International Small Caps in Focus

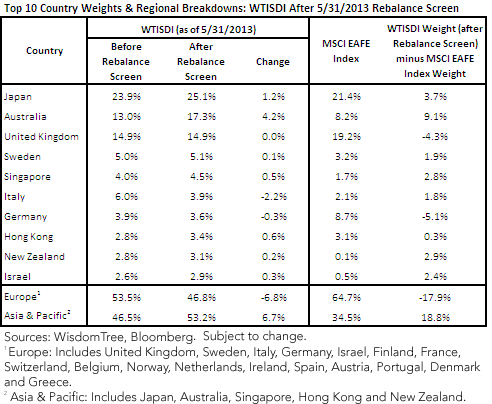

• Changes at 5/31/2013 Rebalance: Australia saw the biggest absolute change—a 4.2% increase in weight. On the opposite end of the spectrum, Italy lost approximately 2.2% of its weight. Overall, WTISDI’s exposure to Europe decreased approximately 7%, while its exposure to Asia & Pacific increased approximately 7%. In fact, all Asia & Pacific countries (Japan, Australia, Hong Kong, Singapore and New Zealand) saw weight increases.

• WTISDI Weights Compared to MSCI EAFE Index: It is interesting that there are no double-digit under- or over-weights on the country side. Australia is the biggest over-weight at 9.1%, while Switzerland, France and Germany were some of the biggest under-weights at -7.6%, -6.8% and -5.1%, respectively. However, if one considers the exposures to Europe vs. the exposures to Asia & Pacific, a different picture emerges. WTISDI is nearly 20% under-weight in Europe and nearly 20% over-weight in Asia & Pacific compared to the MSCI EAFE Index.

The Sector Picture

• Changes at 5/31/2013 Rebalance: Australia saw the biggest absolute change—a 4.2% increase in weight. On the opposite end of the spectrum, Italy lost approximately 2.2% of its weight. Overall, WTISDI’s exposure to Europe decreased approximately 7%, while its exposure to Asia & Pacific increased approximately 7%. In fact, all Asia & Pacific countries (Japan, Australia, Hong Kong, Singapore and New Zealand) saw weight increases.

• WTISDI Weights Compared to MSCI EAFE Index: It is interesting that there are no double-digit under- or over-weights on the country side. Australia is the biggest over-weight at 9.1%, while Switzerland, France and Germany were some of the biggest under-weights at -7.6%, -6.8% and -5.1%, respectively. However, if one considers the exposures to Europe vs. the exposures to Asia & Pacific, a different picture emerges. WTISDI is nearly 20% under-weight in Europe and nearly 20% over-weight in Asia & Pacific compared to the MSCI EAFE Index.

The Sector Picture

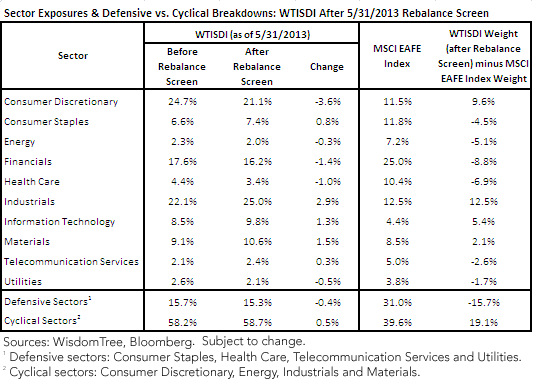

• Changes at the 5/31/2013 Rebalance: Consumer Discretionary saw the biggest absolute change, with its weight decreasing by 3.6%, while Industrials gained the most (2.9%). Most of the other sector changes were quite small.

• WTISDI Weights Compared to MSCI EAFE Index: The sector weights of WTISDI compared to the MSCI EAFE Index exhibit a much wider dispersion than does the country picture. Industrials are the standout—a 12.5% over-weight. But at 9.6%, Consumer Discretionary is also a rather large over-weight. We often describe the small-cap stocks as being more sensitive to the economic environment than large-cap stocks, and these two sector over-weight positions are part of that tilt. The under-weights in small caps compared to large caps come from the defensive sectors—Consumer Staples, Health Care, Telecommunication Services and Utilities. Collectively, the defensive sectors received 15.7% less weight in WTISDI than in the MSCI EAFE Index. On the other hand, cyclical sectors see almost 20% more weight in WTISDI than in the MSCI EAFE Index.

Conclusion

We believe that the WisdomTree International SmallCap Dividend Index rebalance affords a further opportunity to build on the picture of developed international small caps relative to the MSCI EAFE Index. In the near future, we shall turn our focus to the WisdomTree International MidCap Dividend Index in similar fashion.

• Changes at the 5/31/2013 Rebalance: Consumer Discretionary saw the biggest absolute change, with its weight decreasing by 3.6%, while Industrials gained the most (2.9%). Most of the other sector changes were quite small.

• WTISDI Weights Compared to MSCI EAFE Index: The sector weights of WTISDI compared to the MSCI EAFE Index exhibit a much wider dispersion than does the country picture. Industrials are the standout—a 12.5% over-weight. But at 9.6%, Consumer Discretionary is also a rather large over-weight. We often describe the small-cap stocks as being more sensitive to the economic environment than large-cap stocks, and these two sector over-weight positions are part of that tilt. The under-weights in small caps compared to large caps come from the defensive sectors—Consumer Staples, Health Care, Telecommunication Services and Utilities. Collectively, the defensive sectors received 15.7% less weight in WTISDI than in the MSCI EAFE Index. On the other hand, cyclical sectors see almost 20% more weight in WTISDI than in the MSCI EAFE Index.

Conclusion

We believe that the WisdomTree International SmallCap Dividend Index rebalance affords a further opportunity to build on the picture of developed international small caps relative to the MSCI EAFE Index. In the near future, we shall turn our focus to the WisdomTree International MidCap Dividend Index in similar fashion.

Important Risks Related to this Article

You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.