European Earnings Recovery Could Make Equity Markets Attractively Priced

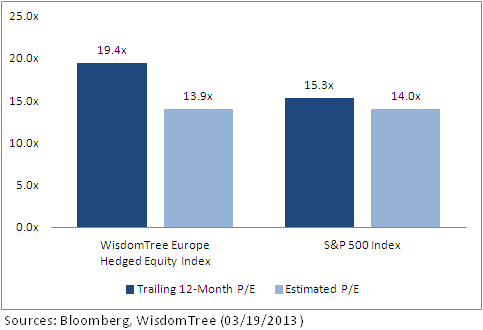

• Earnings Improvement: Using estimated earnings, the WisdomTree Europe Hedged Equity Index had a lower price-to-earnings ratio than the S&P 500 Index. This illustrates that analysts believe that an earnings recovery has the potential to take place in Europe in a number of stocks. Of course, it may not actually materialize and this P/E ratio in no way implies a certain outlook for the future.

In essence, we believe that the larger reason for the difference between these two P/E ratios is closely related to just how low earnings were over the prior 12-month period for these stocks. The sectors most responsible for the recovery in earnings over this period were Financials and Materials, which had very low cyclical earnings for a number of the large European holdings. While we cannot state whether the estimated earnings growth will in fact occur or whether stock prices will respond positively, we do believe that the expectations of earnings growth coming out of a period characterized by significant turmoil are worthy of mention. With all the talk of the various debt-related issues, it is easy to forget that many global companies within Europe are still doing business.

Long-Term Earnings Estimates1: Higher Than the S&P 500

Although the macroeconomic headwinds create uncertainty over Europe’s growth, we have to remember that exporters compete in many global markets. Thus many of these companies are not as severely impacted by Europe’s woes. One very interesting comparison of the current long-term growth estimates for Europe and the U.S. is as follows:

• WisdomTree Europe Hedged Equity Index: 11.17%

• S&P 500 Index: 10.67%

This estimate shows that many companies domiciled in the European Union are still operating, making products and selling goods to people around the world. And their growth opportunities are just as promising as those for the companies in the S&P 500 Index, if not a little better. Again, the main point is not to emphasize that these are the exact levels of earnings growth that will be seen over the coming 12-months, but rather to point out that European firms are seen as having opportunities to grow their earnings.

Hedge Your Currency Risk

European peripheral debt concerns have increased the volatility of the euro. This is not all bad news—the euro’s dropping value can increase the attractiveness of European-made products for consumers abroad. A weakening euro is also good for companies that derive a majority of their revenue from abroad, because when the company brings the overseas sales profit back to Europe, it can convert its foreign currency at a higher exchange rate.

On the other hand, a weakening euro is not good for U.S. investors in European equities—unless they hedge the currency. Currency-hedged strategies allow investors to focus on European equities without the worry over currency declines.

Conclusion

In my opinion, many dismiss Europe due to the uncertain economic situation. But Europe is a big region of the world—and investors may be concentrating too much of their allocations on the United States even though many European companies have a strong global revenue base. European equities also show attractive price-to-earnings ratios and, surprisingly, higher long-term growth estimates than U.S. equities—a combination that makes them potentially attractive opportunities.

1Source: Bloomberg (03/19/2013)

• Earnings Improvement: Using estimated earnings, the WisdomTree Europe Hedged Equity Index had a lower price-to-earnings ratio than the S&P 500 Index. This illustrates that analysts believe that an earnings recovery has the potential to take place in Europe in a number of stocks. Of course, it may not actually materialize and this P/E ratio in no way implies a certain outlook for the future.

In essence, we believe that the larger reason for the difference between these two P/E ratios is closely related to just how low earnings were over the prior 12-month period for these stocks. The sectors most responsible for the recovery in earnings over this period were Financials and Materials, which had very low cyclical earnings for a number of the large European holdings. While we cannot state whether the estimated earnings growth will in fact occur or whether stock prices will respond positively, we do believe that the expectations of earnings growth coming out of a period characterized by significant turmoil are worthy of mention. With all the talk of the various debt-related issues, it is easy to forget that many global companies within Europe are still doing business.

Long-Term Earnings Estimates1: Higher Than the S&P 500

Although the macroeconomic headwinds create uncertainty over Europe’s growth, we have to remember that exporters compete in many global markets. Thus many of these companies are not as severely impacted by Europe’s woes. One very interesting comparison of the current long-term growth estimates for Europe and the U.S. is as follows:

• WisdomTree Europe Hedged Equity Index: 11.17%

• S&P 500 Index: 10.67%

This estimate shows that many companies domiciled in the European Union are still operating, making products and selling goods to people around the world. And their growth opportunities are just as promising as those for the companies in the S&P 500 Index, if not a little better. Again, the main point is not to emphasize that these are the exact levels of earnings growth that will be seen over the coming 12-months, but rather to point out that European firms are seen as having opportunities to grow their earnings.

Hedge Your Currency Risk

European peripheral debt concerns have increased the volatility of the euro. This is not all bad news—the euro’s dropping value can increase the attractiveness of European-made products for consumers abroad. A weakening euro is also good for companies that derive a majority of their revenue from abroad, because when the company brings the overseas sales profit back to Europe, it can convert its foreign currency at a higher exchange rate.

On the other hand, a weakening euro is not good for U.S. investors in European equities—unless they hedge the currency. Currency-hedged strategies allow investors to focus on European equities without the worry over currency declines.

Conclusion

In my opinion, many dismiss Europe due to the uncertain economic situation. But Europe is a big region of the world—and investors may be concentrating too much of their allocations on the United States even though many European companies have a strong global revenue base. European equities also show attractive price-to-earnings ratios and, surprisingly, higher long-term growth estimates than U.S. equities—a combination that makes them potentially attractive opportunities.

1Source: Bloomberg (03/19/2013)Important Risks Related to this Article

One cannot directly invest in an index. Hedging strategies will not necessarily protect against investment losses. The information provided to you herein represents the opinions of WisdomTree and is not intended to be considered a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product, and it should not be relied on as such.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.