Impact of 2013 Rebalance: WisdomTree Japan Hedged Equity Index

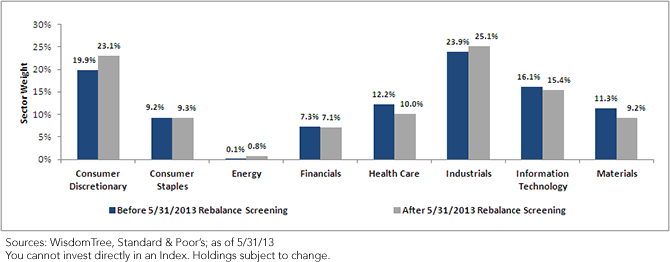

• Additions in Weight: Consumer Discretionary was the greatest addition at 3.2%, with the greatest single company addition being Fast Retailing Co., a .84% weight. This is an apparel company best known for its Uniqlo brand. The Consumer Discretionary sector, among large-cap exporters, is also one of the most globally sensitive sectors in Japan once the export filter is applied (as discussed below). Industrials was the second-greatest addition in weight, with a 1.2% increase, with Mitsubishi Corp. and Japan Airlines Co. being the two largest single company additions in this sector, at 2.67% and 1.01%, respectively.

• Reductions in Weight: Health Care and Materials represented the two greatest reductions in weight, at 2.2% and 2.1%, respectively.

• Utilities and Telecommunications: These two sectors contain firms that tend to derive more than 80% of their revenues from inside Japan. Since the implementation of the 80% revenue filter for this Index on November 30, 2012, no firms from either of these sectors have qualified for inclusion, which is why neither is shown in this chart.

Japan’s Global Revenue Generators

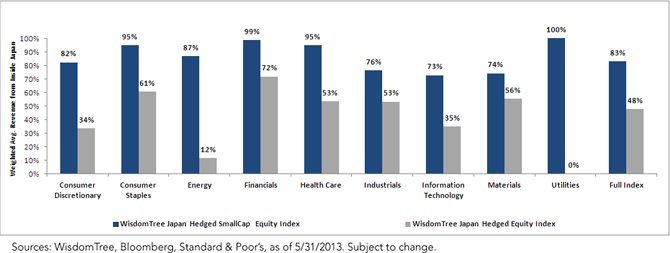

In the chart that follows, we compare the weighted average revenues from inside Japan of the constituents of the WisdomTree Japan Hedged SmallCap Equity Index and the WisdomTree Japan Hedged Equity Index. This is a useful comparison because, while both Indexes consist solely of dividend-paying companies, the small-cap Index does not filter out firms that generate more than 80% of their revenues from inside Japan.

These two Indexes are designed to provide contrasting and complementary exposures: the small-cap one is focused on stocks more sensitive to the underlying local Japanese economy, and the export-tilted Japan Hedged Equity Index is focused on those with a global revenue base.

Within every sector, the revenue filter applied to determine constituent eligibility led to lower weighted average revenues being generated from inside Japan, thereby indicating that its constituents are more globally focused in their revenue base.

Revenues from Inside Japan

• Additions in Weight: Consumer Discretionary was the greatest addition at 3.2%, with the greatest single company addition being Fast Retailing Co., a .84% weight. This is an apparel company best known for its Uniqlo brand. The Consumer Discretionary sector, among large-cap exporters, is also one of the most globally sensitive sectors in Japan once the export filter is applied (as discussed below). Industrials was the second-greatest addition in weight, with a 1.2% increase, with Mitsubishi Corp. and Japan Airlines Co. being the two largest single company additions in this sector, at 2.67% and 1.01%, respectively.

• Reductions in Weight: Health Care and Materials represented the two greatest reductions in weight, at 2.2% and 2.1%, respectively.

• Utilities and Telecommunications: These two sectors contain firms that tend to derive more than 80% of their revenues from inside Japan. Since the implementation of the 80% revenue filter for this Index on November 30, 2012, no firms from either of these sectors have qualified for inclusion, which is why neither is shown in this chart.

Japan’s Global Revenue Generators

In the chart that follows, we compare the weighted average revenues from inside Japan of the constituents of the WisdomTree Japan Hedged SmallCap Equity Index and the WisdomTree Japan Hedged Equity Index. This is a useful comparison because, while both Indexes consist solely of dividend-paying companies, the small-cap Index does not filter out firms that generate more than 80% of their revenues from inside Japan.

These two Indexes are designed to provide contrasting and complementary exposures: the small-cap one is focused on stocks more sensitive to the underlying local Japanese economy, and the export-tilted Japan Hedged Equity Index is focused on those with a global revenue base.

Within every sector, the revenue filter applied to determine constituent eligibility led to lower weighted average revenues being generated from inside Japan, thereby indicating that its constituents are more globally focused in their revenue base.

Revenues from Inside Japan

• While the WisdomTree Japan Hedged SmallCap Equity Index derives 83% of its weighted average revenues from inside Japan, the WisdomTree Japan Hedged Equity Index derives a little more than half that (48%) from inside Japan.

Conclusion

Japan is gaining attention primarily due to government activities aimed at promoting economic growth. When people consider how these policies might impact equity markets, we recommend taking a step back and noting the bigger picture. If one is interested in equities sensitive to domestic Japanese demand, the WisdomTree Japan Hedged SmallCap Equity Index clearly has more of its revenues coming from inside Japan. However, if one is interested in equities characterized by global revenue streams, the WisdomTree Japan Hedged Equity Index could better represent that economic view.

Source is Bloomberg unless otherwise noted.

• While the WisdomTree Japan Hedged SmallCap Equity Index derives 83% of its weighted average revenues from inside Japan, the WisdomTree Japan Hedged Equity Index derives a little more than half that (48%) from inside Japan.

Conclusion

Japan is gaining attention primarily due to government activities aimed at promoting economic growth. When people consider how these policies might impact equity markets, we recommend taking a step back and noting the bigger picture. If one is interested in equities sensitive to domestic Japanese demand, the WisdomTree Japan Hedged SmallCap Equity Index clearly has more of its revenues coming from inside Japan. However, if one is interested in equities characterized by global revenue streams, the WisdomTree Japan Hedged Equity Index could better represent that economic view.

Source is Bloomberg unless otherwise noted.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments focusing in Japan thereby increase the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investment risk and the effect of varied economic conditions.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.