In a

recent blog, I discussed one segment of the market that often gets overlooked in the hunt for income-producing asset classes: mid- and small-cap dividend payers in the United States. Most investors focus solely on the large-cap, blue-chip dividend payers, despite the fact that mid- and small caps often have higher

dividend yields, based on an analysis of the WisdomTree Dividend Indexes. When looking to the international arena, we feel that the case for dividend-paying equities could be even stronger.

International Equities Tend to Pay More Dividends

For starters, international markets generally pay more dividends than U.S. markets—which means they may represent a bigger investment opportunity set. Based on the

WisdomTree Global Dividend Index, the

Dividend Stream® as of the most recent screening date (May 31, 2012) was over $1 trillion. While the U.S. market made up 29.2% of the total

dividend stream, the developed world ex-U.S. accounted for 53.8% of it. The international developed world also tends to have higher

trailing 12-month dividend yields than the United States.

Weighting the eligible companies in our international Dividend Indexes by cash dividends enables us to potentially magnify the effect on yield and performance compared to

market capitalization-weighted indexes representing similar equity markets. Market capitalization-weighted indexes provide the benefit of as broad an exposure as possible to a given universe of stocks, but they do not directly focus on dividends or weight by fundamental factors. WisdomTree’s dividend-weighted Indexes, on the other hand, focus solely on dividend payers, and additionally, their dividend-weighted approach may serve to boost trailing 12-month dividend yields compared to market capitalization-weighted approaches. These differences in methodology should be kept in mind when considering the following analysis.

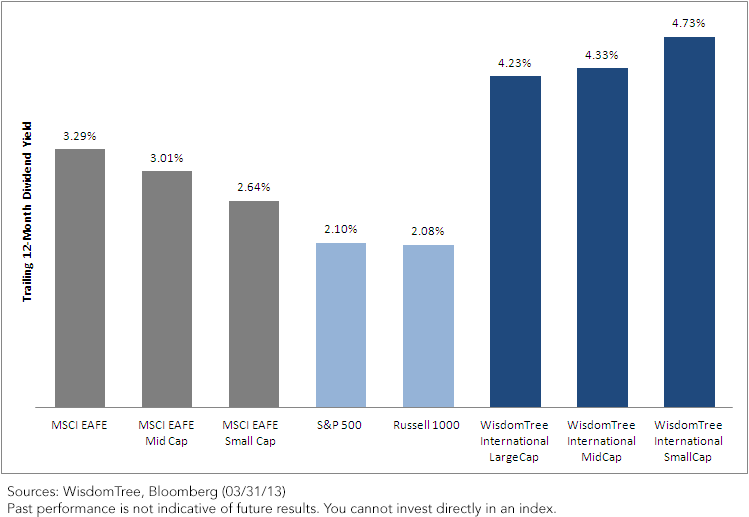

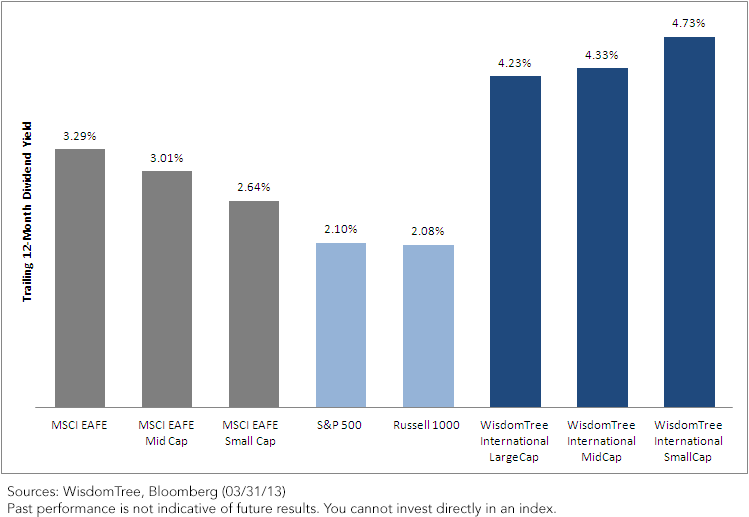

Figure 1: Dividend Yield and Size Segment of the Markets

For definitions of the indexes, visit our Glossary.

For definitions of the indexes, visit our Glossary.

•

International Equities Have Had Higher Yields – All the MSCI EAFE indexes and WisdomTree International Dividend Indexes shown above had higher trailing 12-month dividend yields than both the

S&P 500 Index and the

Russell 1000 Index.

•

WisdomTree International Dividend Indexes Have Had Highest Yields – Each of these WisdomTree International Indexes had at least twice the trailing 12-month dividend yield of the S&P 500 Index and the Russell 1000 Index. There are other notable differences between these indexes, but we think it is important to highlight the difference in dividend yield, because many domestic investors are much more heavily invested in US markets than in international markets.

•

WisdomTree International SmallCap Leads – As you move down the size spectrum in the WisdomTree International Dividend family, you see a higher trailing 12-month yield than what’s present in the MSCI EAFE indexes, where the largest-market-capitalization firms (represented by those in the

MSCI EAFE Index) have the highest trailing 12-month dividend yields.

Weighting by Fundamentals: The Dividend Difference

We believe dividends provide an objective measure of company profitability and have theoretical and empirical importance in determining stock values. Furthermore, weighting by dividends in international markets may be even more important because there are many accounting differences across various regions of the world. Dividends paid in cash represent a metric that is independent of accounting differences, making it easier to determine how one firm should be weighted against another in accordance with its fundamentals. Each stock eligible for inclusion in one of the WisdomTree International Dividend Indexes is weighted by its share of trailing 12-month dividends. In a

recent market insight, we evaluated how various indexes allocate weights to companies in different dividend yield buckets. We concluded:

•

More Weight in High Payers – The WisdomTree International Dividend Indexes tend to have higher weights in higher-yielding companies than the MSCI EAFE Index, allowing these Indexes to have potentially higher yields. All WisdomTree International Dividend Indexes have over 40% of their weight in companies with trailing 12-month dividend yields over 4%.

•

Less Weight in Low Payers – By weighting our Indexes on dividend income instead of market capitalization, we are able to potentially have lower weight in relatively lower-yielding companies and avoid companies that do not pay dividends.

Conclusion

In today’s slow-growth and low-yielding environment, many investors are looking for sources of potential income, and we believe that dividends may warrant attention for this purpose. Specifically, looking to international dividend-paying equities for increased diversification and potential increased income is something to consider.

Important Risks Related to this Article

You cannot invest directly in an index. Index performance does not represent actual Fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs or other expenses that would be incurred by a fund or portfolio, or brokerage commissions on transactions in fund shares. Such fees, expenses, and commissions could reduce returns. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.