Diversifying Dividend Exposure with Small Caps

For definitions of terms and indexes in the chart, please visit our glossary.

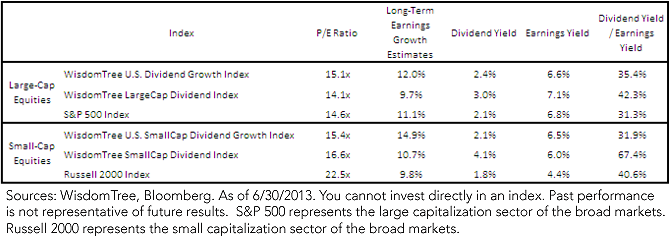

• Large-Cap Picture: The WisdomTree LargeCap Dividend Index, which includes the 300 largest regular dividend payers in the United States, has a lower P/E ratio than the S&P 500 Index, which does not consist solely of dividend payers. The WisdomTree U.S. Dividend Growth Index, which focuses on primarily large-cap, dividend-paying equities with growth characteristics, has a slightly higher P/E ratio than the S&P 500 Index, but it also has higher long-term earnings growth expectations as well as a higher dividend yield. In large-cap equities, it is therefore difficult to classify dividend payers—both broadly and those with growth potential—as “expensive,” if the baseline is the S&P 500 Index.

• Small-Cap Picture: The WisdomTree SmallCap Dividend Index, which includes the bottom 25% of the market capitalization of the WisdomTree Dividend Index, has a lower P/E ratio than the Russell 2000 Index. The WisdomTree U.S. Small Cap Dividend Growth Index, which focuses specifically on those stocks in the WisdomTree SmallCap Dividend Index that have growth characteristics, also has a lower P/E ratio than the Russell 2000 Index, as well as significantly higher long-term earnings growth expectations. Similar to the large-cap picture, the picture of small caps as of June 30, 2013, makes it difficult to broadly classify dividend stocks as “expensive.”

We believe that the small-cap segment of the dividend-paying market deserves special attention. In addition to the highest long-term earnings growth expectations of any of the indexes in the chart, it is worth noting that these are the only two U.S. equity Indexes (the WisdomTree SmallCap Dividend Index and the WisdomTree U.S. Small Cap Dividend Growth Index) that focus solely on small-cap dividend payers1 . While the large-cap space is without question much more competitive, looking to the small-cap space may provide a diversification benefit at what we believe to be an attractive price.

Do Dividend Indexes Concentrate in Defensive Sectors?

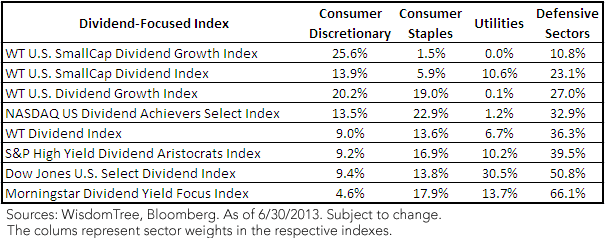

It is important to point out that dividend indexes do not need to concentrate solely in the defensive sectors (i.e., Consumer Staples, Health Care, Telecommunication Services, and Utilities). In addition to providing exposure to a different capitalization segment of the market, it’s quite clear that WisdomTree’s small-cap dividend Indexes also can provide very different sector exposures than traditional dividend indexes that concentrate on the large-cap segment of the market.

For definitions of terms and indexes in the chart, please visit our glossary.

• Large-Cap Picture: The WisdomTree LargeCap Dividend Index, which includes the 300 largest regular dividend payers in the United States, has a lower P/E ratio than the S&P 500 Index, which does not consist solely of dividend payers. The WisdomTree U.S. Dividend Growth Index, which focuses on primarily large-cap, dividend-paying equities with growth characteristics, has a slightly higher P/E ratio than the S&P 500 Index, but it also has higher long-term earnings growth expectations as well as a higher dividend yield. In large-cap equities, it is therefore difficult to classify dividend payers—both broadly and those with growth potential—as “expensive,” if the baseline is the S&P 500 Index.

• Small-Cap Picture: The WisdomTree SmallCap Dividend Index, which includes the bottom 25% of the market capitalization of the WisdomTree Dividend Index, has a lower P/E ratio than the Russell 2000 Index. The WisdomTree U.S. Small Cap Dividend Growth Index, which focuses specifically on those stocks in the WisdomTree SmallCap Dividend Index that have growth characteristics, also has a lower P/E ratio than the Russell 2000 Index, as well as significantly higher long-term earnings growth expectations. Similar to the large-cap picture, the picture of small caps as of June 30, 2013, makes it difficult to broadly classify dividend stocks as “expensive.”

We believe that the small-cap segment of the dividend-paying market deserves special attention. In addition to the highest long-term earnings growth expectations of any of the indexes in the chart, it is worth noting that these are the only two U.S. equity Indexes (the WisdomTree SmallCap Dividend Index and the WisdomTree U.S. Small Cap Dividend Growth Index) that focus solely on small-cap dividend payers1 . While the large-cap space is without question much more competitive, looking to the small-cap space may provide a diversification benefit at what we believe to be an attractive price.

Do Dividend Indexes Concentrate in Defensive Sectors?

It is important to point out that dividend indexes do not need to concentrate solely in the defensive sectors (i.e., Consumer Staples, Health Care, Telecommunication Services, and Utilities). In addition to providing exposure to a different capitalization segment of the market, it’s quite clear that WisdomTree’s small-cap dividend Indexes also can provide very different sector exposures than traditional dividend indexes that concentrate on the large-cap segment of the market.

For definitions of indexes in the chart, please visit our glossary.

• Defensive Sectors: The WisdomTree U.S. Small Cap Dividend Growth Index and WisdomTree SmallCap Dividend Index each have less than 25% of their exposure in the defensive sectors. Competing dividend-focused indexes have anywhere from one-third to two-thirds of their exposures here.

• Consumer Discretionary: If the U.S. economy is indeed on track to recovery, Consumer Discretionary can be a very important sector through which to gain exposure. The WisdomTree U.S. Small Cap Dividend Growth Index has more than 25% of its exposure in this sector. By contrast, Consumer Staples is a sector that is often the top exposure in many large-cap focused dividend indexes, and this sector receives less than 2% weight in the U.S. SmallCap Dividend Growth Index. This is a measure of the dividend landscape diversification this Index brings.

Doing Dividends Differently

WisdomTree continues to believe that there are opportunities in U.S. dividends. When people think about U.S. small caps, we believe that it is time to think beyond the Russell 2000 Index. Dividend-paying small caps offer a completely different exposure, all the while providing growth potential without an expensive valuation relative to the broader market.

1Source: WisdomTree, Bloomberg

For definitions of indexes in the chart, please visit our glossary.

• Defensive Sectors: The WisdomTree U.S. Small Cap Dividend Growth Index and WisdomTree SmallCap Dividend Index each have less than 25% of their exposure in the defensive sectors. Competing dividend-focused indexes have anywhere from one-third to two-thirds of their exposures here.

• Consumer Discretionary: If the U.S. economy is indeed on track to recovery, Consumer Discretionary can be a very important sector through which to gain exposure. The WisdomTree U.S. Small Cap Dividend Growth Index has more than 25% of its exposure in this sector. By contrast, Consumer Staples is a sector that is often the top exposure in many large-cap focused dividend indexes, and this sector receives less than 2% weight in the U.S. SmallCap Dividend Growth Index. This is a measure of the dividend landscape diversification this Index brings.

Doing Dividends Differently

WisdomTree continues to believe that there are opportunities in U.S. dividends. When people think about U.S. small caps, we believe that it is time to think beyond the Russell 2000 Index. Dividend-paying small caps offer a completely different exposure, all the while providing growth potential without an expensive valuation relative to the broader market.

1Source: WisdomTree, BloombergImportant Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Diversification does not eliminate the risk of experiencing investment loss. You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.