A Benefit to Hedging the Euro from a Different Perspective

(For definitions of terms in this chart, please see our Glossary.)

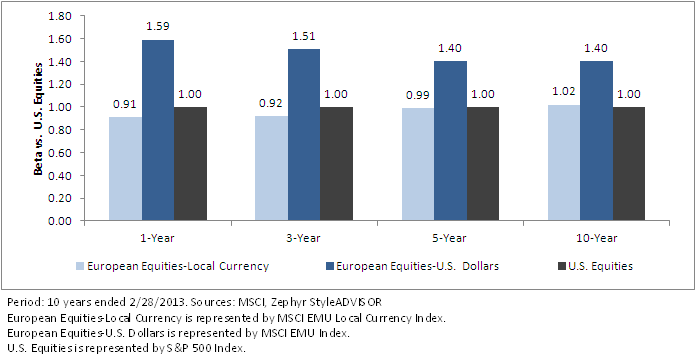

• Risk Reduction: Removing the euro risk from the equation significantly lowered the beta of European equities compared to U.S. equities. In fact, over the one-, three- and five-year periods, this index had a beta of less than 1, and the beta was approximately equal to 1 over the 10-year period.

• Incremental Risk of Euro Exposure: It is worth noting that for the 10-year period ending February 28, 2013, exposure to the euro increased the beta of European Equities by nearly 40%. Over shorter periods, this additional risk was even more pronounced.

Why Be 100% Unhedged?

When it comes to a currency such as the euro, I believe there will be cycles of both appreciation and depreciation against the U.S. dollar. Given the difficulty in predicting exactly when these cycles will turn, we question why typical allocations should always fully assume this currency risk. To me, an allocation that is 50% hedged and 50% unhedged—especially for someone without a strong view as to a currency’s future performance—would seem a better baseline to dial up or down from, depending on one’s conviction regarding the direction of any future currency trend.

Take the euro out of Europe (Video)

12/28/2003–2/28/2013.

(For definitions of terms in this chart, please see our Glossary.)

• Risk Reduction: Removing the euro risk from the equation significantly lowered the beta of European equities compared to U.S. equities. In fact, over the one-, three- and five-year periods, this index had a beta of less than 1, and the beta was approximately equal to 1 over the 10-year period.

• Incremental Risk of Euro Exposure: It is worth noting that for the 10-year period ending February 28, 2013, exposure to the euro increased the beta of European Equities by nearly 40%. Over shorter periods, this additional risk was even more pronounced.

Why Be 100% Unhedged?

When it comes to a currency such as the euro, I believe there will be cycles of both appreciation and depreciation against the U.S. dollar. Given the difficulty in predicting exactly when these cycles will turn, we question why typical allocations should always fully assume this currency risk. To me, an allocation that is 50% hedged and 50% unhedged—especially for someone without a strong view as to a currency’s future performance—would seem a better baseline to dial up or down from, depending on one’s conviction regarding the direction of any future currency trend.

Take the euro out of Europe (Video)

12/28/2003–2/28/2013.Important Risks Related to this Article

Past performance does not guarantee future results.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.