Rising Interest Rates and Performance Divergences

For definitions of indexes in the chart, please visit our Glossary.

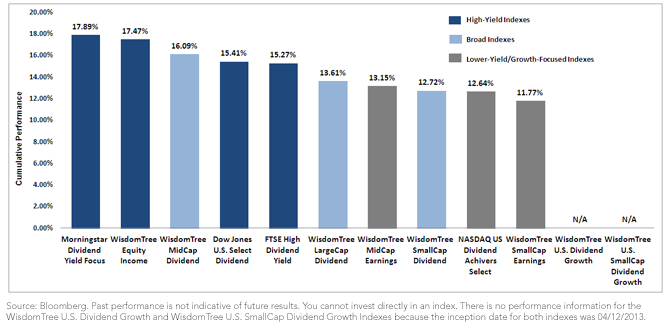

• High-Yield-Focused Indexes Outperformed through April – Over the first four months of 2013, as interest rates generally declined, the high-yield-focused indexes outperformed other broad and growth indexes shown above. The broad equity market, measured by the S&P 500 Index, was up 12.74%, which means that the yield-focused indexes also outperformed the broad market. Lower-yielding, growth-sensitive indexes lagged in the first four months of the year.

Index Performance: 04/30/13–08/20/13

For definitions of indexes in the chart, please visit our Glossary.

• High-Yield-Focused Indexes Outperformed through April – Over the first four months of 2013, as interest rates generally declined, the high-yield-focused indexes outperformed other broad and growth indexes shown above. The broad equity market, measured by the S&P 500 Index, was up 12.74%, which means that the yield-focused indexes also outperformed the broad market. Lower-yielding, growth-sensitive indexes lagged in the first four months of the year.

Index Performance: 04/30/13–08/20/13

For definitions of indexes in the chart, please visit our Glossary.

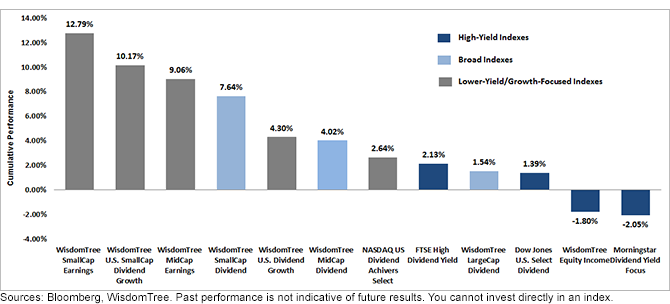

• Since May 1, the performance situation reversed from the first four months of the year.

• High-Yield-Focused Indexes Have Underperformed since May 1 – Since interest rates began their climb, over the period displayed above, high-yield-focused indexes have underperformed other broad and growth indexes shown above. The broad equity market, measured by the S&P 500 Index, was up 4.19%, which means that the yield-focused indexes also underperformed the broad equity market. During this period, the 10-Year Treasury trended significantly higher.

• Morningstar Dividend Yield Focus Index – This index was the worst-performing of all indexes shown above, with a return of -2.05%, underperforming the S&P 500 by 6.23%, after being the best-performing index through April, a period during which it outperformed the S&P 500 by 5.15%.

A Look to Growth-Focused Indexes

The spike in interest rates in 2013 has caused a reevaluation of dividend-yield-focused indexes and the stocks with highest yields, but not all dividend-paying equities underperformed. Smaller-capitalization and dividend-growth indexes outperformed during the period associated with rising rates. Their outperformance might be a result of their higher growth expectations, which become more desirable with improving economic activity. The smaller-capitalization dividend stocks also have less exposure to some sectors of the market that many felt were becoming expensive. It is important to look to these diversified baskets of dividend-paying stocks for diversification and potential growth. In our market insight on this topic, we evaluate in more detail the underlying exposures that led to this performance divergence across the various equity indexes.

1Source: Bloomberg (05/01/13–08/20/13).

For definitions of indexes in the chart, please visit our Glossary.

• Since May 1, the performance situation reversed from the first four months of the year.

• High-Yield-Focused Indexes Have Underperformed since May 1 – Since interest rates began their climb, over the period displayed above, high-yield-focused indexes have underperformed other broad and growth indexes shown above. The broad equity market, measured by the S&P 500 Index, was up 4.19%, which means that the yield-focused indexes also underperformed the broad equity market. During this period, the 10-Year Treasury trended significantly higher.

• Morningstar Dividend Yield Focus Index – This index was the worst-performing of all indexes shown above, with a return of -2.05%, underperforming the S&P 500 by 6.23%, after being the best-performing index through April, a period during which it outperformed the S&P 500 by 5.15%.

A Look to Growth-Focused Indexes

The spike in interest rates in 2013 has caused a reevaluation of dividend-yield-focused indexes and the stocks with highest yields, but not all dividend-paying equities underperformed. Smaller-capitalization and dividend-growth indexes outperformed during the period associated with rising rates. Their outperformance might be a result of their higher growth expectations, which become more desirable with improving economic activity. The smaller-capitalization dividend stocks also have less exposure to some sectors of the market that many felt were becoming expensive. It is important to look to these diversified baskets of dividend-paying stocks for diversification and potential growth. In our market insight on this topic, we evaluate in more detail the underlying exposures that led to this performance divergence across the various equity indexes.

1Source: Bloomberg (05/01/13–08/20/13).Important Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment loss. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.