A Focus on Japan Small Caps for Domestic Demand

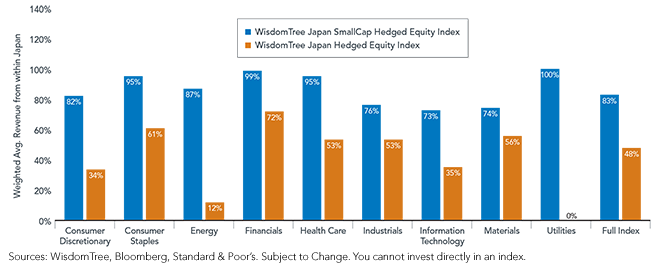

• Small Caps Are Locally Based: The WisdomTree Japan SmallCap Hedged Equity Index derives nearly twice the amount of revenue from within Japan (83%) than the WisdomTree Japan Hedged Equity Index on a weighted average basis.

• Over half the constituents of the Japan SmallCap Hedged Equity Index have 100% of their revenue coming from Japan.

• Sector Comparisons: The WisdomTree Japan SmallCap Hedged Equity Index derives a greater weighted average revenue from within Japan than the WisdomTree Japan Hedged Equity Index in all 10 industry sectors. Consumer Staples, Financials, Health Care and Utilities stand out as being the most locally based, but even the Consumer Discretionary sector (which is the most globally based sector in the export basket) has 82% of its revenue coming from Japan.

Additional Valuation Advantage

The WisdomTree Japan SmallCap Hedged Equity Index also exhibits a valuation advantage compared to the WisdomTree Japan Hedged Equity Index as of the May 31, 2013, Index Screening:

• The WisdomTree Japan SmallCap Hedged Equity Index has a price-to-earnings (P/E) ratio of about 13x earnings and a price-to-book value (P/B) ratio of .8x.

• The WisdomTree Japan Hedged Equity Index has a P/E ratio of about 14x earnings and a P/B ratio of 1.2x.

We believe this relationship between the Japanese large and small cap equities to be impacted by a lot of international investor interest in Japan—the large global revenue generators in the WisdomTree Japan Hedged Equity Index are the firms that these investors would know, whereas the smaller firms in the WisdomTree Japan SmallCap Hedged Equity Index would be less familiar.

Conclusion

We believe that Abenomics will not fade quickly—on both the monetary and fiscal side, commitments have been made with a focus on long-term results and a willingness to stay the course. That points to a need for flexibility: Japan’s global revenue generators might be in favor some of the time, while at other times the focus could shift more toward the more domestically sensitive firms. In conceptualizing how best to measure the performance of Japanese equities, it could make sense to consider each of what we believe are quite different ways of looking at a single country’s equities.

1Companies with a global revenue base are identified as companies that have less than 80% of their revenue coming from Japan.

• Small Caps Are Locally Based: The WisdomTree Japan SmallCap Hedged Equity Index derives nearly twice the amount of revenue from within Japan (83%) than the WisdomTree Japan Hedged Equity Index on a weighted average basis.

• Over half the constituents of the Japan SmallCap Hedged Equity Index have 100% of their revenue coming from Japan.

• Sector Comparisons: The WisdomTree Japan SmallCap Hedged Equity Index derives a greater weighted average revenue from within Japan than the WisdomTree Japan Hedged Equity Index in all 10 industry sectors. Consumer Staples, Financials, Health Care and Utilities stand out as being the most locally based, but even the Consumer Discretionary sector (which is the most globally based sector in the export basket) has 82% of its revenue coming from Japan.

Additional Valuation Advantage

The WisdomTree Japan SmallCap Hedged Equity Index also exhibits a valuation advantage compared to the WisdomTree Japan Hedged Equity Index as of the May 31, 2013, Index Screening:

• The WisdomTree Japan SmallCap Hedged Equity Index has a price-to-earnings (P/E) ratio of about 13x earnings and a price-to-book value (P/B) ratio of .8x.

• The WisdomTree Japan Hedged Equity Index has a P/E ratio of about 14x earnings and a P/B ratio of 1.2x.

We believe this relationship between the Japanese large and small cap equities to be impacted by a lot of international investor interest in Japan—the large global revenue generators in the WisdomTree Japan Hedged Equity Index are the firms that these investors would know, whereas the smaller firms in the WisdomTree Japan SmallCap Hedged Equity Index would be less familiar.

Conclusion

We believe that Abenomics will not fade quickly—on both the monetary and fiscal side, commitments have been made with a focus on long-term results and a willingness to stay the course. That points to a need for flexibility: Japan’s global revenue generators might be in favor some of the time, while at other times the focus could shift more toward the more domestically sensitive firms. In conceptualizing how best to measure the performance of Japanese equities, it could make sense to consider each of what we believe are quite different ways of looking at a single country’s equities.

1Companies with a global revenue base are identified as companies that have less than 80% of their revenue coming from Japan.

Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments focusing in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investments which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.