Comparing Opportunities within WisdomTree’s Emerging Markets Family

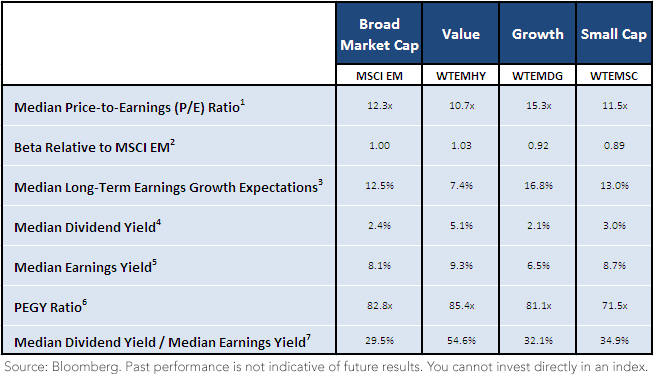

1Median price-to-earnings (P/E) ratio: P/E ratio of index constituents where 50% of constituent values fall above and 50% fall below.

2Beta relative to MSCI EM: Of the specified index, based on its 7/31/2013 constituents, relative to the MSCI Emerging Markets Index.

3Median long-term earnings growth expectations: Compilation of analyst estimates of the growth in operating earnings expected to occur over the company’s next full business cycle, typically three to five years. Value reflects the point where 50% of values are above and 50% are below.

4Median dividend yield: Value of the trailing 12-month dividend yield for a given index for which 50% of values are above and 50% are below.

5Median earnings yield: Earnings per share divided by share price. Value reflects the point where 50% of values are above and 50% are below.

6PEGY ratio: Ratio of the median price-to-earnings (P/E) ratio divided by the sum of the median long-term earnings growth expectations and the median dividend yield. Lower numbers indicate lower prices relative to the median long-term earnings growth expectations and median dividend yield of the underlying stocks.

7Median dividend yield/median earnings yield: Meant to calculate the median payout ratio, which is the median dividend per share divided by the median earnings per share.

• WTEMSC for Small Caps—A Unique Option with the Lowest Beta of the Indexes Shown: It is counterintuitive that the lowest beta Index shown—the only one below .9—is focused entirely on small-cap stocks. WTEMSC also has a P/E ratio below that of the MSCI EM and long-term earnings growth expectations in double-digit territory. We believe that WTEMSC’s lower beta is largely due to the fact that its exposures steer it away from Russia and China and toward Taiwan, its largest absolute weight, and also gives a nearly 10% weight to Malaysia, an equity market with a beta of below .7 as of July 31, 2013. It is also worth noting that WTEMSC has the lowest PEGY ratio of all the indexes shown, indicating that the median long-term growth expectations and median dividend yield are particularly high relative to the current median P/E ratio.

• WTEMHY for Value: WTEMHY has the lowest median P/E ratio and the highest median dividend yield, but to be fair, it also has the lowest long-term earnings growth expectations, in part due to a median payout ratio of nearly 55%, nearly twice as high as that of the other indexes shown. When indexes have higher payout ratios, constituents are reinvesting a lower percentage of their earnings to fund future growth opportunities. WTEMHY’s underlying focus on valuations—by sorting the market by dividend yield and selecting the highest dividend yield stocks as part of its selection process—drives this result. The best valuations are currently found in Russia and China on the country side, and in Energy on the sector side, so it makes sense that WTEMHY’s beta is above 1.00, given what I detailed in the prior blog post about how these countries and this sector all have betas above 1.00.

• WTEMDG for Growth: WTEMDG has the highest median P/E ratio and the lowest current median dividend yield, but its higher long-term earnings growth expectations compared to the other indexes shown is also important. This illustrates a potential trade-off in the financial markets: high current yield (WTEMHY) or future growth potential (WTEMDG). Quantitatively, this can be shown through the lower PEGY ratio for WTEMDG compared to both the MSCI EM and WTEMHY, meaning that if one accounts for the higher median long-term growth expectations and median dividend yield, price levels for WTEMDG are actually lower. Relative to WTEMHY, WTEMDG has less exposure to Russia and Energy stocks and more exposure to Indonesia, Mexico and Consumer Staples. WTEMDG basket trades at a higher median P/E ratio but has a lower expected beta. WTEMDG includes historical three-year average return on equity (ROE) and return on assets (ROA) as part of its selection criteria—and these stocks often sell at higher multiples and deserve the premium multiples1. The ROE/ROA focus of the WTEMDG methodology reminds me of the famous quote from Charlie Munger:

“We’ve really made the money out of high quality businesses . . . If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result.” – Charlie Munger at USC Business School in 1994

Conclusion

With the plethora of emerging market equity indexes that have come into existence, there are more options for fine-tuning the type of emerging market exposure desired. Each individual has his or her own goals, and it is important to focus on the indexes with exposure characteristics most closely aligned with those goals.

Read the full research paper here.

1The terms "higher multiples" and "premium multiples" refer to the P/E ratio.

1Median price-to-earnings (P/E) ratio: P/E ratio of index constituents where 50% of constituent values fall above and 50% fall below.

2Beta relative to MSCI EM: Of the specified index, based on its 7/31/2013 constituents, relative to the MSCI Emerging Markets Index.

3Median long-term earnings growth expectations: Compilation of analyst estimates of the growth in operating earnings expected to occur over the company’s next full business cycle, typically three to five years. Value reflects the point where 50% of values are above and 50% are below.

4Median dividend yield: Value of the trailing 12-month dividend yield for a given index for which 50% of values are above and 50% are below.

5Median earnings yield: Earnings per share divided by share price. Value reflects the point where 50% of values are above and 50% are below.

6PEGY ratio: Ratio of the median price-to-earnings (P/E) ratio divided by the sum of the median long-term earnings growth expectations and the median dividend yield. Lower numbers indicate lower prices relative to the median long-term earnings growth expectations and median dividend yield of the underlying stocks.

7Median dividend yield/median earnings yield: Meant to calculate the median payout ratio, which is the median dividend per share divided by the median earnings per share.

• WTEMSC for Small Caps—A Unique Option with the Lowest Beta of the Indexes Shown: It is counterintuitive that the lowest beta Index shown—the only one below .9—is focused entirely on small-cap stocks. WTEMSC also has a P/E ratio below that of the MSCI EM and long-term earnings growth expectations in double-digit territory. We believe that WTEMSC’s lower beta is largely due to the fact that its exposures steer it away from Russia and China and toward Taiwan, its largest absolute weight, and also gives a nearly 10% weight to Malaysia, an equity market with a beta of below .7 as of July 31, 2013. It is also worth noting that WTEMSC has the lowest PEGY ratio of all the indexes shown, indicating that the median long-term growth expectations and median dividend yield are particularly high relative to the current median P/E ratio.

• WTEMHY for Value: WTEMHY has the lowest median P/E ratio and the highest median dividend yield, but to be fair, it also has the lowest long-term earnings growth expectations, in part due to a median payout ratio of nearly 55%, nearly twice as high as that of the other indexes shown. When indexes have higher payout ratios, constituents are reinvesting a lower percentage of their earnings to fund future growth opportunities. WTEMHY’s underlying focus on valuations—by sorting the market by dividend yield and selecting the highest dividend yield stocks as part of its selection process—drives this result. The best valuations are currently found in Russia and China on the country side, and in Energy on the sector side, so it makes sense that WTEMHY’s beta is above 1.00, given what I detailed in the prior blog post about how these countries and this sector all have betas above 1.00.

• WTEMDG for Growth: WTEMDG has the highest median P/E ratio and the lowest current median dividend yield, but its higher long-term earnings growth expectations compared to the other indexes shown is also important. This illustrates a potential trade-off in the financial markets: high current yield (WTEMHY) or future growth potential (WTEMDG). Quantitatively, this can be shown through the lower PEGY ratio for WTEMDG compared to both the MSCI EM and WTEMHY, meaning that if one accounts for the higher median long-term growth expectations and median dividend yield, price levels for WTEMDG are actually lower. Relative to WTEMHY, WTEMDG has less exposure to Russia and Energy stocks and more exposure to Indonesia, Mexico and Consumer Staples. WTEMDG basket trades at a higher median P/E ratio but has a lower expected beta. WTEMDG includes historical three-year average return on equity (ROE) and return on assets (ROA) as part of its selection criteria—and these stocks often sell at higher multiples and deserve the premium multiples1. The ROE/ROA focus of the WTEMDG methodology reminds me of the famous quote from Charlie Munger:

“We’ve really made the money out of high quality businesses . . . If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result.” – Charlie Munger at USC Business School in 1994

Conclusion

With the plethora of emerging market equity indexes that have come into existence, there are more options for fine-tuning the type of emerging market exposure desired. Each individual has his or her own goals, and it is important to focus on the indexes with exposure characteristics most closely aligned with those goals.

Read the full research paper here.

1The terms "higher multiples" and "premium multiples" refer to the P/E ratio.Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.