Dividend Growth versus Dividend Yield in the Emerging Markets

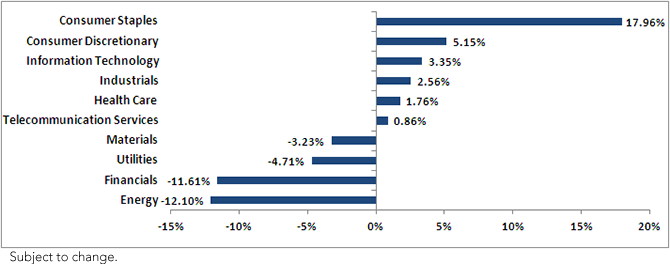

Sector Exposures (as of 6/30/2013)

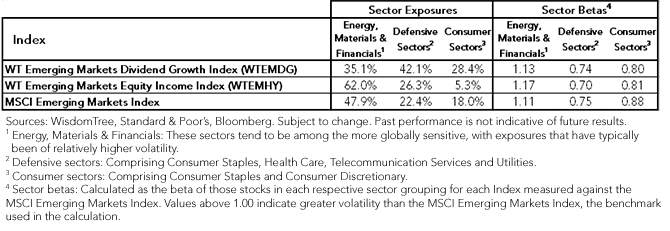

Sector Exposures (as of 6/30/2013)

Sectors leading the beta reduction in WTEMDG vs. WTEMHY:

• Lower allocation to higher-beta Energy, Materials and Financial stocks

• Biggest is the 20% position in Consumer Staples stocks, which have a .75 beta vs. the MSCI Emerging Markets Index; this sector receives a marginal weight in WTEMHY, at only 2%, as its dividend yields are low compared to those in other emerging market equity sectors.

The sector exposures are intertwined with the country exposures. As of June 30, 2013:

• WTEMDG gives much less weight to Russia, one of the higher-beta countries, than does WTEMHY.

• WTEMDG gives more weight to Mexico, Indonesia and Thailand (“MIT”) than it does to Brazil, Russia, India and China (BRIC). By contrast, the MSCI Emerging Markets Index gives almost four times more weight to BRIC countries than to MIT.

• South Korea and Taiwan: Combined, they represent just over one-quarter of the weight of the MSCI Emerging Markets Index but less than 10% of WTEMDG.

For a more thorough analysis of the country and sector exposures, please read our market insight here.

Conclusion: A Differentiated Exposure for Emerging Market Equities

WisdomTree has been a pioneer in creating Indexes of dividend payers for the emerging markets. We started with an Index that focuses on the highest-dividend-yielding part of the dividend-paying market—a strict valuation-based selection requirement. The introduction of this new growth-oriented Index provides a natural complement—these stocks have lower current dividend yields but are expected to grow those dividends faster over time. We believe the contrasting sector and country exposures allow investors to tailor exposure to the emerging markets in a more precise and balanced way.

Unless otherwise stated, data source is WisdomTree.

1Refers to initial constituent eligibility for inclusion in WTEMHY contingent upon being in the top 30% of stocks by trailing 12-month dividend yield from within the broader WisdomTree Emerging Markets Dividend Index.

2Sources: Bloomberg, Zephyr StyleADVISOR. Measured against the MSCI Emerging Markets Index for the period from 6/1/2007 to 6/30/2013.

3Refers to those stocks in the MSCI Emerging Markets Energy and Materials indexes.

4Sources: Bloomberg, Zephyr StyleADVISOR. Betas are calculated for the MSCI Emerging Markets Energy and Materials indexes against the MSCI Emerging Markets Index and then ranked against the 10 MSCI Emerging Markets sector indexes.

5Source: Bloomberg.

Sectors leading the beta reduction in WTEMDG vs. WTEMHY:

• Lower allocation to higher-beta Energy, Materials and Financial stocks

• Biggest is the 20% position in Consumer Staples stocks, which have a .75 beta vs. the MSCI Emerging Markets Index; this sector receives a marginal weight in WTEMHY, at only 2%, as its dividend yields are low compared to those in other emerging market equity sectors.

The sector exposures are intertwined with the country exposures. As of June 30, 2013:

• WTEMDG gives much less weight to Russia, one of the higher-beta countries, than does WTEMHY.

• WTEMDG gives more weight to Mexico, Indonesia and Thailand (“MIT”) than it does to Brazil, Russia, India and China (BRIC). By contrast, the MSCI Emerging Markets Index gives almost four times more weight to BRIC countries than to MIT.

• South Korea and Taiwan: Combined, they represent just over one-quarter of the weight of the MSCI Emerging Markets Index but less than 10% of WTEMDG.

For a more thorough analysis of the country and sector exposures, please read our market insight here.

Conclusion: A Differentiated Exposure for Emerging Market Equities

WisdomTree has been a pioneer in creating Indexes of dividend payers for the emerging markets. We started with an Index that focuses on the highest-dividend-yielding part of the dividend-paying market—a strict valuation-based selection requirement. The introduction of this new growth-oriented Index provides a natural complement—these stocks have lower current dividend yields but are expected to grow those dividends faster over time. We believe the contrasting sector and country exposures allow investors to tailor exposure to the emerging markets in a more precise and balanced way.

Unless otherwise stated, data source is WisdomTree.

1Refers to initial constituent eligibility for inclusion in WTEMHY contingent upon being in the top 30% of stocks by trailing 12-month dividend yield from within the broader WisdomTree Emerging Markets Dividend Index.

2Sources: Bloomberg, Zephyr StyleADVISOR. Measured against the MSCI Emerging Markets Index for the period from 6/1/2007 to 6/30/2013.

3Refers to those stocks in the MSCI Emerging Markets Energy and Materials indexes.

4Sources: Bloomberg, Zephyr StyleADVISOR. Betas are calculated for the MSCI Emerging Markets Energy and Materials indexes against the MSCI Emerging Markets Index and then ranked against the 10 MSCI Emerging Markets sector indexes.

5Source: Bloomberg.

Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.