How Exposed to the Technology Sector Is Your Dividend Index?

Information Technology has been the unmistakable dividend growth leader since November 30, 2007. While we can’t predict the future with certainty, we do believe that tech firms will continue to generate large amounts of cash, and recent announcements from some of the largest among them signal a commitment to return some of that bounty to shareholders in the form of both dividends and share buybacks. However:

• Setting a Baseline for Analysis: As of March 31, 2013, the S&P 500 Index (which does not focus on dividend payers or dividend growth in any way) had a baseline exposure to the Information Technology sector of about 18%. This allows us to set somewhat of a baseline exposure of the market capitalization-weighted picture of U.S. equities, with the thought being that, if the sector is believed to be an important dividend growth driver in the future, it may make sense to be over-weight compared to this benchmark.

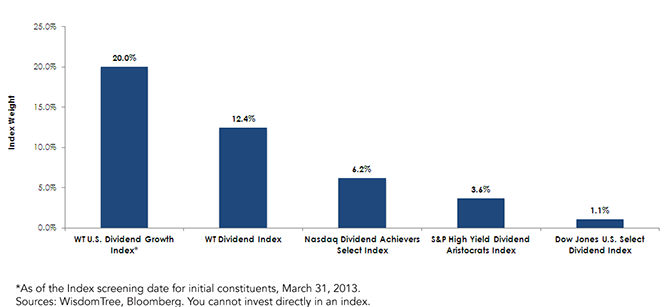

• Tech’s Lack of History: The problem with Information Technology firms is one of “history,” or lack thereof. These firms have largely not been paying dividends for five years, much less increasing them for 10 or 20. The respective weights of the sector in the NASDAQ US Dividend Achievers Select Index (which requires 10 years of consecutive dividend increases), S&P High Yield Dividend Aristocrats Index (20 years of consecutive dividend increases) and Dow Jones U.S. Select Dividend Index (five years of non-negative dividend growth) illustrate this issue. We believe a drawback of these indexes is their failure to emphasize dividend growth potential in their methodologies, which is actually lost in the requirement to have so much history.

• The WisdomTree U.S. Dividend Growth Index: When people look at equity markets, we believe they look at past performance but are also thinking about future potential. We believe there are better options than solely extrapolating from the past. As a result, we’ve created our WisdomTree U.S. Dividend Growth Index (methodology detailed in prior blogs). In essence, the methodology is geared toward identifying a basket of companies we think will be above-average dividend growers tomorrow, rather than just selecting the dividend growers of yesterday.

NASDAQ US Dividend Achievers Select Index

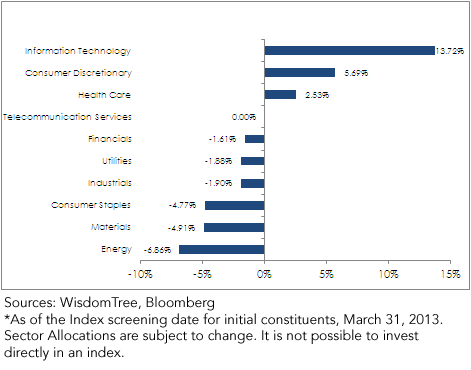

This index focuses on firms able to generate 10 consecutive years of dividend increases, and since it doesn’t focus on any yield-based selection beyond that (weighting is essentially by market capitalization), we have set it as the market capitalization-weighted benchmark by which the performance of the WisdomTree U.S. Dividend Growth Index (WTDGI) is measured. What we see from the initial picture of sector exposures, based on the screening for initial constituents for WTDGI is this:

Information Technology has been the unmistakable dividend growth leader since November 30, 2007. While we can’t predict the future with certainty, we do believe that tech firms will continue to generate large amounts of cash, and recent announcements from some of the largest among them signal a commitment to return some of that bounty to shareholders in the form of both dividends and share buybacks. However:

• Setting a Baseline for Analysis: As of March 31, 2013, the S&P 500 Index (which does not focus on dividend payers or dividend growth in any way) had a baseline exposure to the Information Technology sector of about 18%. This allows us to set somewhat of a baseline exposure of the market capitalization-weighted picture of U.S. equities, with the thought being that, if the sector is believed to be an important dividend growth driver in the future, it may make sense to be over-weight compared to this benchmark.

• Tech’s Lack of History: The problem with Information Technology firms is one of “history,” or lack thereof. These firms have largely not been paying dividends for five years, much less increasing them for 10 or 20. The respective weights of the sector in the NASDAQ US Dividend Achievers Select Index (which requires 10 years of consecutive dividend increases), S&P High Yield Dividend Aristocrats Index (20 years of consecutive dividend increases) and Dow Jones U.S. Select Dividend Index (five years of non-negative dividend growth) illustrate this issue. We believe a drawback of these indexes is their failure to emphasize dividend growth potential in their methodologies, which is actually lost in the requirement to have so much history.

• The WisdomTree U.S. Dividend Growth Index: When people look at equity markets, we believe they look at past performance but are also thinking about future potential. We believe there are better options than solely extrapolating from the past. As a result, we’ve created our WisdomTree U.S. Dividend Growth Index (methodology detailed in prior blogs). In essence, the methodology is geared toward identifying a basket of companies we think will be above-average dividend growers tomorrow, rather than just selecting the dividend growers of yesterday.

NASDAQ US Dividend Achievers Select Index

This index focuses on firms able to generate 10 consecutive years of dividend increases, and since it doesn’t focus on any yield-based selection beyond that (weighting is essentially by market capitalization), we have set it as the market capitalization-weighted benchmark by which the performance of the WisdomTree U.S. Dividend Growth Index (WTDGI) is measured. What we see from the initial picture of sector exposures, based on the screening for initial constituents for WTDGI is this:

The standout is clearly the almost 14% over-weight to Information Technology. Companies such as Apple, indicated to be the largest payer of indicated cash dividends in the world as of April 23, 2013,3 are immediately eligible for inclusion in the WisdomTree Index. It will take until 2023 to determine whether Apple increased its cash dividends year over year for 10 consecutive years.

Conclusion

No index methodology can know ahead of time from where future dividend growth will come. However, we would argue that there are benefits to being flexible and able to steer toward potential dividend growth as opposed to being constrained to waiting long periods before being able to react. We believe that, as index development advances, historical dividend growth screens will cease to be the only option for indexes focused on potential dividend growth in the future.

View Jeremy Schwartz discuss dividends (Video)

Read our Dividend Growth series here.

1Sources: WisdomTree, Standard & Poor’s for universe of the WisdomTree Earnings Index, as of 3/31/2013.

2Sources: WisdomTree, Bloomberg for universe of WisdomTree Dividend Index, measured from the 11/30/2007 screening date to the 11/30/2012 screening date.

3Source: Apple Press Info, “Apple More than Doubles Capital Return Program,” April 23, 2013.

The standout is clearly the almost 14% over-weight to Information Technology. Companies such as Apple, indicated to be the largest payer of indicated cash dividends in the world as of April 23, 2013,3 are immediately eligible for inclusion in the WisdomTree Index. It will take until 2023 to determine whether Apple increased its cash dividends year over year for 10 consecutive years.

Conclusion

No index methodology can know ahead of time from where future dividend growth will come. However, we would argue that there are benefits to being flexible and able to steer toward potential dividend growth as opposed to being constrained to waiting long periods before being able to react. We believe that, as index development advances, historical dividend growth screens will cease to be the only option for indexes focused on potential dividend growth in the future.

View Jeremy Schwartz discuss dividends (Video)

Read our Dividend Growth series here.

1Sources: WisdomTree, Standard & Poor’s for universe of the WisdomTree Earnings Index, as of 3/31/2013.

2Sources: WisdomTree, Bloomberg for universe of WisdomTree Dividend Index, measured from the 11/30/2007 screening date to the 11/30/2012 screening date.

3Source: Apple Press Info, “Apple More than Doubles Capital Return Program,” April 23, 2013.Important Risks Related to this Article

Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.