Positioning for a European Recovery with Small Caps, Part II

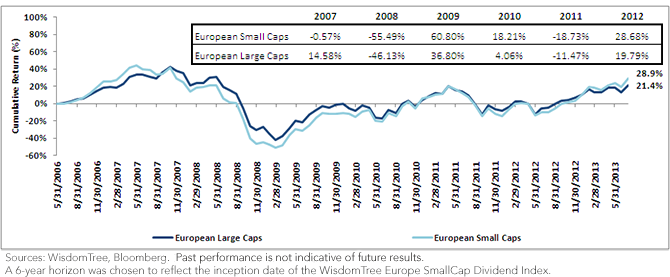

• Higher Beta Exposure: European Small Caps have far outpaced European Large Caps during market rallies. Outperformance in 2009: 24%. Outperformance in 2010: Approximately 14%. Outperformance in 2012: Approximately 9%. True, European Small Caps did go down further in both 2008 and in 2011, but we find it interesting to note that since its inception, even while going down further during these years, cumulative returns are in fact higher over the full period of history available.

• Economic Sensitivity Rooted in Cyclical Exposures: European Large Caps are market capitalization weighted, which means that they’re biased toward larger companies. Some of the resulting exposures include very large telecommunication services or utilities firms. On the other hand, European Small Caps rebalance back toward the small-cap segment of European equities on an annual basis, steering away from larger European companies. The result: While European Small Caps have approximately 83% exposure to cyclical sectors, the European Large Caps have only a 64% exposure to cyclical sectors.

The Industries Driving These Cyclical Over-weights:

• Consumer Discretionary: European Small Caps have over 6% more weight in the cyclical stocks in this Consumer sector. The largest industry over-weight in this sector is in Retailing. An increase in European economic growth should have the potential to benefit these European consumer stocks.

• Industrials: European Small Caps have about twice as much weight (over 20%) in the Industrials sector as do European large caps—a sector that is often very sensitive to economic conditions. On an industry basis, there is an over-weight in capital goods companies involved in large projects that incorporate high levels of capital spending . This sector could be positioned closer to the front end of any increases in capital spending and the expansion of production capability.

• Information Technology: European Small Caps have about 10% more weight in the IT sector than do European Large Caps, and on an industry basis, it’s the technology hardware and equipment industries. Central here are firms trying to improve efficiency, for example through enhanced data storage and communications equipment. As long as productivity improvements are a central theme for companies trying to emerge from protracted slowdowns, this industry could remain important.

Conclusion

If data coming out of Europe continues to improve, European Small Caps offer an interesting contrast to European Large Caps. The performance history of European Small Caps shows more sensitivity to market trends—whether positive during up markets or negative during contractions. Additionally, the specific industry over-weights, as of July 31, 2013, appear highly leveraged toward an improving economic situation.

Unless otherwise stated, data source is Bloomberg.

• Higher Beta Exposure: European Small Caps have far outpaced European Large Caps during market rallies. Outperformance in 2009: 24%. Outperformance in 2010: Approximately 14%. Outperformance in 2012: Approximately 9%. True, European Small Caps did go down further in both 2008 and in 2011, but we find it interesting to note that since its inception, even while going down further during these years, cumulative returns are in fact higher over the full period of history available.

• Economic Sensitivity Rooted in Cyclical Exposures: European Large Caps are market capitalization weighted, which means that they’re biased toward larger companies. Some of the resulting exposures include very large telecommunication services or utilities firms. On the other hand, European Small Caps rebalance back toward the small-cap segment of European equities on an annual basis, steering away from larger European companies. The result: While European Small Caps have approximately 83% exposure to cyclical sectors, the European Large Caps have only a 64% exposure to cyclical sectors.

The Industries Driving These Cyclical Over-weights:

• Consumer Discretionary: European Small Caps have over 6% more weight in the cyclical stocks in this Consumer sector. The largest industry over-weight in this sector is in Retailing. An increase in European economic growth should have the potential to benefit these European consumer stocks.

• Industrials: European Small Caps have about twice as much weight (over 20%) in the Industrials sector as do European large caps—a sector that is often very sensitive to economic conditions. On an industry basis, there is an over-weight in capital goods companies involved in large projects that incorporate high levels of capital spending . This sector could be positioned closer to the front end of any increases in capital spending and the expansion of production capability.

• Information Technology: European Small Caps have about 10% more weight in the IT sector than do European Large Caps, and on an industry basis, it’s the technology hardware and equipment industries. Central here are firms trying to improve efficiency, for example through enhanced data storage and communications equipment. As long as productivity improvements are a central theme for companies trying to emerge from protracted slowdowns, this industry could remain important.

Conclusion

If data coming out of Europe continues to improve, European Small Caps offer an interesting contrast to European Large Caps. The performance history of European Small Caps shows more sensitivity to market trends—whether positive during up markets or negative during contractions. Additionally, the specific industry over-weights, as of July 31, 2013, appear highly leveraged toward an improving economic situation.

Unless otherwise stated, data source is Bloomberg.Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.