Diving Deeper into Specific Emerging Market Opportunities

1Beta relative to MSCI EM: Of the specified index, based on its 7/31/2013 constituents, relative to the MSCI Emerging

Markets Index.

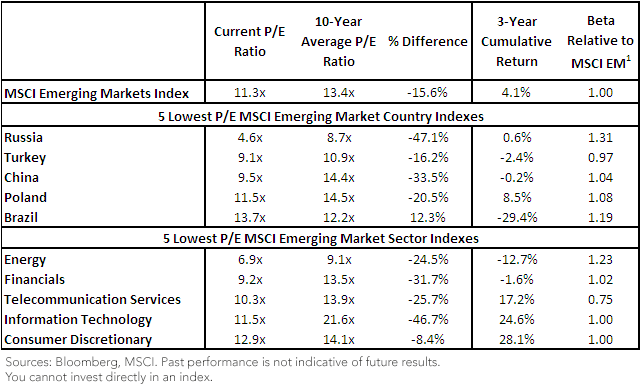

• Single-Digit P/E Ratios:

o Countries: When one looks at the current P/E ratios, single-digit values certainly stand out for Russia, Turkey

and China. China’s current P/E ratio is more than 30% lower than its 10-year average, while Russia’s is nearly

50% lower.

o Sectors: Energy and Financials also have single-digit P/E ratios that are approximately 25% and 32% below

their respective 10-year averages.

o Not one of these single-digit P/E ratio countries or sectors delivered a strong performance over the prior three

years, with Russia leading with a cumulative return of 0.6%.

• Low P/E Ratios but High Betas: Of the 10 indexes shown in this chart, eight have betas of 1.00 or greater relative to the broad MSCI EM. Russia and Energy, topping the country and sector lists, respectively, as the least expensive, each have betas above 1.20. We find this to be of particular interest, in that it indicates that approaches to emerging markets seeking valuation opportunities today might have to contend with greater potential sensitivity to broader market moves and, thus, increased volatility. This can be a benefit if there is a subsequent rally, but as is the case with any value approach, the valuation opportunity can persist for an unknown period before that rally occurs.

What the Chart Isn’t Showing

In our effort to zero in on where the potential valuation opportunity may be within emerging market equities, we have, of course left out some of the more expensive countries or sectors. For reference, we will outline those countries and sectors with P/E ratios of 20.0x or higher as of July 31, 2013:

• Taiwan, Mexico and Chile: Each of these country indexes exhibits a P/E ratio of 20.0x or greater, but interestingly, Taiwan and Chile, which tended to trade at similarly high multiples over the past 10 years, are still below their 10-year average P/E ratios, albeit only slightly. Mexico, on the other hand, is approximately 30% above its 10-year average. Over the past three years, Chile’s cumulative returns were down approximately 12%, but Taiwan’s and Mexico’s were up about 24% and 34%, respectively. Finally, each of these country indexes has a beta of less than 1.00 relative to the MSCI Emerging Markets Index.

• Consumer Staples and Health Care: Both of these sectors exhibit a P/E ratio of above 20.0x, and each is above its 10-year average. Over the past three years, Health Care and Consumer Staples were up approximately 25% and 50%, respectively. Additionally, these sectors are among the lowest beta sectors within emerging markets, with betas of .75 and below.

Conclusion

We believe that this analysis takes our prior dividend yield analysis to the next level, as we now have reason to believe that any potential valuation opportunity is more likely to occur in some countries or sectors than in others. Additionally, we conclude that those valuation opportunities may have a higher likelihood of being confined to countries or sectors with higher betas—lower beta sectors and countries tend toward the more expensive end of their historical valuation ranges. Therefore, we believe we have built a foundation upon which to analyze the types of exposures being obtained from a few different types of equity-focused emerging market indexes.

Unless otherwise stated, data source is Bloomberg.

Read the full research here.

1Source- Bloomberg, WisdomTree as of 7/31/2013

1Beta relative to MSCI EM: Of the specified index, based on its 7/31/2013 constituents, relative to the MSCI Emerging

Markets Index.

• Single-Digit P/E Ratios:

o Countries: When one looks at the current P/E ratios, single-digit values certainly stand out for Russia, Turkey

and China. China’s current P/E ratio is more than 30% lower than its 10-year average, while Russia’s is nearly

50% lower.

o Sectors: Energy and Financials also have single-digit P/E ratios that are approximately 25% and 32% below

their respective 10-year averages.

o Not one of these single-digit P/E ratio countries or sectors delivered a strong performance over the prior three

years, with Russia leading with a cumulative return of 0.6%.

• Low P/E Ratios but High Betas: Of the 10 indexes shown in this chart, eight have betas of 1.00 or greater relative to the broad MSCI EM. Russia and Energy, topping the country and sector lists, respectively, as the least expensive, each have betas above 1.20. We find this to be of particular interest, in that it indicates that approaches to emerging markets seeking valuation opportunities today might have to contend with greater potential sensitivity to broader market moves and, thus, increased volatility. This can be a benefit if there is a subsequent rally, but as is the case with any value approach, the valuation opportunity can persist for an unknown period before that rally occurs.

What the Chart Isn’t Showing

In our effort to zero in on where the potential valuation opportunity may be within emerging market equities, we have, of course left out some of the more expensive countries or sectors. For reference, we will outline those countries and sectors with P/E ratios of 20.0x or higher as of July 31, 2013:

• Taiwan, Mexico and Chile: Each of these country indexes exhibits a P/E ratio of 20.0x or greater, but interestingly, Taiwan and Chile, which tended to trade at similarly high multiples over the past 10 years, are still below their 10-year average P/E ratios, albeit only slightly. Mexico, on the other hand, is approximately 30% above its 10-year average. Over the past three years, Chile’s cumulative returns were down approximately 12%, but Taiwan’s and Mexico’s were up about 24% and 34%, respectively. Finally, each of these country indexes has a beta of less than 1.00 relative to the MSCI Emerging Markets Index.

• Consumer Staples and Health Care: Both of these sectors exhibit a P/E ratio of above 20.0x, and each is above its 10-year average. Over the past three years, Health Care and Consumer Staples were up approximately 25% and 50%, respectively. Additionally, these sectors are among the lowest beta sectors within emerging markets, with betas of .75 and below.

Conclusion

We believe that this analysis takes our prior dividend yield analysis to the next level, as we now have reason to believe that any potential valuation opportunity is more likely to occur in some countries or sectors than in others. Additionally, we conclude that those valuation opportunities may have a higher likelihood of being confined to countries or sectors with higher betas—lower beta sectors and countries tend toward the more expensive end of their historical valuation ranges. Therefore, we believe we have built a foundation upon which to analyze the types of exposures being obtained from a few different types of equity-focused emerging market indexes.

Unless otherwise stated, data source is Bloomberg.

Read the full research here.

1Source- Bloomberg, WisdomTree as of 7/31/2013Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.