The Future of International Dividend Growth Indexes

For definitions of terms and indexes, visit our Glossary.

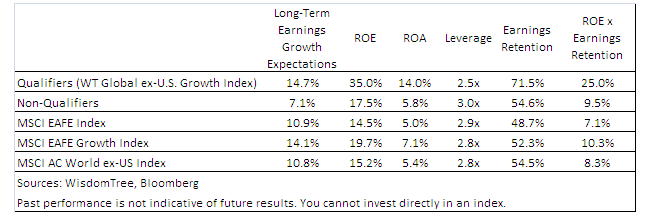

• Higher Growth Expectations: The average long-term earnings growth estimates were over 7 percentage points higher for qualifiers to this Index than for non-qualifiers. They were also higher than the MSCI EAFE Index, the MSCI EAFE Growth Index and the MSCI AC World ex-US Index. Admittedly, these indexes are weighted by market capitalization and do not focus on dividend-paying stocks. However, we include them as widely followed international benchmarks outside the U.S., and it is a fact that the MSCI EAFE Growth Index does focus on companies that MSCI selects based on their above-average growth prospects relative to the universe defined by the broader EAFE Index.

• The ROE/Dividend Connection: The ROE for the qualifiers for the WT Global ex-U.S. Growth Index was almost twice as high as that of the MSCI EAFE Growth Index, the next highest. Additionally, the ROA was also basically double that of the MSCI EAFE Growth Index. This is a combination that we believe indicates that our selection criteria are focused on creating exposure to firms that are generating their profits efficiently.

• Lower Leverage: The qualifiers to the WT Global ex-U.S. Growth Index employ less leverage to operate their businesses than both the non-qualifiers and the broader equity market measures.

Conclusion

While there is no way to know what will happen in the future with certainty, we believe that our dividend growth methodology applies a framework to selecting stocks with growth characteristics. We have focused on variables that we believe are key drivers of dividend growth. Companies incorporated outside U.S. markets provide a widely ranging opportunity set of dividend payers, and we believe it makes sense to provide an option that attempts to select those best positioned for potential dividend growth.

Read our full research here.

For definitions of terms and indexes, visit our Glossary.

• Higher Growth Expectations: The average long-term earnings growth estimates were over 7 percentage points higher for qualifiers to this Index than for non-qualifiers. They were also higher than the MSCI EAFE Index, the MSCI EAFE Growth Index and the MSCI AC World ex-US Index. Admittedly, these indexes are weighted by market capitalization and do not focus on dividend-paying stocks. However, we include them as widely followed international benchmarks outside the U.S., and it is a fact that the MSCI EAFE Growth Index does focus on companies that MSCI selects based on their above-average growth prospects relative to the universe defined by the broader EAFE Index.

• The ROE/Dividend Connection: The ROE for the qualifiers for the WT Global ex-U.S. Growth Index was almost twice as high as that of the MSCI EAFE Growth Index, the next highest. Additionally, the ROA was also basically double that of the MSCI EAFE Growth Index. This is a combination that we believe indicates that our selection criteria are focused on creating exposure to firms that are generating their profits efficiently.

• Lower Leverage: The qualifiers to the WT Global ex-U.S. Growth Index employ less leverage to operate their businesses than both the non-qualifiers and the broader equity market measures.

Conclusion

While there is no way to know what will happen in the future with certainty, we believe that our dividend growth methodology applies a framework to selecting stocks with growth characteristics. We have focused on variables that we believe are key drivers of dividend growth. Companies incorporated outside U.S. markets provide a widely ranging opportunity set of dividend payers, and we believe it makes sense to provide an option that attempts to select those best positioned for potential dividend growth.

Read our full research here.

Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.