In Search of Income: Consider Mid and Small Caps

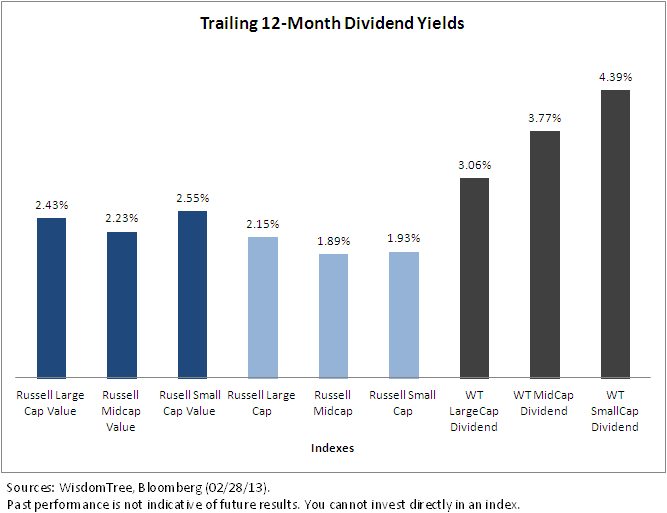

• In the current environment, WisdomTree’s domestic Dividend Indexes turn this way of thinking on its head—the WisdomTree SmallCap Dividend Index had a yield advantage over the WisdomTree MidCap Dividend Index, and the WisdomTree MidCap Dividend Index had a yield advantage over the WisdomTree LargeCap Dividend Index.

• The WisdomTree SmallCap Dividend Index had a trailing 12-month dividend yield advantage of more than 1.8% over its market cap-weighted index peers, the Russell 2000 Value and the Russell 2000 indexes.

• The WisdomTree MidCap Dividend Index had a trailing 12-month dividend yield advantage of more than 1.4% over its market cap-weighted index peers, the Russell Midcap Value and the Russell Midcap indexes.

Weighting by Fundamentals: The Dividend Difference

We believe dividends provide an objective measure of company profitability and have theoretical and empirical importance in determining stock values. Weighting eligible companies in our Indexes by their indicated dividend streams enables us to magnify the effect dividends have on performance. Each stock eligible for inclusion in an Index is weighted by its share of the dividend stream (which is the sum of regular cash dividends paid by all the companies in the Index). In a recent market insight, we evaluated how various indexes allocate weights to companies in different dividend yield buckets. We concluded here:

• Higher Weights in Highest-Dividend Stocks: For stocks with dividend yields greater than 4%, both WisdomTree MidCap and SmallCap Indexes have more than twice the weight, 25% and 32%, respectively, of their market cap-weighted value peers. The Russell Midcap Value and the Russell 2000 Value indexes have 20% and 40%, respectively, weight in companies with no indicated dividend yields.

• Non-Payers Allocations: All Russell indexes are market capitalization weighted and, as such, place the largest weights on firms with the largest market capitalizations. This means they will all have weight in non-dividend paying stocks (20% for the Russell Midcap value and 40% for the Russell 2000 Value), which, of course, are ineligible for the WisdomTree Dividend Indexes.

Conclusion

In our opinion, mid- and small-cap companies are important tools for providing diversification benefits and increased potential return. Specifically, we think that mid- and small-cap dividend-paying companies deserve a larger share than they’re currently being allocated by market cap-weighted indexes. Allocation to mid- and small-cap dividend-paying companies can increase trailing 12-month dividend yield.

At WisdomTree, we do things differently. We build our Indexes and the ETFs designed to track them with proprietary methodologies, smart structures and/or uncommon access to provide investors with the potential for income, performance, diversification and more. In the mid- and small-cap market, we believe our approach can help investors more successfully capture a higher level of income from smaller companies.

For more information on the subject, read our research here.

• In the current environment, WisdomTree’s domestic Dividend Indexes turn this way of thinking on its head—the WisdomTree SmallCap Dividend Index had a yield advantage over the WisdomTree MidCap Dividend Index, and the WisdomTree MidCap Dividend Index had a yield advantage over the WisdomTree LargeCap Dividend Index.

• The WisdomTree SmallCap Dividend Index had a trailing 12-month dividend yield advantage of more than 1.8% over its market cap-weighted index peers, the Russell 2000 Value and the Russell 2000 indexes.

• The WisdomTree MidCap Dividend Index had a trailing 12-month dividend yield advantage of more than 1.4% over its market cap-weighted index peers, the Russell Midcap Value and the Russell Midcap indexes.

Weighting by Fundamentals: The Dividend Difference

We believe dividends provide an objective measure of company profitability and have theoretical and empirical importance in determining stock values. Weighting eligible companies in our Indexes by their indicated dividend streams enables us to magnify the effect dividends have on performance. Each stock eligible for inclusion in an Index is weighted by its share of the dividend stream (which is the sum of regular cash dividends paid by all the companies in the Index). In a recent market insight, we evaluated how various indexes allocate weights to companies in different dividend yield buckets. We concluded here:

• Higher Weights in Highest-Dividend Stocks: For stocks with dividend yields greater than 4%, both WisdomTree MidCap and SmallCap Indexes have more than twice the weight, 25% and 32%, respectively, of their market cap-weighted value peers. The Russell Midcap Value and the Russell 2000 Value indexes have 20% and 40%, respectively, weight in companies with no indicated dividend yields.

• Non-Payers Allocations: All Russell indexes are market capitalization weighted and, as such, place the largest weights on firms with the largest market capitalizations. This means they will all have weight in non-dividend paying stocks (20% for the Russell Midcap value and 40% for the Russell 2000 Value), which, of course, are ineligible for the WisdomTree Dividend Indexes.

Conclusion

In our opinion, mid- and small-cap companies are important tools for providing diversification benefits and increased potential return. Specifically, we think that mid- and small-cap dividend-paying companies deserve a larger share than they’re currently being allocated by market cap-weighted indexes. Allocation to mid- and small-cap dividend-paying companies can increase trailing 12-month dividend yield.

At WisdomTree, we do things differently. We build our Indexes and the ETFs designed to track them with proprietary methodologies, smart structures and/or uncommon access to provide investors with the potential for income, performance, diversification and more. In the mid- and small-cap market, we believe our approach can help investors more successfully capture a higher level of income from smaller companies.

For more information on the subject, read our research here.

Important Risks Related to this Article

Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.