A Growth Style Characteristic for a Dividend ETF

For definitions of terms and indexes, visit our Glossary.

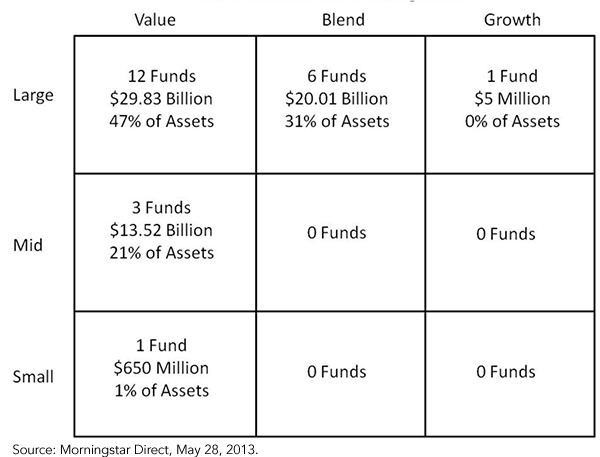

• There were 23 funds in the universe of broad-based U.S.-listed ETFs, and these had a total of more than $64 billion in total assets.

• Approximately 99% of the assets in these 23 ETFs were classified by Morningstar as Large Value, Large Blend, or Mid-Cap Value. If new broad-based dividend ETFs come into existence that are classified in these areas of the style box, they might have a more difficult time differentiating themselves from the options already in existence.

• The style boxes that are notably “light” fall within the small-cap row as well as along the growth column. The singular funds represented in these areas are both WisdomTree Funds, the WisdomTree SmallCap Dividend Fund (DES) in the Small Value box, and the WisdomTree U.S. Dividend Growth Fund (DGRW) in the Large Growth box. We believe a major reason asset levels are currently small is that investors aren’t aware that dividend-focused options actually exist in small caps or in growth-oriented equities.

DGRW was created with a methodology to select dividend-paying stocks with growth characteristics. The selection factors of DGRW include a multi-factor ranking process based on long-term earnings growth expectations, historical three-year average return on equity and historical three-year average return on assets. Historically, these variables tend to coincide largely with growth stocks—and stocks we believe have the most potential to grow dividends over time.

Conclusion

As people try to make sense of the myriad investment options that exist within ETFs, our hope is that the above chart might help simplify the dividend-focused picture of U.S. equities. Many options exist, but most of them are categorized within a very limited portion of the style box. We’d encourage investors to recognize that U.S. dividend payers (and ETFs focused on them) can exist within the small-cap row as well as the growth column of the style box, giving the potential to offer differentiated exposure to complement existing dividend-focused strategies.

1Style: Morningstar defines its style box along two axes—large, mid and small, as well as value, blend and growth. If two strategies are in the same style box, it does not mean that they hold the exact same portfolios, but it could mean that it might be harder to generate significantly different returns, as compared to strategies in different style boxes.

2 The style box classifications and asset levels were sourced from Morningstar Direct, current as of May 28, 2013.

For definitions of terms and indexes, visit our Glossary.

• There were 23 funds in the universe of broad-based U.S.-listed ETFs, and these had a total of more than $64 billion in total assets.

• Approximately 99% of the assets in these 23 ETFs were classified by Morningstar as Large Value, Large Blend, or Mid-Cap Value. If new broad-based dividend ETFs come into existence that are classified in these areas of the style box, they might have a more difficult time differentiating themselves from the options already in existence.

• The style boxes that are notably “light” fall within the small-cap row as well as along the growth column. The singular funds represented in these areas are both WisdomTree Funds, the WisdomTree SmallCap Dividend Fund (DES) in the Small Value box, and the WisdomTree U.S. Dividend Growth Fund (DGRW) in the Large Growth box. We believe a major reason asset levels are currently small is that investors aren’t aware that dividend-focused options actually exist in small caps or in growth-oriented equities.

DGRW was created with a methodology to select dividend-paying stocks with growth characteristics. The selection factors of DGRW include a multi-factor ranking process based on long-term earnings growth expectations, historical three-year average return on equity and historical three-year average return on assets. Historically, these variables tend to coincide largely with growth stocks—and stocks we believe have the most potential to grow dividends over time.

Conclusion

As people try to make sense of the myriad investment options that exist within ETFs, our hope is that the above chart might help simplify the dividend-focused picture of U.S. equities. Many options exist, but most of them are categorized within a very limited portion of the style box. We’d encourage investors to recognize that U.S. dividend payers (and ETFs focused on them) can exist within the small-cap row as well as the growth column of the style box, giving the potential to offer differentiated exposure to complement existing dividend-focused strategies.

1Style: Morningstar defines its style box along two axes—large, mid and small, as well as value, blend and growth. If two strategies are in the same style box, it does not mean that they hold the exact same portfolios, but it could mean that it might be harder to generate significantly different returns, as compared to strategies in different style boxes.

2 The style box classifications and asset levels were sourced from Morningstar Direct, current as of May 28, 2013.

Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company paying dividends may cease paying dividends at any time. There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.