With Emerging Market Status Upgrade, Middle East Countries Are in Focus

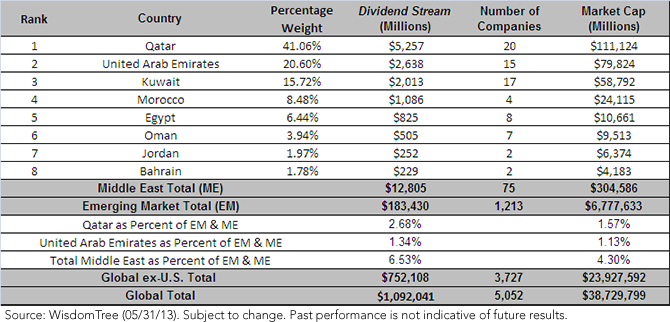

• Qatar Tops Middle East List – Qatar is the largest dividend-paying country in the region, almost doubling the Dividend Stream of the second-largest payer, the United Arab Emirates. Qatar accounts for over 40% of the region’s total Dividend Stream and for over 35% of the region’s market cap.

• United Arab Emirates (UAE) and Kuwait Both Over $2 Billion – Rounding out the top three countries in the region are the UAE and Kuwait. Both have a respectable Dividend Stream of over $2 billion and are fairly represented in the Index with 15 and 17 companies, respectively. It is interesting that these two countries together have a smaller Dividend Stream than Qatar even though, collectively, they have a larger market cap.

• Middle East in Perspective – Although these Dividend Stream and market cap numbers are large in absolute dollars, they are still relatively small compared to the emerging or global markets overall. Depending on whether you look at market cap or Dividend Stream, the Middle East makes up approximately 5% of the emerging markets and about 1% of the global markets.

Market Capitalization Weighting

The MSCI Emerging Markets Index is a market capitalization-weighted index, meaning more weight is given to the companies with the largest market caps. To get an idea of the potential weight these countries might garner after the 2014 index review, I looked at the market cap of the countries in the WisdomTree Middle East Dividend Index. The market cap percentages below are displayed as a percentage of both the WisdomTree Middle East and Emerging Markets Dividend Indexes market cap as of May 31, 2013:

• Qatar – 1.57%

• United Arab Emirates – 1.13%

Dividend Stream Weighting

I thought it would also be interesting to see what type of potential weight these countries might garner if they were included in the WisdomTree Emerging Markets Dividend Index. It is important to note that WisdomTree has no plans to add these countries and the below is strictly for hypothetical purposes. WisdomTree weights its Indexes by Dividend Stream, so to get an idea of potential weights, I looked at the Dividend Streams of both countries and compared them to the current Dividend Stream of the WisdomTree Emerging Markets Dividend Index. The Dividend Stream percentages below are displayed as a percentage of both the WisdomTree Middle East and Emerging Markets Dividend Indexes Dividend Stream as of 05/31/13:

• Qatar – 2.68%

• United Arab Emirates – 1.34%

Exposure to Region

It is impossible to know what the new country weights are going to be in the future, but we do know that market participants will need to add exposure to Qatar and the United Arab Emirates. The WisdomTree Middle East Dividend Index does not provide direct exposure to these countries but does provides exposure to dividend-paying companies in the region. Furthermore, Qatar and the UAE will make up approximately 56% of the WisdomTree Middle East Dividend Index after the annual rebalance is completed.

It is important to remember that individual country returns can vary significantly year over year, and it is impossible to time the best-performing countries. As a result, we think it is important to remain diversified across the different emerging countries and not focus just on the largest by market capitalization. The WisdomTree Middle East Dividend Index tracks dividend-paying stocks in countries that tend to be under-weighted in many investors’ portfolios.

• Qatar Tops Middle East List – Qatar is the largest dividend-paying country in the region, almost doubling the Dividend Stream of the second-largest payer, the United Arab Emirates. Qatar accounts for over 40% of the region’s total Dividend Stream and for over 35% of the region’s market cap.

• United Arab Emirates (UAE) and Kuwait Both Over $2 Billion – Rounding out the top three countries in the region are the UAE and Kuwait. Both have a respectable Dividend Stream of over $2 billion and are fairly represented in the Index with 15 and 17 companies, respectively. It is interesting that these two countries together have a smaller Dividend Stream than Qatar even though, collectively, they have a larger market cap.

• Middle East in Perspective – Although these Dividend Stream and market cap numbers are large in absolute dollars, they are still relatively small compared to the emerging or global markets overall. Depending on whether you look at market cap or Dividend Stream, the Middle East makes up approximately 5% of the emerging markets and about 1% of the global markets.

Market Capitalization Weighting

The MSCI Emerging Markets Index is a market capitalization-weighted index, meaning more weight is given to the companies with the largest market caps. To get an idea of the potential weight these countries might garner after the 2014 index review, I looked at the market cap of the countries in the WisdomTree Middle East Dividend Index. The market cap percentages below are displayed as a percentage of both the WisdomTree Middle East and Emerging Markets Dividend Indexes market cap as of May 31, 2013:

• Qatar – 1.57%

• United Arab Emirates – 1.13%

Dividend Stream Weighting

I thought it would also be interesting to see what type of potential weight these countries might garner if they were included in the WisdomTree Emerging Markets Dividend Index. It is important to note that WisdomTree has no plans to add these countries and the below is strictly for hypothetical purposes. WisdomTree weights its Indexes by Dividend Stream, so to get an idea of potential weights, I looked at the Dividend Streams of both countries and compared them to the current Dividend Stream of the WisdomTree Emerging Markets Dividend Index. The Dividend Stream percentages below are displayed as a percentage of both the WisdomTree Middle East and Emerging Markets Dividend Indexes Dividend Stream as of 05/31/13:

• Qatar – 2.68%

• United Arab Emirates – 1.34%

Exposure to Region

It is impossible to know what the new country weights are going to be in the future, but we do know that market participants will need to add exposure to Qatar and the United Arab Emirates. The WisdomTree Middle East Dividend Index does not provide direct exposure to these countries but does provides exposure to dividend-paying companies in the region. Furthermore, Qatar and the UAE will make up approximately 56% of the WisdomTree Middle East Dividend Index after the annual rebalance is completed.

It is important to remember that individual country returns can vary significantly year over year, and it is impossible to time the best-performing countries. As a result, we think it is important to remain diversified across the different emerging countries and not focus just on the largest by market capitalization. The WisdomTree Middle East Dividend Index tracks dividend-paying stocks in countries that tend to be under-weighted in many investors’ portfolios.

Important Risks Related to this Article

You cannot invest directly in an index. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in the Middle East increase the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets such as the Middle East are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.