How to Position Portfolios, Given New Market Highs

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investors shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com

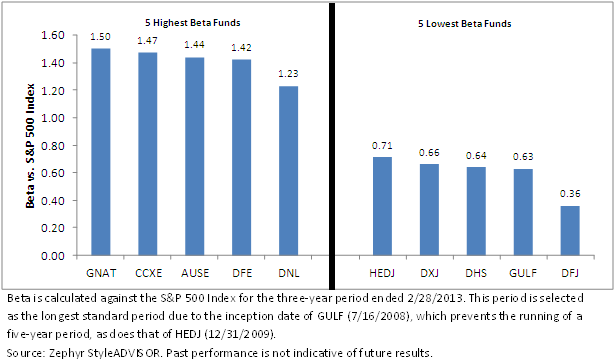

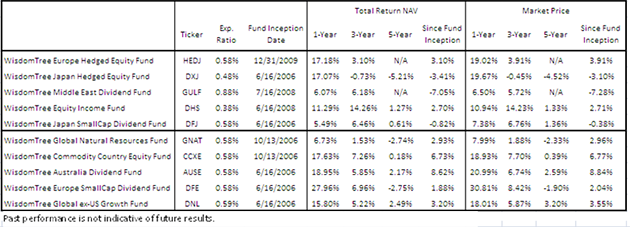

High Beta for More Bullish Views: For those who are more bullish and want to increase portfolio sensitivity to U.S. market movements, ETFs with higher beta and more sensitivity to the market—especially those focused on commodity-related equities—are a major theme.

• GNAT, AUSE and CCXE all share this sensitivity. GNAT targets dividend-paying natural resource stocks; AUSE targets dividend-paying Australian stocks; and CCXE targets dividend-paying stocks from eight different “commodity countries”1. Australia is one of the eight countries in CCXE, so it makes sense that both funds are found in this higher beta group.

• DFE and DNL round out the group with a focus on European small caps and on growth stocks outside the U.S., respectively.

Lower Beta for More Cautious Views: For those who are more cautious with respect to their viewpoint on equities, exploring lower beta exposures could be helpful.

• On the low-beta side, currency hedging is a major theme—seen in both HEDJ and DXJ for European hedged equities and Japanese hedged equities, respectively.

• GULF, a Fund consisting of exposure to the Middle East, offers strong diversification potential relative to developed markets in that it is exposed to many factors unique to that region of the world.

• DHS offers a classic focus on relatively inexpensive U.S. dividend payers.

• DFJ, which focuses on small-cap dividend-payers in Japan, is the lowest-beta Fund in WisdomTree’s lineup against the S&P 500 Index over the past three years. One reason for this is its exposure to the yen, a currency that actually has tended to appreciate during periods when global equity markets have been largely negative.

Conclusion

Every investor’s portfolio is different, and every client comes to the table with their own unique viewpoint on what they believe the market will do over the next day, week, month or even year. We believe that this analysis could be helpful in showcasing certain tools that WisdomTree can offer to assist in building portfolios and allowing clients to have flexibility in manifesting what they believe to be the most likely economic scenario—regardless of what it may be.

Unless otherwise noted, data source is Bloomberg.

1WisdomTree has developed a list of eight commodity countries, each of which having significant commodity exports: Australia, New Zealand, Canada, Norway, Brazil, Russia, South Africa and Chile.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investors shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com

High Beta for More Bullish Views: For those who are more bullish and want to increase portfolio sensitivity to U.S. market movements, ETFs with higher beta and more sensitivity to the market—especially those focused on commodity-related equities—are a major theme.

• GNAT, AUSE and CCXE all share this sensitivity. GNAT targets dividend-paying natural resource stocks; AUSE targets dividend-paying Australian stocks; and CCXE targets dividend-paying stocks from eight different “commodity countries”1. Australia is one of the eight countries in CCXE, so it makes sense that both funds are found in this higher beta group.

• DFE and DNL round out the group with a focus on European small caps and on growth stocks outside the U.S., respectively.

Lower Beta for More Cautious Views: For those who are more cautious with respect to their viewpoint on equities, exploring lower beta exposures could be helpful.

• On the low-beta side, currency hedging is a major theme—seen in both HEDJ and DXJ for European hedged equities and Japanese hedged equities, respectively.

• GULF, a Fund consisting of exposure to the Middle East, offers strong diversification potential relative to developed markets in that it is exposed to many factors unique to that region of the world.

• DHS offers a classic focus on relatively inexpensive U.S. dividend payers.

• DFJ, which focuses on small-cap dividend-payers in Japan, is the lowest-beta Fund in WisdomTree’s lineup against the S&P 500 Index over the past three years. One reason for this is its exposure to the yen, a currency that actually has tended to appreciate during periods when global equity markets have been largely negative.

Conclusion

Every investor’s portfolio is different, and every client comes to the table with their own unique viewpoint on what they believe the market will do over the next day, week, month or even year. We believe that this analysis could be helpful in showcasing certain tools that WisdomTree can offer to assist in building portfolios and allowing clients to have flexibility in manifesting what they believe to be the most likely economic scenario—regardless of what it may be.

Unless otherwise noted, data source is Bloomberg.

1WisdomTree has developed a list of eight commodity countries, each of which having significant commodity exports: Australia, New Zealand, Canada, Norway, Brazil, Russia, South Africa and Chile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.