The Search for High Quality and Dividend Growth in the Emerging Markets

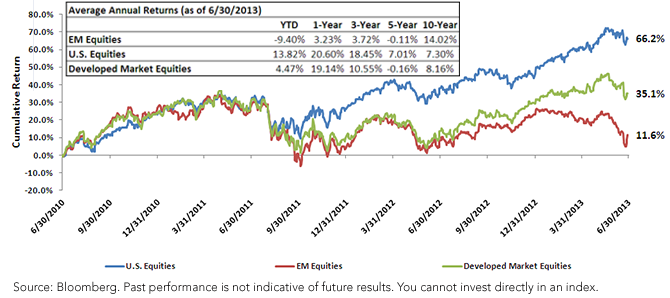

We think the fact that EM Equities have been lagging could present a good opportunity to think about new tools, such as baskets of emerging market dividend growth stocks, that could potentially provide differentiated exposure that adds value to traditional portfolio allocations.

Combining a Focus on Dividend Growth Stocks with Relative Value Rebalancing

WisdomTree believes that a focus on growth-oriented companies must be married with a disciplined focus on valuations, and when we consider dividend growth potential as a component of index methodology, we always marry it with other elements that yield a sensitivity to valuation.

Specifically, WisdomTree uses a rules-based rebalancing program that involves tying Index constituent weights back to the Dividend Stream® to focus on valuations—as it does in all its dividend-based Indexes. What is unique about this new growth Index methodology are the stock selection factors we have identified as important drivers of dividend growth over time. These factors diverge from a sole focus on past dividend growth behavior to determine potential future dividend growth behavior.

Introducing the WisdomTree Emerging Markets Dividend Growth Index (WTEMDG):Selection Criteria and Rationale

• Starting universe is stocks in WisdomTree Emerging Markets Dividend Index (WTEMI), a universe of 1,210 stocks with a combined market capitalization of $7.4 trillion as of June 30, 2013.

• Must have a dividend coverage ratio greater than 1.0x.

• The Index comprises the top 50% of companies with the best combined rank of growth and quality factors from this universe.

• Growth Ranking 50%: Long-term earnings growth expectations

• Quality Ranking 50%: Evenly split between three-year average return on assets (ROA) and three-year average return on equity (ROE)

Weighting: The Index is dividend weighted to reflect the proportionate share of the aggregate cash dividends.

Single Holding and Sector Caps: At the annual rebalance, the following caps apply: No single stock can represent more than 5% of the Index, and no sector or country can represent more than 20%. Between annual rebalances, single stocks may fluctuate above 5% and countries or sectors may fluctuate above 20% due to market movement.

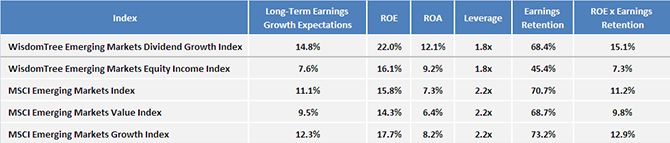

Figure 2: Key Characteristics of WTEMDG Index

We think the fact that EM Equities have been lagging could present a good opportunity to think about new tools, such as baskets of emerging market dividend growth stocks, that could potentially provide differentiated exposure that adds value to traditional portfolio allocations.

Combining a Focus on Dividend Growth Stocks with Relative Value Rebalancing

WisdomTree believes that a focus on growth-oriented companies must be married with a disciplined focus on valuations, and when we consider dividend growth potential as a component of index methodology, we always marry it with other elements that yield a sensitivity to valuation.

Specifically, WisdomTree uses a rules-based rebalancing program that involves tying Index constituent weights back to the Dividend Stream® to focus on valuations—as it does in all its dividend-based Indexes. What is unique about this new growth Index methodology are the stock selection factors we have identified as important drivers of dividend growth over time. These factors diverge from a sole focus on past dividend growth behavior to determine potential future dividend growth behavior.

Introducing the WisdomTree Emerging Markets Dividend Growth Index (WTEMDG):Selection Criteria and Rationale

• Starting universe is stocks in WisdomTree Emerging Markets Dividend Index (WTEMI), a universe of 1,210 stocks with a combined market capitalization of $7.4 trillion as of June 30, 2013.

• Must have a dividend coverage ratio greater than 1.0x.

• The Index comprises the top 50% of companies with the best combined rank of growth and quality factors from this universe.

• Growth Ranking 50%: Long-term earnings growth expectations

• Quality Ranking 50%: Evenly split between three-year average return on assets (ROA) and three-year average return on equity (ROE)

Weighting: The Index is dividend weighted to reflect the proportionate share of the aggregate cash dividends.

Single Holding and Sector Caps: At the annual rebalance, the following caps apply: No single stock can represent more than 5% of the Index, and no sector or country can represent more than 20%. Between annual rebalances, single stocks may fluctuate above 5% and countries or sectors may fluctuate above 20% due to market movement.

Figure 2: Key Characteristics of WTEMDG Index

For definition of indexes in the chart, please visit our glossary.

The WTEMDG Index Methodology Increases:

• Growth Factor: Long-Term Earnings Growth Expectations.

• Quality Factor: ROE & ROA. Companies that show higher ROE and ROA are able to fund growing dividends due to these higher levels of profitability.

• Earnings Retention: Earnings that are retained and then reinvested efficiently (through a high ROE) could become future dividend payments.

The WTEMDG Index Methodology Decreases:

• Exposure to companies with high leverage

Conclusion: A Differentiated Exposure for Emerging Market Equities

WisdomTree has been a pioneer in creating options around the universe of dividend payers in the emerging markets. As of June 30, 2013, over 90% of the market capitalization of emerging market equities is in dividend-paying firms, so we believe a focus on dividend payers in emerging markets doesn’t sacrifice any breadth of coverage or representativeness of the universe.

While many dividend-focused indexes in emerging markets focus on yield and valuation, there is a dearth of options that focus on dividend growth. We believe that the WTEMDG approach with its flexibility to respond to growth potential rather than past dividend behavior exhibits greater congruence with actual underlying dividend behavior. Just like the other dividend growth indexes we have created, we believe the WisdomTree Emerging Markets Dividend Growth Index represents the future of dividend growth-oriented indexing.

Unless otherwise stated, data source is WisdomTree.

1Refers to the S&P 500 Consumer Staples, Health Care, Telecommunication Services and Utilities indexes over the period from 6/30/2010 to 6/30/2013.

2Source: Bloomberg.

For definition of indexes in the chart, please visit our glossary.

The WTEMDG Index Methodology Increases:

• Growth Factor: Long-Term Earnings Growth Expectations.

• Quality Factor: ROE & ROA. Companies that show higher ROE and ROA are able to fund growing dividends due to these higher levels of profitability.

• Earnings Retention: Earnings that are retained and then reinvested efficiently (through a high ROE) could become future dividend payments.

The WTEMDG Index Methodology Decreases:

• Exposure to companies with high leverage

Conclusion: A Differentiated Exposure for Emerging Market Equities

WisdomTree has been a pioneer in creating options around the universe of dividend payers in the emerging markets. As of June 30, 2013, over 90% of the market capitalization of emerging market equities is in dividend-paying firms, so we believe a focus on dividend payers in emerging markets doesn’t sacrifice any breadth of coverage or representativeness of the universe.

While many dividend-focused indexes in emerging markets focus on yield and valuation, there is a dearth of options that focus on dividend growth. We believe that the WTEMDG approach with its flexibility to respond to growth potential rather than past dividend behavior exhibits greater congruence with actual underlying dividend behavior. Just like the other dividend growth indexes we have created, we believe the WisdomTree Emerging Markets Dividend Growth Index represents the future of dividend growth-oriented indexing.

Unless otherwise stated, data source is WisdomTree.

1Refers to the S&P 500 Consumer Staples, Health Care, Telecommunication Services and Utilities indexes over the period from 6/30/2010 to 6/30/2013.

2Source: Bloomberg. Important Risks Related to this Article

Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Past performance is not indicative of future results. You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.