Middle East Countries Diverge from Traditional Emerging Markets

For definitions of the indexes in the chart, please visit our Glossary.

For standardized performance of the WisdomTree Middle East Dividend Index, click here.

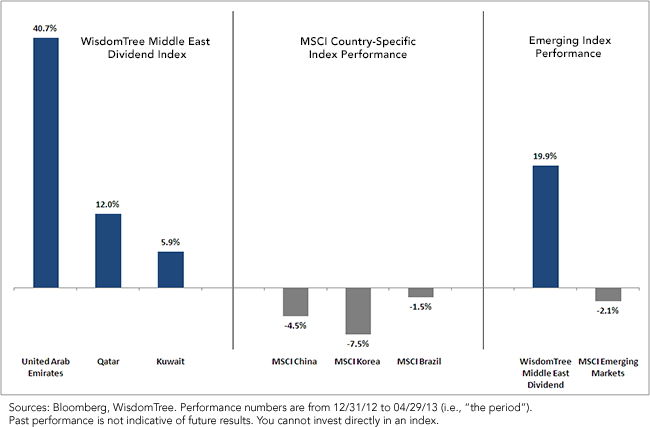

• United Arab Emirates – The stocks domiciled in the UAE have seen strong performance in both the Financials and the Telecommunication Services sectors, up 50.97% and 27.57%, respectively, over the period.

o Financials – Emirates National Bank of Dubai (NBD) has been the best performer, up over 86% over the period. The company increased its dividend in the first quarter and recently announced a quarterly net profit increase of 31% over the previous year.

o Telecommunication Services – Both Emirates Integrated Telecomm (Du) and Emirates Telecom Corporation (Etisalat) have seen strong gains over the period, up 56.26% and 22.85%, respectively. Both have recently reported increases in subscriber growth and profitability, allowing them both to raise their dividends. In the first quarter, Du raised its annual dividend by 100% over the previous year.

• Qatar – The stocks domiciled in Qatar were up by double digits on strong economic numbers. Through the end of 2012, the economy grew over 10% year-over-year and has averaged over 13% growth for the past five years.

o Industrials – Industries Qatar, around a 10% weight in the WisdomTree Middle East Dividend Index, was the largest contributor to both the individual country and overall Index performance, up over 25% year-to-date. In the first quarter, Industries Qatar announced a 13% increase in their annual cash dividend and also plans to pay a 10% stock dividend.

o Financials – Qatar National Bank, around a 5% weight in the WisdomTree Middle East Dividend Index, was up almost 8% over the period. Even more impressive was the fact that the company raised its annual cash dividend by around 65% after reporting an 11% increase in net profits for 2012.

• MSCI Indexes – All of the country-specific indexes shown above had negative returns year-to-date, and the MSCI Emerging Markets Index was also negative.

Rebounding from Market Lows

With the strong gains already experienced in 2013, it is natural to ask if there is any value left in this region. The Middle East has not participated as much as other emerging market countries in the gains off the lows of early 2009. The WisdomTree Middle East Dividend Index is still down over 12% from its inception (06/30/2008), while the MSCI Emerging Markets Index is up over 7% and the S&P 500 Index is up almost 40% during that same period.

Assuming both the MSCI Emerging Markets Index and the S&P 500 Index remain constant, the WisdomTree Middle East Dividend Index would have to rise over 22% to catch the MSCI Emerging Markets Index, and almost 60% to catch up to the S&P 500 Index.

Further Reason to Consider Middle East

One attribute of emerging market countries tends to be relatively low per capita incomes. This is a trait the largest Middle East countries do not share. In fact, the Middle East is home to some of the wealthiest countries in the world. According to International Monterary Fund (IMF) estimates,1 Qatar has a per capita gross domestic product (GDP) that is twice that of the United States, while the United Arab Emirates’ per capita GDP is more than 50% greater than that of the United States; it is also 10 times higher than that of China:

• Qatar: $99,731

• United Arab Emirates: $64,840

• United States: $49,922

• Kuwait: $45,824

• China: $6,076

Exposure to these Middle East countries thus represents a different type of emerging market allocation. Whereas China has the potential to catch up with the developed world on a per capita income basis, the largest Middle East countries already have larger income levels. The investment case is really about how these countries diversify their oil wealth into their economies and create opportunities throughout the broader region for countries such as Egypt, which are not as endowed with oil wealth and high GDP numbers.

Potential Diversification Benefits

It is important to remember that individual country returns can vary significantly year over year, and it is impossible to time the best-performing countries. As a result, we think it is important to remain diversified across the different emerging countries and not focus just on the largest by market capitalization. The WisdomTree Middle East Dividend Index tracks dividend-paying stocks in countries that tend to be under-weighted in many investors’ portfolios.

1IMF Report: April 2013 World Economic Outlook

For definitions of the indexes in the chart, please visit our Glossary.

For standardized performance of the WisdomTree Middle East Dividend Index, click here.

• United Arab Emirates – The stocks domiciled in the UAE have seen strong performance in both the Financials and the Telecommunication Services sectors, up 50.97% and 27.57%, respectively, over the period.

o Financials – Emirates National Bank of Dubai (NBD) has been the best performer, up over 86% over the period. The company increased its dividend in the first quarter and recently announced a quarterly net profit increase of 31% over the previous year.

o Telecommunication Services – Both Emirates Integrated Telecomm (Du) and Emirates Telecom Corporation (Etisalat) have seen strong gains over the period, up 56.26% and 22.85%, respectively. Both have recently reported increases in subscriber growth and profitability, allowing them both to raise their dividends. In the first quarter, Du raised its annual dividend by 100% over the previous year.

• Qatar – The stocks domiciled in Qatar were up by double digits on strong economic numbers. Through the end of 2012, the economy grew over 10% year-over-year and has averaged over 13% growth for the past five years.

o Industrials – Industries Qatar, around a 10% weight in the WisdomTree Middle East Dividend Index, was the largest contributor to both the individual country and overall Index performance, up over 25% year-to-date. In the first quarter, Industries Qatar announced a 13% increase in their annual cash dividend and also plans to pay a 10% stock dividend.

o Financials – Qatar National Bank, around a 5% weight in the WisdomTree Middle East Dividend Index, was up almost 8% over the period. Even more impressive was the fact that the company raised its annual cash dividend by around 65% after reporting an 11% increase in net profits for 2012.

• MSCI Indexes – All of the country-specific indexes shown above had negative returns year-to-date, and the MSCI Emerging Markets Index was also negative.

Rebounding from Market Lows

With the strong gains already experienced in 2013, it is natural to ask if there is any value left in this region. The Middle East has not participated as much as other emerging market countries in the gains off the lows of early 2009. The WisdomTree Middle East Dividend Index is still down over 12% from its inception (06/30/2008), while the MSCI Emerging Markets Index is up over 7% and the S&P 500 Index is up almost 40% during that same period.

Assuming both the MSCI Emerging Markets Index and the S&P 500 Index remain constant, the WisdomTree Middle East Dividend Index would have to rise over 22% to catch the MSCI Emerging Markets Index, and almost 60% to catch up to the S&P 500 Index.

Further Reason to Consider Middle East

One attribute of emerging market countries tends to be relatively low per capita incomes. This is a trait the largest Middle East countries do not share. In fact, the Middle East is home to some of the wealthiest countries in the world. According to International Monterary Fund (IMF) estimates,1 Qatar has a per capita gross domestic product (GDP) that is twice that of the United States, while the United Arab Emirates’ per capita GDP is more than 50% greater than that of the United States; it is also 10 times higher than that of China:

• Qatar: $99,731

• United Arab Emirates: $64,840

• United States: $49,922

• Kuwait: $45,824

• China: $6,076

Exposure to these Middle East countries thus represents a different type of emerging market allocation. Whereas China has the potential to catch up with the developed world on a per capita income basis, the largest Middle East countries already have larger income levels. The investment case is really about how these countries diversify their oil wealth into their economies and create opportunities throughout the broader region for countries such as Egypt, which are not as endowed with oil wealth and high GDP numbers.

Potential Diversification Benefits

It is important to remember that individual country returns can vary significantly year over year, and it is impossible to time the best-performing countries. As a result, we think it is important to remain diversified across the different emerging countries and not focus just on the largest by market capitalization. The WisdomTree Middle East Dividend Index tracks dividend-paying stocks in countries that tend to be under-weighted in many investors’ portfolios.

1IMF Report: April 2013 World Economic OutlookImportant Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment loss. You cannot invest directly in an index. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in the Middle East increase the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging, offshore or frontier markets such as the Middle East are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.