Russia Trading at Steep Discount to Peers

Is the Recent Rebound Credible?

The recent rally in Russian equities is testimony to the ability of its local markets to thrive in an environment of rising U.S. bond yields. With an encouraging second-quarter gross domestic product (GDP) out of the U.S. and a sanguine July Federal Open Market Committee (FOMC) outlook, markets are widely anticipating tapering to occur as early as the fourth quarter this year. While policy rates will remain accommodative for a longer period, steady improvements in the U.S. economy may result in a further increase in treasury yields.

On a relative basis, this may position Russia to perform better than its emerging market peers. From a macroeconomic perspective, Russia has a healthy current account surplus of 2.6% and is thus less dependent on foreign inflows. Many emerging market nations, such as India, South Africa and Indonesia, run large current account deficits and rely on foreign inflows to fund them.

Russia’s current account surplus is especially important in a time of rising U.S. yields. The EM block has experienced outflows, partly due to the narrowing yield gap between the U.S. and the rest of the emerging markets. The closing of this gap renders the EM block less compelling from a yield perspective. However, we feel that Russia is well positioned to withstand the storm, as it is less reliant on external funding and thus better able to keep its monetary policy loose (i.e., low interest rates), while other EM nations tighten their monetary policy—which can slow down their economies—in order to attract foreign flows.

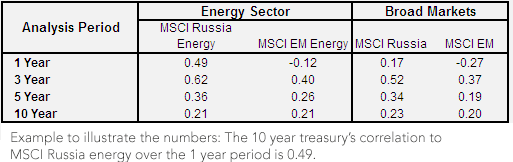

Further, we find that Russia’s equity markets—and the energy sector in particular—are positively correlated with U.S. interest rates3 (10-year yields).

• Emerging market stocks have been positively correlated to U.S. interest rates over longer periods (three, five and ten years), but Russian stocks have been more positively correlated.

• While emerging market stocks were negatively correlated to U.S. 10-year yields over the last one-year period, Russian stocks (and especially Russian energy stocks) were positively correlated over the same period.

• Given that roughly 50% of Russia’s market is composed of energy stocks, it is not surprising that the overall Russian markets exhibit positive correlations to bond yields.

• The positive correlation between Russian energy sector and interest rates seems to be explained by a connection between higher interest rates and stronger global economic growth, which is supportive of energy prices and the Russian markets.

Table 2: Russian Stocks Display Higher Correlation to 10-Year Bond Yields Than MSCI Emerging Markets4

Is the Recent Rebound Credible?

The recent rally in Russian equities is testimony to the ability of its local markets to thrive in an environment of rising U.S. bond yields. With an encouraging second-quarter gross domestic product (GDP) out of the U.S. and a sanguine July Federal Open Market Committee (FOMC) outlook, markets are widely anticipating tapering to occur as early as the fourth quarter this year. While policy rates will remain accommodative for a longer period, steady improvements in the U.S. economy may result in a further increase in treasury yields.

On a relative basis, this may position Russia to perform better than its emerging market peers. From a macroeconomic perspective, Russia has a healthy current account surplus of 2.6% and is thus less dependent on foreign inflows. Many emerging market nations, such as India, South Africa and Indonesia, run large current account deficits and rely on foreign inflows to fund them.

Russia’s current account surplus is especially important in a time of rising U.S. yields. The EM block has experienced outflows, partly due to the narrowing yield gap between the U.S. and the rest of the emerging markets. The closing of this gap renders the EM block less compelling from a yield perspective. However, we feel that Russia is well positioned to withstand the storm, as it is less reliant on external funding and thus better able to keep its monetary policy loose (i.e., low interest rates), while other EM nations tighten their monetary policy—which can slow down their economies—in order to attract foreign flows.

Further, we find that Russia’s equity markets—and the energy sector in particular—are positively correlated with U.S. interest rates3 (10-year yields).

• Emerging market stocks have been positively correlated to U.S. interest rates over longer periods (three, five and ten years), but Russian stocks have been more positively correlated.

• While emerging market stocks were negatively correlated to U.S. 10-year yields over the last one-year period, Russian stocks (and especially Russian energy stocks) were positively correlated over the same period.

• Given that roughly 50% of Russia’s market is composed of energy stocks, it is not surprising that the overall Russian markets exhibit positive correlations to bond yields.

• The positive correlation between Russian energy sector and interest rates seems to be explained by a connection between higher interest rates and stronger global economic growth, which is supportive of energy prices and the Russian markets.

Table 2: Russian Stocks Display Higher Correlation to 10-Year Bond Yields Than MSCI Emerging Markets4

Positioning for Emerging Market Rebound and Rising Rates

Sentiment towards emerging markets has been very negative in 2013. If this trend reverses, we believe Russia might be a prime beneficiary. Given that the other major theme dominating the focus of investors is how to position portfolios for a rising-interest-rate environment, the historical correlations of Russian equities to U.S. interest rates—combined with their steep discount to other emerging markets—make them a potentially attractive option for emerging market portfolio allocations.

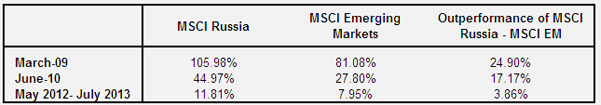

112-Month Forward - 12 month returns post the low points indicated in the table

2Sources: WisdomTree, Bloomberg, as of 7/31/2013.

3Sources: WisdomTree, Bloomberg, as of 7/31/2013.

4Sources: WisdomTree, Bloomberg, as of 7/31/2013.

Positioning for Emerging Market Rebound and Rising Rates

Sentiment towards emerging markets has been very negative in 2013. If this trend reverses, we believe Russia might be a prime beneficiary. Given that the other major theme dominating the focus of investors is how to position portfolios for a rising-interest-rate environment, the historical correlations of Russian equities to U.S. interest rates—combined with their steep discount to other emerging markets—make them a potentially attractive option for emerging market portfolio allocations.

112-Month Forward - 12 month returns post the low points indicated in the table

2Sources: WisdomTree, Bloomberg, as of 7/31/2013.

3Sources: WisdomTree, Bloomberg, as of 7/31/2013.

4Sources: WisdomTree, Bloomberg, as of 7/31/2013.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.