Introducing the WisdomTree United Kingdom Hedged Equity Index

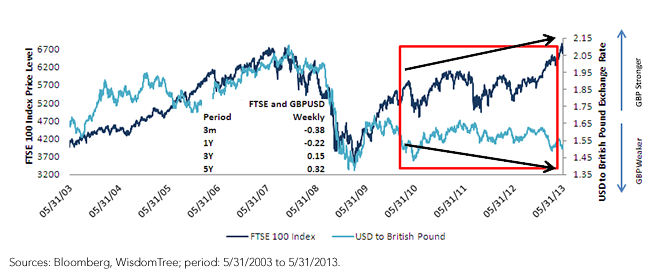

• From May 31, 2003, to approximately May 31, 2009, the movement of the pound vs. the U.S. dollar measured relative to the price level of the FTSE 100 Index implied significantly positive correlation . In essence, we see this through the dark blue line and the light blue line moving in a very similar manner over this period.

• May 31, 2009, marks somewhat of an inflection point, in that the FTSE 100 Index begins a significant upward trend whereas the exchange rate of the pound against the dollar begins to move in the negative direction. The tendency for these two lines to now move in opposite directions implies the emergence of a negative correlation between the currency and equity markets—very much like what is happening in Japan, albeit to a less pronounced degree.

• Measuring the actual correlation statistics between the FTSE 100 Index and the dollar-to-pound exchange rate, one can see a negative correlation of approximately -.3 over the three months ending May 31, 2013, and -.1 over the 12 months preceding the same date. Over the last three and five years, correlation has been positive, indicating to us that the emergence of negative correlation has been fairly recent.

Introducing the WisdomTree United Kingdom Hedged Equity Index

The WisdomTree United Kingdom Hedged Equity Index uses a rules-based process for selecting and weighting securities while managing the British pound risk.

• The universe comprises the largest dividend-paying companies from the WisdomTree DEFA Index (broad developed world ex-U.S.) that are traded in British pounds, with a minimum market capitalization of $1 billion

• A maximum of 80% of revenues can be derived from the United Kingdom

• A 5% cap to any individual security at the time of the annual Index rebalance

• A cap of 25% to any individual sector at the time of the annual Index rebalance

• Between annual rebalances, individual security and sector weights may fluctuate above 5% and 25%, respectively

The stocks trading in the United Kingdom very typically have a global revenue base and also generally are dividend payers—as a result, the exposure in the WisdomTree United Kingdom Hedged Equity Index looks very similar to general market cap-weighted indexes. As of May 31, 2013, when we look at the FTSE 100 Index, 97.8% of its weight is in dividend-paying stocks, and over 83% is represented in the WisdomTree United Kingdom Hedged Equity Index. One reason the companies are so global in nature is that London is considered one of the financial capitals of the world and many global companies list their shares there. We believe the WisdomTree United Kingdom Hedged Equity Index thus is very representative of the performance of UK-listed stocks while hedging the performance of the pound from impacting returns.

The currency-hedging component is done through the use of non-deliverable forward contracts that are rebalanced monthly. Each month, the notional principal of the forward contracts is matched to the assets in the fund.

Conclusion

At WisdomTree, we are excited to have developed our third hedged equity Index focused on a single currency: the WisdomTree United Kingdom Hedged Equity Index. Combining the WisdomTree Japan Hedged Equity Index, the WisdomTree Europe Hedged Equity Index and the WisdomTree United Kingdom Hedged Equity Index, one can essentially focus on hedging three currencies that, as of May 31, 2013, comprise approximately 70% of the weight of the MSCI EAFE Index. We believe this is a strong step forward in our currency hedged equity capabilities.

1 Refers to the WisdomTree DEFA Hedged Equity Index, which consisted of exposures to developed world equities and currencies such as the euro, Japanese yen, British pound, Danish krone, Norwegian krone, Swedish krona and others.

2 Since Japanese prime minister Shinzo Abe’s election 12/16/2012, the Nikkei 225 Index is up over 40% through 5/31/2013 and the yen is down almost 20% (against the U.S. dollar) over the same period.

3Source: Bloomberg, as of 5/31/2013.

• From May 31, 2003, to approximately May 31, 2009, the movement of the pound vs. the U.S. dollar measured relative to the price level of the FTSE 100 Index implied significantly positive correlation . In essence, we see this through the dark blue line and the light blue line moving in a very similar manner over this period.

• May 31, 2009, marks somewhat of an inflection point, in that the FTSE 100 Index begins a significant upward trend whereas the exchange rate of the pound against the dollar begins to move in the negative direction. The tendency for these two lines to now move in opposite directions implies the emergence of a negative correlation between the currency and equity markets—very much like what is happening in Japan, albeit to a less pronounced degree.

• Measuring the actual correlation statistics between the FTSE 100 Index and the dollar-to-pound exchange rate, one can see a negative correlation of approximately -.3 over the three months ending May 31, 2013, and -.1 over the 12 months preceding the same date. Over the last three and five years, correlation has been positive, indicating to us that the emergence of negative correlation has been fairly recent.

Introducing the WisdomTree United Kingdom Hedged Equity Index

The WisdomTree United Kingdom Hedged Equity Index uses a rules-based process for selecting and weighting securities while managing the British pound risk.

• The universe comprises the largest dividend-paying companies from the WisdomTree DEFA Index (broad developed world ex-U.S.) that are traded in British pounds, with a minimum market capitalization of $1 billion

• A maximum of 80% of revenues can be derived from the United Kingdom

• A 5% cap to any individual security at the time of the annual Index rebalance

• A cap of 25% to any individual sector at the time of the annual Index rebalance

• Between annual rebalances, individual security and sector weights may fluctuate above 5% and 25%, respectively

The stocks trading in the United Kingdom very typically have a global revenue base and also generally are dividend payers—as a result, the exposure in the WisdomTree United Kingdom Hedged Equity Index looks very similar to general market cap-weighted indexes. As of May 31, 2013, when we look at the FTSE 100 Index, 97.8% of its weight is in dividend-paying stocks, and over 83% is represented in the WisdomTree United Kingdom Hedged Equity Index. One reason the companies are so global in nature is that London is considered one of the financial capitals of the world and many global companies list their shares there. We believe the WisdomTree United Kingdom Hedged Equity Index thus is very representative of the performance of UK-listed stocks while hedging the performance of the pound from impacting returns.

The currency-hedging component is done through the use of non-deliverable forward contracts that are rebalanced monthly. Each month, the notional principal of the forward contracts is matched to the assets in the fund.

Conclusion

At WisdomTree, we are excited to have developed our third hedged equity Index focused on a single currency: the WisdomTree United Kingdom Hedged Equity Index. Combining the WisdomTree Japan Hedged Equity Index, the WisdomTree Europe Hedged Equity Index and the WisdomTree United Kingdom Hedged Equity Index, one can essentially focus on hedging three currencies that, as of May 31, 2013, comprise approximately 70% of the weight of the MSCI EAFE Index. We believe this is a strong step forward in our currency hedged equity capabilities.

1 Refers to the WisdomTree DEFA Hedged Equity Index, which consisted of exposures to developed world equities and currencies such as the euro, Japanese yen, British pound, Danish krone, Norwegian krone, Swedish krona and others.

2 Since Japanese prime minister Shinzo Abe’s election 12/16/2012, the Nikkei 225 Index is up over 40% through 5/31/2013 and the yen is down almost 20% (against the U.S. dollar) over the same period.

3Source: Bloomberg, as of 5/31/2013.Important Risks Related to this Article

You cannot invest directly in an index. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing in specific regions or countries increase the impact of events and developments associated with the region or country, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.