Why We Believe Dividend Stocks Are Not in a Bubble

For definitions of terms and indexes, visit our Glossary.

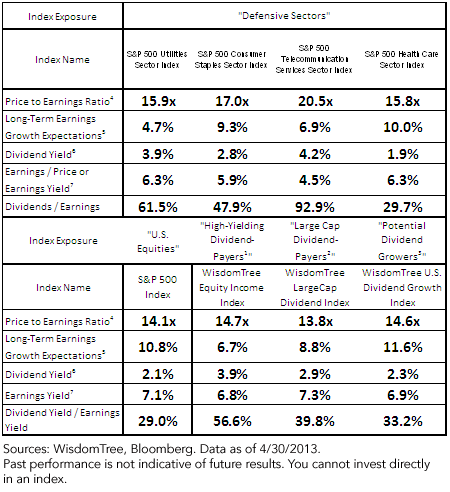

• Defensive Sector Price/Earnings (P/E) Ratios: U.S. equities, defined by the S&P 500—an index weighted by market capitalization that does not focus on dividends in any way—had a P/E ratio of slightly over 14x as of April 30, 2013. The four defensive, typically higher-dividend, sectors all had higher P/E ratios than that of broader U.S. equities, ranging from 15.8x to 20.5x. These numbers are why some analysts consider high- dividend stocks to be expensive.

• Long-Term Earnings Growth Expectations: Additionally, each of the defensive sectors has lower long-term earnings growth expectations, ranging from a low of 4.7% for Utilities to a high of 10.0% for Health Care.

• Dividend Yields: The dividend yields on these defensive sectors range from 1.9% for Health Care to 4.2% for Telecommunication Services.

• Dividend Yield / Earnings Yield: We find it interesting to compare the dividend yields of these indexes to their earnings yields in order to illustrate the impact of dividend policy. What we see is that the Telecommunication Services sector is paying out the vast majority of its earnings as dividends by this metric— that’s how it generates such a high yield. The Health Care sector is on the opposite end of the spectrum, paying out only about 30% of its earnings as dividends.

I would argue that analysts are drawing a misguided conclusion about dividend stock valuations by just looking at these particular higher-dividend sectors. When one looks at diversified baskets of dividend stocks across all market sectors, shown through the WisdomTree Indexes above, the valuation picture changes.

It is also important to remember that not all dividend strategies offer exposure to the same types of dividend-paying stocks. Some dividend indexes are designed to represent a broad basket of dividend payers, while others select stocks based on high dividend yields or dividend stocks with growth characteristics. Below, we review WisdomTree Indexes for each category along with their current valuation picture.

Similar P/E Ratios: Whether one looks at high-yielding dividend payers, large-cap dividend payers or potential dividend growers, we find the P/E ratios to be in a very narrow band and all below 15 times earnings. We find these to be very reasonable valuations, especially given where U.S. equities are by the same metric.

Primary Difference Is Dividend Payout Ratio: Because the price-to-earnings ratios and, conversely, the earnings yields (earnings-to-price ratios) are broadly similar for these indexes above dividend strategies, one of the key elements leading to the differences in dividend yields would be the payout ratio. The potential dividend growers had the lowest dividend payout ratio (dividend yield / earnings yield)—33%—and thus a lower dividend yield than the high-yielding dividend payers, which had a dividend payout ratio of 56.6%. But that is not to say that one set of stocks is dramatically more expensive than the other—the P/E ratios are similar. The story being told by the numbers is that the high-yielding dividend payers are returning more of their earnings to shareholders, whereas the potential dividend growers—similarly priced on a P/E ratio basis—are reinvesting a greater share of their earnings or returning cash to shareholders through the use of stock buybacks.

Long-Term Earnings Growth Expectations: Given the lower dividend payout ratios (and higher reinvestment in the company or use of cash to fund stock buybacks), it should not come as a surprise that high-yielding dividend payers had lower growth expectations than the potential dividend growers. Given similar price-to-earnings ratios, many might view the potential dividend growers as being more attractively priced, given their higher growth expectations.

Exposure to Expensive-Defensives

For those who believe that the defensive sectors are relatively expensive, we discuss how various dividend-focused indexes are exposed to these sectors. We believe that many investors would think all dividend indexes were always heavily exposed and that they’d be surprised to learn that the exposure actually ranged from below 30% to nearly 70% as of April 30, 2013.

For definitions of terms and indexes, visit our Glossary.

• Defensive Sector Price/Earnings (P/E) Ratios: U.S. equities, defined by the S&P 500—an index weighted by market capitalization that does not focus on dividends in any way—had a P/E ratio of slightly over 14x as of April 30, 2013. The four defensive, typically higher-dividend, sectors all had higher P/E ratios than that of broader U.S. equities, ranging from 15.8x to 20.5x. These numbers are why some analysts consider high- dividend stocks to be expensive.

• Long-Term Earnings Growth Expectations: Additionally, each of the defensive sectors has lower long-term earnings growth expectations, ranging from a low of 4.7% for Utilities to a high of 10.0% for Health Care.

• Dividend Yields: The dividend yields on these defensive sectors range from 1.9% for Health Care to 4.2% for Telecommunication Services.

• Dividend Yield / Earnings Yield: We find it interesting to compare the dividend yields of these indexes to their earnings yields in order to illustrate the impact of dividend policy. What we see is that the Telecommunication Services sector is paying out the vast majority of its earnings as dividends by this metric— that’s how it generates such a high yield. The Health Care sector is on the opposite end of the spectrum, paying out only about 30% of its earnings as dividends.

I would argue that analysts are drawing a misguided conclusion about dividend stock valuations by just looking at these particular higher-dividend sectors. When one looks at diversified baskets of dividend stocks across all market sectors, shown through the WisdomTree Indexes above, the valuation picture changes.

It is also important to remember that not all dividend strategies offer exposure to the same types of dividend-paying stocks. Some dividend indexes are designed to represent a broad basket of dividend payers, while others select stocks based on high dividend yields or dividend stocks with growth characteristics. Below, we review WisdomTree Indexes for each category along with their current valuation picture.

Similar P/E Ratios: Whether one looks at high-yielding dividend payers, large-cap dividend payers or potential dividend growers, we find the P/E ratios to be in a very narrow band and all below 15 times earnings. We find these to be very reasonable valuations, especially given where U.S. equities are by the same metric.

Primary Difference Is Dividend Payout Ratio: Because the price-to-earnings ratios and, conversely, the earnings yields (earnings-to-price ratios) are broadly similar for these indexes above dividend strategies, one of the key elements leading to the differences in dividend yields would be the payout ratio. The potential dividend growers had the lowest dividend payout ratio (dividend yield / earnings yield)—33%—and thus a lower dividend yield than the high-yielding dividend payers, which had a dividend payout ratio of 56.6%. But that is not to say that one set of stocks is dramatically more expensive than the other—the P/E ratios are similar. The story being told by the numbers is that the high-yielding dividend payers are returning more of their earnings to shareholders, whereas the potential dividend growers—similarly priced on a P/E ratio basis—are reinvesting a greater share of their earnings or returning cash to shareholders through the use of stock buybacks.

Long-Term Earnings Growth Expectations: Given the lower dividend payout ratios (and higher reinvestment in the company or use of cash to fund stock buybacks), it should not come as a surprise that high-yielding dividend payers had lower growth expectations than the potential dividend growers. Given similar price-to-earnings ratios, many might view the potential dividend growers as being more attractively priced, given their higher growth expectations.

Exposure to Expensive-Defensives

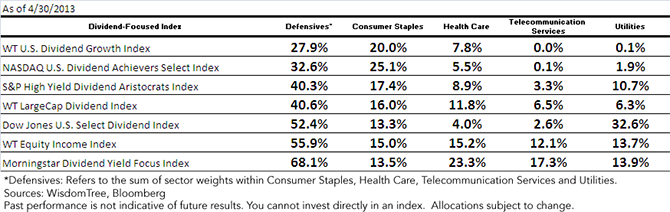

For those who believe that the defensive sectors are relatively expensive, we discuss how various dividend-focused indexes are exposed to these sectors. We believe that many investors would think all dividend indexes were always heavily exposed and that they’d be surprised to learn that the exposure actually ranged from below 30% to nearly 70% as of April 30, 2013.

For definitions of terms and indexes, visit our Glossary.

• The WisdomTree U.S. Dividend Growth and NASDAQ US Dividend Achievers Select indexes focus on dividend growth, albeit in different ways. Their exposure to the defensive sectors was on the low end of the range.

• The Dow Jones U.S. Select Dividend, WisdomTree Equity Income and Morningstar Dividend Yield Focus indexes each incorporate dividend yield into their selection methodologies, leading them to having the highest exposure to defensive sectors of all the dividend-focused indexes shown.

• The WisdomTree LargeCap Dividend Index does not focus on yield or growth as part of its selection methodology and ends up in the middle position on this chart. The S&P High Yield Dividend Aristocrats Index does in fact weight its constituents by dividend yield, but the fact that it requires 20 consecutive years of dividend growth for its constituents lowers its exposure to the defensive sectors compared to the other yield- focused approaches.

Conclusion

While one can argue that the Consumer Staples, Health Care, Telecommunication Services and Utilities sectors are becoming expensive, since they’ve led the recent rally, we believe it is a mistake to make the generalization that all dividend payers are becoming expensive based on that fact alone. Additionally, there are dividend-focused indexes that do not have majority exposure to these sectors, so avenues exist through which one can apply a dividend focus without having to seek exposure to defensive sectors.

View Jeremy Schwartz discuss dividends (Video)

Read our Dividend Growth series here.

For definitions of terms and indexes, visit our Glossary.

• The WisdomTree U.S. Dividend Growth and NASDAQ US Dividend Achievers Select indexes focus on dividend growth, albeit in different ways. Their exposure to the defensive sectors was on the low end of the range.

• The Dow Jones U.S. Select Dividend, WisdomTree Equity Income and Morningstar Dividend Yield Focus indexes each incorporate dividend yield into their selection methodologies, leading them to having the highest exposure to defensive sectors of all the dividend-focused indexes shown.

• The WisdomTree LargeCap Dividend Index does not focus on yield or growth as part of its selection methodology and ends up in the middle position on this chart. The S&P High Yield Dividend Aristocrats Index does in fact weight its constituents by dividend yield, but the fact that it requires 20 consecutive years of dividend growth for its constituents lowers its exposure to the defensive sectors compared to the other yield- focused approaches.

Conclusion

While one can argue that the Consumer Staples, Health Care, Telecommunication Services and Utilities sectors are becoming expensive, since they’ve led the recent rally, we believe it is a mistake to make the generalization that all dividend payers are becoming expensive based on that fact alone. Additionally, there are dividend-focused indexes that do not have majority exposure to these sectors, so avenues exist through which one can apply a dividend focus without having to seek exposure to defensive sectors.

View Jeremy Schwartz discuss dividends (Video)

Read our Dividend Growth series here.Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.