Dissecting the Strong Performance of Australian Equities in Q1 2013

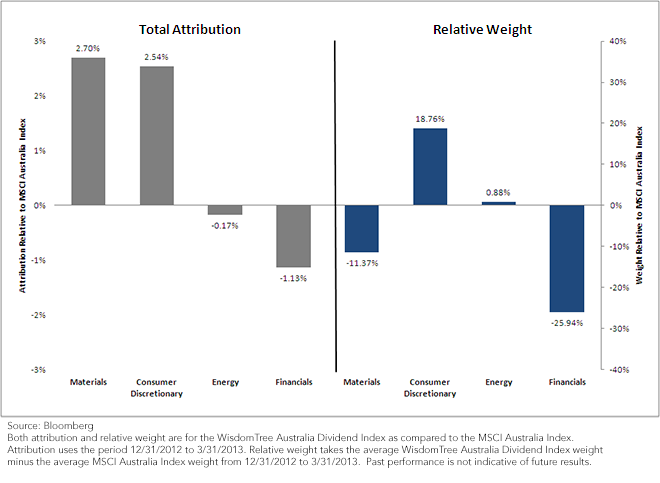

• Strongest Boost to Relative Performance: The strongest boost to relative performance came from the Materials sector, where the WisdomTree Australia Dividend Index had a nearly 11.5% under-weight. BHP Billiton LTD, a greater than 11% average weight within the MSCI Australia Index for the quarter, was down slightly over 10%. The WisdomTree Australia Dividend Index still included this rather well-known firm, but its average weight was only about 1.2%.

• Tilting Toward Consumer Discretionary: Consumer Discretionary represented a nearly 20% overweight for the WisdomTree Australia Dividend Index against the MSCI Australia Index. Within this strongly-performing sector, WisdomTree’s specific Consumer Discretionary stocks outperformed those of the MSCI Australia Index by more than 8.2%, helped by 6 firms that delivered double-digit returns. Many of these firms related to either real estate or vacation planning, so we believe they could indicate positive potential for the Australian economy.

• Biggest Detractor: The Financials sector was actually a strong performer, and since WisdomTree’s Index was almost 26% under-weight, this positioning detracted from its relative performance. At each rebalance, the WisdomTree Australia Dividend Index caps its maximum weight to any sector at 25%. Similar to the Consumer Discretionary sector’s strong performance, we believe that such performance by the Financials sector may also be indicative of confidence regarding Australia’s economic prospects.

Conclusion

The fact of the matter is that there will likely be times when each of the 10 sectors takes its turn as the strongest-performing segment within Australia’s equity market, no matter the approach. We believe that for passive indexes, greater diversification helps mitigate the risk of having large weights on the worst-performing sectors.

Data sources are WisdomTree and Bloomberg.

• Strongest Boost to Relative Performance: The strongest boost to relative performance came from the Materials sector, where the WisdomTree Australia Dividend Index had a nearly 11.5% under-weight. BHP Billiton LTD, a greater than 11% average weight within the MSCI Australia Index for the quarter, was down slightly over 10%. The WisdomTree Australia Dividend Index still included this rather well-known firm, but its average weight was only about 1.2%.

• Tilting Toward Consumer Discretionary: Consumer Discretionary represented a nearly 20% overweight for the WisdomTree Australia Dividend Index against the MSCI Australia Index. Within this strongly-performing sector, WisdomTree’s specific Consumer Discretionary stocks outperformed those of the MSCI Australia Index by more than 8.2%, helped by 6 firms that delivered double-digit returns. Many of these firms related to either real estate or vacation planning, so we believe they could indicate positive potential for the Australian economy.

• Biggest Detractor: The Financials sector was actually a strong performer, and since WisdomTree’s Index was almost 26% under-weight, this positioning detracted from its relative performance. At each rebalance, the WisdomTree Australia Dividend Index caps its maximum weight to any sector at 25%. Similar to the Consumer Discretionary sector’s strong performance, we believe that such performance by the Financials sector may also be indicative of confidence regarding Australia’s economic prospects.

Conclusion

The fact of the matter is that there will likely be times when each of the 10 sectors takes its turn as the strongest-performing segment within Australia’s equity market, no matter the approach. We believe that for passive indexes, greater diversification helps mitigate the risk of having large weights on the worst-performing sectors.

Data sources are WisdomTree and Bloomberg.Important Risks Related to this Article

You cannot invest directly in an index. Diversification does not eliminate the risk of experiencing investment losses.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.