Thoughtful Index Construction Brings Scale to Emerging Markets Investing

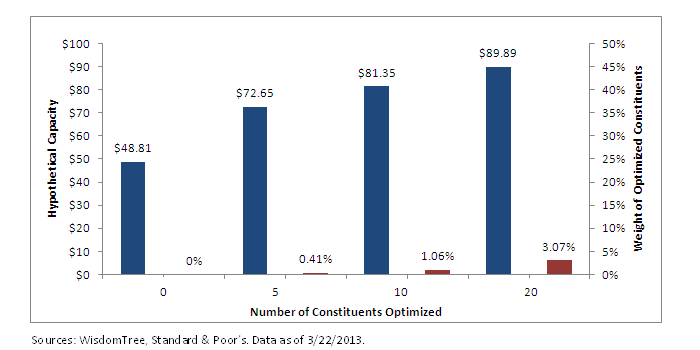

(For definitions in this chart, please refer to our glossary: Hypothetical capacity, Number of constituents optimized, Weight of optimized constituents.)

• Scalable Methodology: On March 22, 2013, the WisdomTree Emerging Markets Equity Income Index (WTEMHY) had 331 constituents. Almost $49 billion of hypothetical assets could track WTEMHY prior to that strategy holding 10% of an underlying firm.

• Optimization Helps Further: Were any hypothetical strategy tracking WTEMHY to optimize around the 5, 10 or even 20 most constraining firms, the level of hypothetical assets prior to reaching a 10% position in any underlying firm could become significantly larger. To be fair, optimization such as this could lead to greater potential for tracking error, but we believe it is important to note that even with taking the 20 most constraining firms out of the mix, this would represent only about 3% of WTEMHY’s total weight.

Innovative Methodology Drives This Result

WTEMHY is designed to weight relatively high-yielding equities within emerging markets on the basis of their cash dividend streams. In contrast to different yield-focused weighting methodologies, weighting by cash dividend stream lends a degree of scalability to the Index in that it accounts for the number of shares outstanding—something that weighting solely by dividend yield does not do. The closing of a number of high-profile active strategies re-emphasizes a benefit of index-based strategies, both in terms of their potential scalability and larger capacity.

For current holdings in the WisdomTree Emerging Markets Equity Income Index (WTEMHY), click here.

(For definitions in this chart, please refer to our glossary: Hypothetical capacity, Number of constituents optimized, Weight of optimized constituents.)

• Scalable Methodology: On March 22, 2013, the WisdomTree Emerging Markets Equity Income Index (WTEMHY) had 331 constituents. Almost $49 billion of hypothetical assets could track WTEMHY prior to that strategy holding 10% of an underlying firm.

• Optimization Helps Further: Were any hypothetical strategy tracking WTEMHY to optimize around the 5, 10 or even 20 most constraining firms, the level of hypothetical assets prior to reaching a 10% position in any underlying firm could become significantly larger. To be fair, optimization such as this could lead to greater potential for tracking error, but we believe it is important to note that even with taking the 20 most constraining firms out of the mix, this would represent only about 3% of WTEMHY’s total weight.

Innovative Methodology Drives This Result

WTEMHY is designed to weight relatively high-yielding equities within emerging markets on the basis of their cash dividend streams. In contrast to different yield-focused weighting methodologies, weighting by cash dividend stream lends a degree of scalability to the Index in that it accounts for the number of shares outstanding—something that weighting solely by dividend yield does not do. The closing of a number of high-profile active strategies re-emphasizes a benefit of index-based strategies, both in terms of their potential scalability and larger capacity.

For current holdings in the WisdomTree Emerging Markets Equity Income Index (WTEMHY), click here.Important Risks Related to this Article

You cannot invest directly in an index. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.