told, the Federal Reserve has expanded its balance sheet by nearly $3 trillion; today, the U.S. dollar is stronger against seven out of twenty emerging market currencies. While we acknowledge that growth has slowed in many emerging markets as of late, we believe that current exchange rates do not accurately reflect the long-term potential of many of these economies. In many instances, EM currencies are now trading at multi-year lows against the U.S. dollar. Additionally, with only a single exception (the Chinese yuan), EM currencies continue to trade well off their high water marks set in 2006.

Emerging Market Interest Rates

In a similar vein as EM currencies, EM interest rates appear attractive at current levels. As U.S. interest rates touched 3% for the first time in several years, EM rates approached the 7% mark for the first time in three years. At these levels, we believe that emerging markets currently strike an attractive balance between risk and reward. As compared to EM corporate credit, which has exposure to U.S. interest rates, investors in local debt are substituting currency risk (and volatility) plus local interest rate risk. As we noted in a recent blog post, we believe that once the market has acclimated to an eventual Fed tapering, emerging market interest rates will increasingly be influenced by domestic factors as opposed to U.S. policy. However, with rates rising significantly in advance of a Fed tapering that has yet to materialize, we believe EM assets are attractively priced.

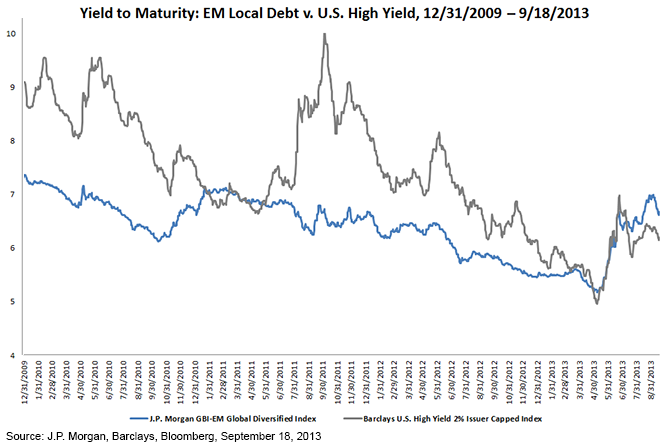

At present, the investable universe of emerging market local debt is rated 93% investment grade.4 With some emerging markets being upgraded as recently as May 2013, we believe that only a select few pose a risk of a credit rating downgrade. However, as shown in the graph below, EM local debt was recently offering the largest yield advantage compared to U.S. high yield in history.

As shown in the table above, EM currencies, on average, are only modestly positive on a net basis since the depths of the global financial crisis. All told, the Federal Reserve has expanded its balance sheet by nearly $3 trillion; today, the U.S. dollar is stronger against seven out of twenty emerging market currencies. While we acknowledge that growth has slowed in many emerging markets as of late, we believe that current exchange rates do not accurately reflect the long-term potential of many of these economies. In many instances, EM currencies are now trading at multi-year lows against the U.S. dollar. Additionally, with only a single exception (the Chinese yuan), EM currencies continue to trade well off their high water marks set in 2006.

Emerging Market Interest Rates

In a similar vein as EM currencies, EM interest rates appear attractive at current levels. As U.S. interest rates touched 3% for the first time in several years, EM rates approached the 7% mark for the first time in three years. At these levels, we believe that emerging markets currently strike an attractive balance between risk and reward. As compared to EM corporate credit, which has exposure to U.S. interest rates, investors in local debt are substituting currency risk (and volatility) plus local interest rate risk. As we noted in a recent blog post, we believe that once the market has acclimated to an eventual Fed tapering, emerging market interest rates will increasingly be influenced by domestic factors as opposed to U.S. policy. However, with rates rising significantly in advance of a Fed tapering that has yet to materialize, we believe EM assets are attractively priced.

At present, the investable universe of emerging market local debt is rated 93% investment grade.4 With some emerging markets being upgraded as recently as May 2013, we believe that only a select few pose a risk of a credit rating downgrade. However, as shown in the graph below, EM local debt was recently offering the largest yield advantage compared to U.S. high yield in history.

For definitions of terms and indexes in the chart, please visit our Glossary.

Volatility

Compared to traditional U.S. Treasury Bonds, “opportunistic fixed income,” such as emerging market local debt, has a much different volatility profile. For many investors, investing in bonds with equity-like growth elements is a comparatively new undertaking. In light of recent market developments, we believe that volatility is going to be increasing for nearly all asset classes, including fixed income. However, there is a major distinction between volatility and solvency risk. The recent volatility in the asset class has largely been attributable to movements in emerging market currencies. But unlike past periods of rapid currency depreciation, emerging market economies have taken made significant strides to reduce their external vulnerabilities. At present, an overwhelming number of emerging market countries have significant levels of foreign exchange reserves. These reserves can either be converted from U.S. dollars to support/dampen the volatility of their exchange rates or be used to directly finance their government.

Outlook: Being Paid to Wait

Ultimately, we believe EM local debt is attractively priced at current levels. However, there is always the possibility that market volatility may persist as the U.S. struggles to provide appropriate guidance on the future path of interest rates. At current yields, we believe that EM local debt provides an attractive level of carry that may help dampen future volatility associated with locally denominated fixed income.

1Source: Bloomberg, September 18, 2013

2Source: J.P. Morgan, Bloomberg, September 18, 2013

3Source: WisdomTree, J.P. Morgan, Bloomberg

4J.P. Morgan, August 31, 2013

For definitions of terms and indexes in the chart, please visit our Glossary.

Volatility

Compared to traditional U.S. Treasury Bonds, “opportunistic fixed income,” such as emerging market local debt, has a much different volatility profile. For many investors, investing in bonds with equity-like growth elements is a comparatively new undertaking. In light of recent market developments, we believe that volatility is going to be increasing for nearly all asset classes, including fixed income. However, there is a major distinction between volatility and solvency risk. The recent volatility in the asset class has largely been attributable to movements in emerging market currencies. But unlike past periods of rapid currency depreciation, emerging market economies have taken made significant strides to reduce their external vulnerabilities. At present, an overwhelming number of emerging market countries have significant levels of foreign exchange reserves. These reserves can either be converted from U.S. dollars to support/dampen the volatility of their exchange rates or be used to directly finance their government.

Outlook: Being Paid to Wait

Ultimately, we believe EM local debt is attractively priced at current levels. However, there is always the possibility that market volatility may persist as the U.S. struggles to provide appropriate guidance on the future path of interest rates. At current yields, we believe that EM local debt provides an attractive level of carry that may help dampen future volatility associated with locally denominated fixed income.

1Source: Bloomberg, September 18, 2013

2Source: J.P. Morgan, Bloomberg, September 18, 2013

3Source: WisdomTree, J.P. Morgan, Bloomberg

4J.P. Morgan, August 31, 2013Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.