Dividend Growth Strategies Must Be Married with a Valuation Focus

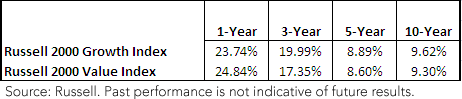

Average Annual Returns as of June 30, 2013

Average Annual Returns as of June 30, 2013

Total Return Comes from Three Factors

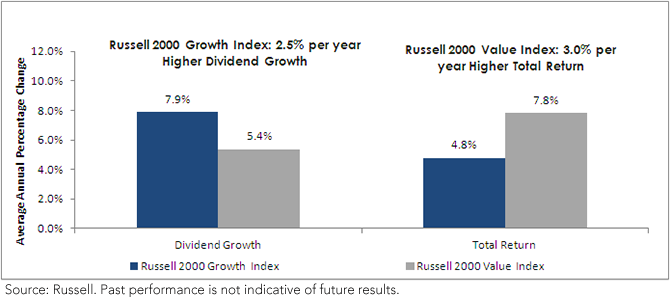

In essence, Small Cap Growth exhibited higher dividend growth over this period—the attribute that many investors are focused on today. However, Small Cap Value outperformed. How is this possible? Remember the mantra: valuation, valuation, valuation.

There are three components of total return:

1. Starting dividend yield (the starting valuation)

2. Dividend growth over the period2

3. Return from valuation changes over the period3

One can deconstruct the components of total return for any equity index in this fashion. Over the 15-year period we studied, from June 30, 1998, to June 30, 2013, while Small Cap Growth had 2.5% higher dividend growth per year, its starting dividend yield was 1.63% lower 15 years ago (.39% for Small Cap Growth vs. 2.02% for Small Cap Value as of June 30, 1998) and it lost about 3.5% per year to valuation changes (-3.49% per year for Small Cap Growth versus .45% per year for Small Cap Value from June 30, 1998 to June 30, 2013). Small Cap Growth started the period expensive and saw its valuation ratios compress4 compared to Small Cap Value—despite exhibiting faster dividend growth. While it lagged in dividend growth, Small Cap Value made up this difference because it had a low starting valuation ratio that expanded5 and contributed positively to returns.

The Marriage of Two Philosophies: Dividend Growth Selection and Dividend Stream® Rebalancing

WisdomTree is known for Dividend Stream weighted Indexes that incorporate a rules-based rebalancing program for its family of dividend-based equity Indexes. The weighting process creates scalability for any investments built to track these Indexes, but it also introduces a critical relative value rebalancing mechanism to anchor weights back to the Dividend Stream. The methodology is evaluating price changes versus dividend changes to determine where to add or subtract weight—and it is a critical part for how WisdomTree focuses on the valuation mantra.

In April of 2013, WisdomTree launched its U.S. Dividend Growth Index (large-cap) as well as the U.S. SmallCap Dividend Growth Index to provide exposure to dividend-paying stocks with growth characteristics. This focus on dividend growth potential is achieved through the selection requirements of the methodology. This is an essential point: While WisdomTree has designed its growth Indexes to select on growth potential, they weight and rebalance back to the Dividend Stream, incorporating a sensitivity to valuation.

Conclusion

The small-cap segment, as represented by the Russell 2000 Growth versus Value example, often carries the highest expectations for growth—and investors often ignore the valuation or the price they are paying for that growth. We believe the new WisdomTree U.S. SmallCap Dividend Growth Index offers a compelling solution for those looking for growth-oriented small-cap strategies but who also want a dividend-based valuation discipline incorporated in the methodology.

1“The highest dividend yield stocks” refers to those within the defensive sectors, most notably within the S&P 500 Consumer Staples, Health Care, Telecommunication Services and Utilities indexes.

2Dividend growth over the period: Refers to the average annual growth in trailing 12-month dividends, in this case from 6/30/1998 to 6/30/2013.

3Return from valuation changes over the period: Average annual measure in the change in price level relative to dividend level. Positive values indicate that prices have increased faster than dividend growth, resulting in less dividends per unit of share price and, ultimately more expensive dividends

4Valuation ratios compressing is another way to reference the negative 3.5% per year negative return from valuation changes.

5The expanding valuation ratio is another way to reference a positive return from valuation changes.

Total Return Comes from Three Factors

In essence, Small Cap Growth exhibited higher dividend growth over this period—the attribute that many investors are focused on today. However, Small Cap Value outperformed. How is this possible? Remember the mantra: valuation, valuation, valuation.

There are three components of total return:

1. Starting dividend yield (the starting valuation)

2. Dividend growth over the period2

3. Return from valuation changes over the period3

One can deconstruct the components of total return for any equity index in this fashion. Over the 15-year period we studied, from June 30, 1998, to June 30, 2013, while Small Cap Growth had 2.5% higher dividend growth per year, its starting dividend yield was 1.63% lower 15 years ago (.39% for Small Cap Growth vs. 2.02% for Small Cap Value as of June 30, 1998) and it lost about 3.5% per year to valuation changes (-3.49% per year for Small Cap Growth versus .45% per year for Small Cap Value from June 30, 1998 to June 30, 2013). Small Cap Growth started the period expensive and saw its valuation ratios compress4 compared to Small Cap Value—despite exhibiting faster dividend growth. While it lagged in dividend growth, Small Cap Value made up this difference because it had a low starting valuation ratio that expanded5 and contributed positively to returns.

The Marriage of Two Philosophies: Dividend Growth Selection and Dividend Stream® Rebalancing

WisdomTree is known for Dividend Stream weighted Indexes that incorporate a rules-based rebalancing program for its family of dividend-based equity Indexes. The weighting process creates scalability for any investments built to track these Indexes, but it also introduces a critical relative value rebalancing mechanism to anchor weights back to the Dividend Stream. The methodology is evaluating price changes versus dividend changes to determine where to add or subtract weight—and it is a critical part for how WisdomTree focuses on the valuation mantra.

In April of 2013, WisdomTree launched its U.S. Dividend Growth Index (large-cap) as well as the U.S. SmallCap Dividend Growth Index to provide exposure to dividend-paying stocks with growth characteristics. This focus on dividend growth potential is achieved through the selection requirements of the methodology. This is an essential point: While WisdomTree has designed its growth Indexes to select on growth potential, they weight and rebalance back to the Dividend Stream, incorporating a sensitivity to valuation.

Conclusion

The small-cap segment, as represented by the Russell 2000 Growth versus Value example, often carries the highest expectations for growth—and investors often ignore the valuation or the price they are paying for that growth. We believe the new WisdomTree U.S. SmallCap Dividend Growth Index offers a compelling solution for those looking for growth-oriented small-cap strategies but who also want a dividend-based valuation discipline incorporated in the methodology.

1“The highest dividend yield stocks” refers to those within the defensive sectors, most notably within the S&P 500 Consumer Staples, Health Care, Telecommunication Services and Utilities indexes.

2Dividend growth over the period: Refers to the average annual growth in trailing 12-month dividends, in this case from 6/30/1998 to 6/30/2013.

3Return from valuation changes over the period: Average annual measure in the change in price level relative to dividend level. Positive values indicate that prices have increased faster than dividend growth, resulting in less dividends per unit of share price and, ultimately more expensive dividends

4Valuation ratios compressing is another way to reference the negative 3.5% per year negative return from valuation changes.

5The expanding valuation ratio is another way to reference a positive return from valuation changes.

Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Diversification does not eliminate the risk of experiencing investment loss. You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.