Positioning for a European Recovery with Small Caps

Small Caps Are More Local to Europe

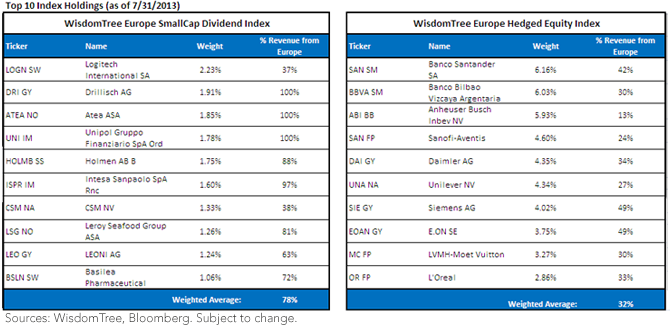

Small-cap stocks of a particular region are often more domestically sensitive, deriving more of their revenues from that region than their large-cap compatriots. To illustrate the point, the above table takes the top 10 holdings of our two European indexes, highlighting the percentage of revenues coming from Europe for each company.

• Weighted Average Revenues: The top 10 constituents of European Small Caps had weighted average revenues of 78% from Europe, as compared to only 32% for European Exporters. The exporter screen of the Europe Hedged Equity Index results in the more global focus for these top holdings.

We believe that this points to an interesting potential opportunity for revenue diversification across Indexes, or for thinking along the lines of either over-weighting the revenues from Europe or over-weighting blue-chip, multinational revenue generators.

Further Points of Diversification

European Exporters share very few common constituents with European Small Caps—12 as of July 31, 2013, to be precise. They comprise:

• Less than 1% of the weight of European Exporters

• 7.2% of the weight of European Small Caps

Considering a Blended Currency Approach

Blending exposure to stocks with a currency hedge with exposure to those that do not have a currency hedge could have the potential to minimize the risk of being on the wrong side of the euro’s performance against the U.S. dollar. Thus far in 2013, the euro has exhibited significant volatility that hasn’t resulted in a sustained trend of either weakness or strength against the U.S. dollar. For those unsure of which direction the euro may move in the near term, considering a blend that is 50% long and 50% hedged against euro declines would yield positions that could benefit no matter which way the currency may go.

Conclusion

With potential economic green shoots perking up in the European landscape, (as detailed in yesterday’s blog by Jeremy Schwartz), the time could be ripe to consider the tools and options available across European equity indexes. European small-cap stocks may be some of the best positioned to benefit from a rebound in Europe’s economy and deserve some special consideration.

Small Caps Are More Local to Europe

Small-cap stocks of a particular region are often more domestically sensitive, deriving more of their revenues from that region than their large-cap compatriots. To illustrate the point, the above table takes the top 10 holdings of our two European indexes, highlighting the percentage of revenues coming from Europe for each company.

• Weighted Average Revenues: The top 10 constituents of European Small Caps had weighted average revenues of 78% from Europe, as compared to only 32% for European Exporters. The exporter screen of the Europe Hedged Equity Index results in the more global focus for these top holdings.

We believe that this points to an interesting potential opportunity for revenue diversification across Indexes, or for thinking along the lines of either over-weighting the revenues from Europe or over-weighting blue-chip, multinational revenue generators.

Further Points of Diversification

European Exporters share very few common constituents with European Small Caps—12 as of July 31, 2013, to be precise. They comprise:

• Less than 1% of the weight of European Exporters

• 7.2% of the weight of European Small Caps

Considering a Blended Currency Approach

Blending exposure to stocks with a currency hedge with exposure to those that do not have a currency hedge could have the potential to minimize the risk of being on the wrong side of the euro’s performance against the U.S. dollar. Thus far in 2013, the euro has exhibited significant volatility that hasn’t resulted in a sustained trend of either weakness or strength against the U.S. dollar. For those unsure of which direction the euro may move in the near term, considering a blend that is 50% long and 50% hedged against euro declines would yield positions that could benefit no matter which way the currency may go.

Conclusion

With potential economic green shoots perking up in the European landscape, (as detailed in yesterday’s blog by Jeremy Schwartz), the time could be ripe to consider the tools and options available across European equity indexes. European small-cap stocks may be some of the best positioned to benefit from a rebound in Europe’s economy and deserve some special consideration.

Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.