Rethinking Strategy to Increase Allocations to Asia

(For definitions of terms in this chart, please see our Glossary.)

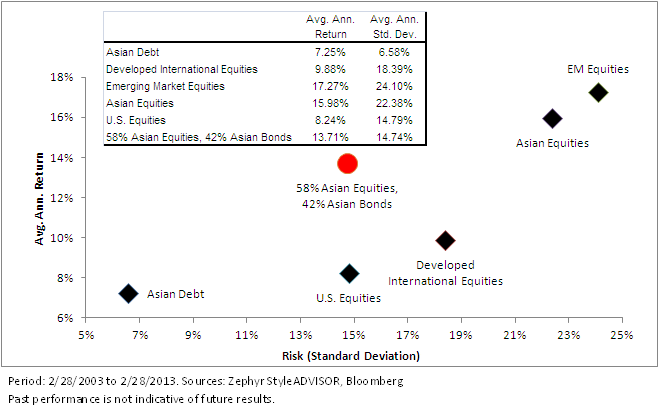

• Asian Debt: Delivered an average annual standard deviation that was approximately one-quarter that of Asian equities and less than half that of U.S. equities over the period. Asia’s debt—specifically its sovereign debt—registered a yield to maturity of 3.59% and a duration of 5.63 years—all while being 94% investment grade as of February 28, 2013.

• 58% Asian Equities/42% Asian Bonds: The combination (very close to a 60%/40% equity/bond model) delivered approximately the same level of average annual standard deviation as did U.S. equities over the past 10 years. However, the 58/42 equity/bond combination exceeded the average annual return of U.S. equities by nearly 5.5%.

Of course, there is no way to know whether this combination will produce a level of risk comparable to U.S. equities over the next 10 years, but we believe it is a worthwhile illustration of how a multi-asset class approach could have the potential to lower the volatility experienced by Asian equities alone.

Another Tool in the Search for Income Generation

When considering the aforementioned blend of Asian equities and Asian bonds, we believe that another useful attribute could relate to the current low interest rate environment. The truth of the matter is that traditional income-producing assets—such as 10-Year U.S. Treasury Notes or high-quality fixed income (Barclays U.S. Aggregate Bond Index)—remain at very low levels. As of February 28, 2013, Asian equities exhibited a higher trailing 12-month dividend yield than U.S. equities, and Asian bonds exhibited a higher yield to maturity than both high-quality fixed income and 10-Year U.S. Treasury Notes.

Further Potential Benefits with a Fundamental Focus

WisdomTree focuses on Asia with strategies for both equities and debt markets. The main difference regards a separation of market capitalization from weighting, instead focusing on fundamentals.

In the coming years, Asian countries have the potential to be engines of global growth. We believe that multi-asset-class exposure as well as a fundamental focus could have strong potential.

For more information on the subject, read our research here.

(For definitions of terms in this chart, please see our Glossary.)

• Asian Debt: Delivered an average annual standard deviation that was approximately one-quarter that of Asian equities and less than half that of U.S. equities over the period. Asia’s debt—specifically its sovereign debt—registered a yield to maturity of 3.59% and a duration of 5.63 years—all while being 94% investment grade as of February 28, 2013.

• 58% Asian Equities/42% Asian Bonds: The combination (very close to a 60%/40% equity/bond model) delivered approximately the same level of average annual standard deviation as did U.S. equities over the past 10 years. However, the 58/42 equity/bond combination exceeded the average annual return of U.S. equities by nearly 5.5%.

Of course, there is no way to know whether this combination will produce a level of risk comparable to U.S. equities over the next 10 years, but we believe it is a worthwhile illustration of how a multi-asset class approach could have the potential to lower the volatility experienced by Asian equities alone.

Another Tool in the Search for Income Generation

When considering the aforementioned blend of Asian equities and Asian bonds, we believe that another useful attribute could relate to the current low interest rate environment. The truth of the matter is that traditional income-producing assets—such as 10-Year U.S. Treasury Notes or high-quality fixed income (Barclays U.S. Aggregate Bond Index)—remain at very low levels. As of February 28, 2013, Asian equities exhibited a higher trailing 12-month dividend yield than U.S. equities, and Asian bonds exhibited a higher yield to maturity than both high-quality fixed income and 10-Year U.S. Treasury Notes.

Further Potential Benefits with a Fundamental Focus

WisdomTree focuses on Asia with strategies for both equities and debt markets. The main difference regards a separation of market capitalization from weighting, instead focusing on fundamentals.

In the coming years, Asian countries have the potential to be engines of global growth. We believe that multi-asset-class exposure as well as a fundamental focus could have strong potential.

For more information on the subject, read our research here.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.