Emerging Market Cyclical Stocks Look Inexpensive

(For definitions of terms in this chart, please see our Glossary.)

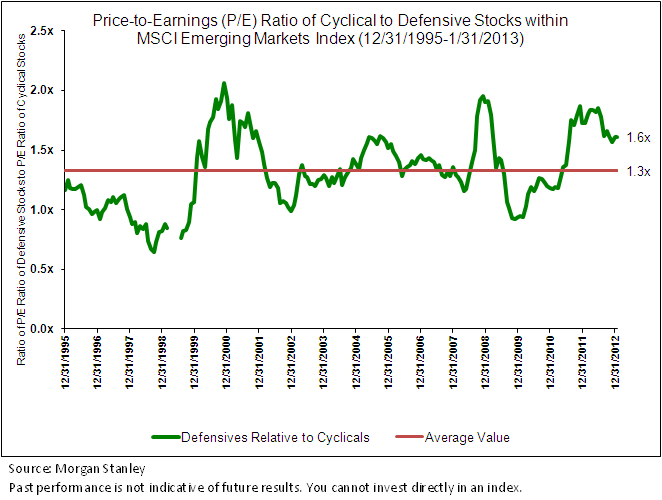

Historical Premium for Defensive Stocks

• The P/E ratio for defensives versus cyclicals is likely to remain above 1.0x. Emerging market equities tend to be riskier than equities in other regions in the world, and investors may be willing to pay a higher price to gain exposure to more defensive stocks within this space.

• Starting in 2011, emerging market defensive stocks traded at a more significant premium multiple than cyclical stocks. Obviously, this happened before, but there has been a tendency for the relationship to revert toward 1.3x and sometimes well below that level.

Put simply, according to the historical relationships exhibited between cyclical and defensive stocks in emerging markets for the period shown in the preceding figure, defensive stocks are currently “too expensive.” There are two ways that this situation might correct itself and return to its historical average:

• Defensive stocks become less expensive relative to their earnings.

• Cyclical stocks become more expensive relative to their earnings.

History Has Shown a Tendency for Correction

Research shows that when defensive stocks have traded at such expensive multiples compared to cyclical stocks in the past, their forward-looking relative performance has suffered:

• The 6-month cumulative underperformance of defensives: -7.8% (meaning they lagged cyclical stocks by this much)

• The 12-month cumulative underperformance of defensives: -16.1% (meaning they lagged cyclical stocks by this much)

There can be no guarantee that valuations will compress1 or that this relative performance will always hold, but we believe this research to be a powerful illustration encompassing almost 20 years of returns and historical relationships that Morgan Stanley has identified.

WisdomTree’s Current Positioning in Emerging Markets More to Cyclicals

WisdomTree’s Emerging Markets Equity Income Index (WTEMHY) undergoes an annual rules-based rebalance, which is based on a screen run on May 31 of each year. As of the most recent rebalance, based on the May 31, 2012, Index screening, the sectors that saw the highest increases in weight at the rebalance were in the cyclical sectors of Energy and Materials, and sectors that received lower weights at the rebalance were in the defensive basket, namely Consumer Staples and Telecommunication Services.

At no point during the annual screening does WisdomTree’s rebalance process for WTEMHY distinguish between equities that are cyclical and equities that are defensive in nature—the process is purely based on the relationship between dividend growth and price performance over the year leading up to the annual screening date. However, we believe it is worth mentioning WTEMHY’s current positioning—specifically, its over-weight toward two sectors that have underperformed for the most recent full calendar year2.

Conclusion

While there is no way to know future performance with certainty, history has shown a tendency for defensive stocks within the emerging markets to be about 1.3x as expensive as cyclical stocks on a P/E ratio basis. As of January 31, 2013, this figure was over 1.6x, indicating to us that defensive stocks may be expensive in historical terms. While no guarantee of future performance, this makes us supportive of WTEMHY’s current positioning with some of its largest weightings in the Energy and Materials sectors.

For more information on the subject, read our research here.

1“Compress” in this context means “become less expensive,” observed through a decline in the P/E ratio.

2Refers to the Energy and Materials sectors within the MSCI Emerging Markets Index for the 2012 calendar year. Source: Bloomberg.

(For definitions of terms in this chart, please see our Glossary.)

Historical Premium for Defensive Stocks

• The P/E ratio for defensives versus cyclicals is likely to remain above 1.0x. Emerging market equities tend to be riskier than equities in other regions in the world, and investors may be willing to pay a higher price to gain exposure to more defensive stocks within this space.

• Starting in 2011, emerging market defensive stocks traded at a more significant premium multiple than cyclical stocks. Obviously, this happened before, but there has been a tendency for the relationship to revert toward 1.3x and sometimes well below that level.

Put simply, according to the historical relationships exhibited between cyclical and defensive stocks in emerging markets for the period shown in the preceding figure, defensive stocks are currently “too expensive.” There are two ways that this situation might correct itself and return to its historical average:

• Defensive stocks become less expensive relative to their earnings.

• Cyclical stocks become more expensive relative to their earnings.

History Has Shown a Tendency for Correction

Research shows that when defensive stocks have traded at such expensive multiples compared to cyclical stocks in the past, their forward-looking relative performance has suffered:

• The 6-month cumulative underperformance of defensives: -7.8% (meaning they lagged cyclical stocks by this much)

• The 12-month cumulative underperformance of defensives: -16.1% (meaning they lagged cyclical stocks by this much)

There can be no guarantee that valuations will compress1 or that this relative performance will always hold, but we believe this research to be a powerful illustration encompassing almost 20 years of returns and historical relationships that Morgan Stanley has identified.

WisdomTree’s Current Positioning in Emerging Markets More to Cyclicals

WisdomTree’s Emerging Markets Equity Income Index (WTEMHY) undergoes an annual rules-based rebalance, which is based on a screen run on May 31 of each year. As of the most recent rebalance, based on the May 31, 2012, Index screening, the sectors that saw the highest increases in weight at the rebalance were in the cyclical sectors of Energy and Materials, and sectors that received lower weights at the rebalance were in the defensive basket, namely Consumer Staples and Telecommunication Services.

At no point during the annual screening does WisdomTree’s rebalance process for WTEMHY distinguish between equities that are cyclical and equities that are defensive in nature—the process is purely based on the relationship between dividend growth and price performance over the year leading up to the annual screening date. However, we believe it is worth mentioning WTEMHY’s current positioning—specifically, its over-weight toward two sectors that have underperformed for the most recent full calendar year2.

Conclusion

While there is no way to know future performance with certainty, history has shown a tendency for defensive stocks within the emerging markets to be about 1.3x as expensive as cyclical stocks on a P/E ratio basis. As of January 31, 2013, this figure was over 1.6x, indicating to us that defensive stocks may be expensive in historical terms. While no guarantee of future performance, this makes us supportive of WTEMHY’s current positioning with some of its largest weightings in the Energy and Materials sectors.

For more information on the subject, read our research here.

1“Compress” in this context means “become less expensive,” observed through a decline in the P/E ratio.

2Refers to the Energy and Materials sectors within the MSCI Emerging Markets Index for the 2012 calendar year. Source: Bloomberg.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.