Brazil Repeals Financial Transaction Tax. What Could it Mean for Bond Investors?

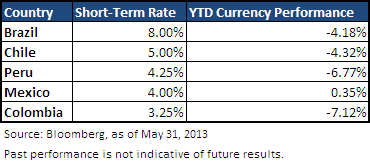

As shown in the table above, Brazil currently offers some of the highest yields in all of Latin America. While the potential for near-term volatility is still present in many of these markets, Brazil offers a potential “cushion” against further currency weakness due to its higher rates. Should some of the negative clouds regarding economic growth lift, we believe the real could trade higher than its current depressed levels.

Recently, the ratings agency Standard & Poor’s revised its ratings outlook for Brazil from stable to negative. The agency noted the potential for a continued deterioration in the growth outlook combined with Brazil’s current fiscal and external vulnerabilities as the reason for the announcement. In our view, we believe this could serve as a shot across the bow for Brazil and other EM countries to continue their efforts to further reduce external vulnerability. After a series of upgrades in credit ratings for many EM countries by the ratings agencies in the past few months S&P’s announcement has caused an already fragile market to weaken further. Even though the near-term headwinds appear to continue, we believe that Brazil may still present an attractive risk/reward near current levels.

While the impact of the announcement of the removal of the Financial Transaction Tax was muted by other market forces, we view this development as a longer-term positive for investment in the Brazilian bond market. For some investors, high levels of carry and a currency trading near multi-year highs may provide an attractive option for diversifying away from U.S. dollar-based investments.

1IOF: Imposto sobre Operações Financeiras (Portugese)

2Standard & Poor’s, June 7, 2013.

3Source: Standard Chartered Bank, June 6, 2013.

4Source: Bloomberg, June 11, 2013.

As shown in the table above, Brazil currently offers some of the highest yields in all of Latin America. While the potential for near-term volatility is still present in many of these markets, Brazil offers a potential “cushion” against further currency weakness due to its higher rates. Should some of the negative clouds regarding economic growth lift, we believe the real could trade higher than its current depressed levels.

Recently, the ratings agency Standard & Poor’s revised its ratings outlook for Brazil from stable to negative. The agency noted the potential for a continued deterioration in the growth outlook combined with Brazil’s current fiscal and external vulnerabilities as the reason for the announcement. In our view, we believe this could serve as a shot across the bow for Brazil and other EM countries to continue their efforts to further reduce external vulnerability. After a series of upgrades in credit ratings for many EM countries by the ratings agencies in the past few months S&P’s announcement has caused an already fragile market to weaken further. Even though the near-term headwinds appear to continue, we believe that Brazil may still present an attractive risk/reward near current levels.

While the impact of the announcement of the removal of the Financial Transaction Tax was muted by other market forces, we view this development as a longer-term positive for investment in the Brazilian bond market. For some investors, high levels of carry and a currency trading near multi-year highs may provide an attractive option for diversifying away from U.S. dollar-based investments.

1IOF: Imposto sobre Operações Financeiras (Portugese)

2Standard & Poor’s, June 7, 2013.

3Source: Standard Chartered Bank, June 6, 2013.

4Source: Bloomberg, June 11, 2013.Important Risks Related to this Article

Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition when interest rates fall income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuers ability to make such payments will cause the price of that bond to decline. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.