With Japan Market Sell Off, Focus on the Fundamentals

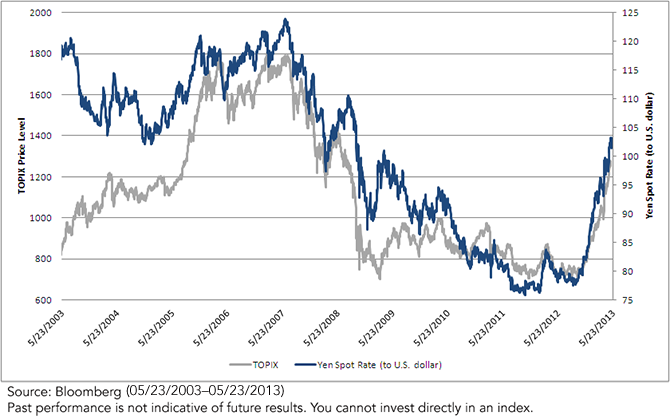

• Recently Strong Trend – The yen has weakened by more than 14.0% against the U.S. dollar, and the TOPIX has returned over 38% year-to-date. The yen has weakened over 25% since its 2011 highs against the dollar, and the TOPIX has gained over 70% since its 2012 lows.

• Still Below Recent Highs – Although the yen has weakened substantially against the U.S. dollar and the TOPIX has surged, both are below their pre-crisis levels. The yen would need to depreciate another 22%, and the TOPIX would have to appreciate over 52% for them to return to the highs set in 2007. To put this in perspective, the S&P 500 Index is currently around 4% above its 2007 high.

• Current Levels – Many experts expect the yen to weaken further against the dollar as a result of the Bank of Japan’s monetary actions and 2% inflation target. Considering the price action over the past 10 years, I also think there is more room for the yen to weaken if the Bank of Japan continues to stimulate the economy through monetary policy.

Yen Weakness May Provide Support to Earnings

The products that Japanese companies sell worldwide become cheaper to foreign buyers as the yen weakens against their domestic currencies. As these products become relatively cheaper across the globe, the demand increases, allowing Japanese companies to sell more. The companies eventually must bring the money back to Japan, and when they do, they are able to exchange the foreign currencies against more yen. This process has allowed many Japanese companies to report increases in sales and profits. Keeping valuation multiples constant, increases in company profitability potentially translate to higher equity prices.

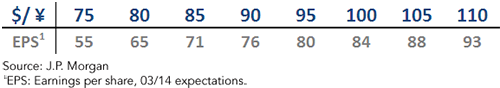

J.P. Morgan’s Japan strategist Jesper Koll conducted an excellent analysis of how he expects earnings to fluctuate for various levels of the yen exchange rate.

• Recently Strong Trend – The yen has weakened by more than 14.0% against the U.S. dollar, and the TOPIX has returned over 38% year-to-date. The yen has weakened over 25% since its 2011 highs against the dollar, and the TOPIX has gained over 70% since its 2012 lows.

• Still Below Recent Highs – Although the yen has weakened substantially against the U.S. dollar and the TOPIX has surged, both are below their pre-crisis levels. The yen would need to depreciate another 22%, and the TOPIX would have to appreciate over 52% for them to return to the highs set in 2007. To put this in perspective, the S&P 500 Index is currently around 4% above its 2007 high.

• Current Levels – Many experts expect the yen to weaken further against the dollar as a result of the Bank of Japan’s monetary actions and 2% inflation target. Considering the price action over the past 10 years, I also think there is more room for the yen to weaken if the Bank of Japan continues to stimulate the economy through monetary policy.

Yen Weakness May Provide Support to Earnings

The products that Japanese companies sell worldwide become cheaper to foreign buyers as the yen weakens against their domestic currencies. As these products become relatively cheaper across the globe, the demand increases, allowing Japanese companies to sell more. The companies eventually must bring the money back to Japan, and when they do, they are able to exchange the foreign currencies against more yen. This process has allowed many Japanese companies to report increases in sales and profits. Keeping valuation multiples constant, increases in company profitability potentially translate to higher equity prices.

J.P. Morgan’s Japan strategist Jesper Koll conducted an excellent analysis of how he expects earnings to fluctuate for various levels of the yen exchange rate.

• Earnings Expectations Increase with Yen Weakness: Given a 10-point move in the yen from ¥90 to ¥100, J.P. Morgan would expect a similar percentage increase in earnings from 76 to 84, or about a 10% increase in earnings. If the yen depreciated from ¥100 to ¥110, J.P. Morgan estimates another 10% increase in earnings, from 84 to 93.

• My base case scenario is that the yen will continue to depreciate against the U.S. dollar and EPS should increase as a result. J.P. Morgan’s model gives at least one guide for how aggregate Japan earnings might respond to this yen change.

Hedge Yourself Against Further Weakness

Although Japanese exporters may potentially benefit from further yen weakness, it does not help U.S. investors who are not hedged. When investing in foreign markets investors are exposed to movements in equity prices as well as movements in currency. Japanese equities are positive year-to-date, but the yen weakness (against the dollar) has detracted from the total return, unless the currency was hedged. It is, of course, impossible to know with certainty if the yen will weaken or strengthen against the dollar in the future, so hedging currency also helps mitigate the risk of currency impacting returns by isolating simply the equity exposure.

The WisdomTree Japan Hedged Equity Index is designed to provide exposure to Japanese equity markets while at the same time neutralizing exposure to fluctuations of the Japanese yen movements against the U.S. dollar. The Index consists of dividend-paying companies incorporated in Japan that derive less than 80% of their revenue from sources in Japan. By excluding companies that derive 80% or more of their revenue from Japan, the Index is potentially tilted toward export-oriented companies with a more significant global revenue base.

Time to invest in Japan? (Video)

• Earnings Expectations Increase with Yen Weakness: Given a 10-point move in the yen from ¥90 to ¥100, J.P. Morgan would expect a similar percentage increase in earnings from 76 to 84, or about a 10% increase in earnings. If the yen depreciated from ¥100 to ¥110, J.P. Morgan estimates another 10% increase in earnings, from 84 to 93.

• My base case scenario is that the yen will continue to depreciate against the U.S. dollar and EPS should increase as a result. J.P. Morgan’s model gives at least one guide for how aggregate Japan earnings might respond to this yen change.

Hedge Yourself Against Further Weakness

Although Japanese exporters may potentially benefit from further yen weakness, it does not help U.S. investors who are not hedged. When investing in foreign markets investors are exposed to movements in equity prices as well as movements in currency. Japanese equities are positive year-to-date, but the yen weakness (against the dollar) has detracted from the total return, unless the currency was hedged. It is, of course, impossible to know with certainty if the yen will weaken or strengthen against the dollar in the future, so hedging currency also helps mitigate the risk of currency impacting returns by isolating simply the equity exposure.

The WisdomTree Japan Hedged Equity Index is designed to provide exposure to Japanese equity markets while at the same time neutralizing exposure to fluctuations of the Japanese yen movements against the U.S. dollar. The Index consists of dividend-paying companies incorporated in Japan that derive less than 80% of their revenue from sources in Japan. By excluding companies that derive 80% or more of their revenue from Japan, the Index is potentially tilted toward export-oriented companies with a more significant global revenue base.

Time to invest in Japan? (Video)

Important Risks Related to this Article

Investments that are concentrated in Japan are more likely to be impacted by events and developments in Japan which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. ALPS Distributors, Inc. is not affiliated with J.P. Morgan.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.