We Are Still Bullish on Emerging Market Equities for 2013

(For definitions of terms in this chart, please see our Glossary.)

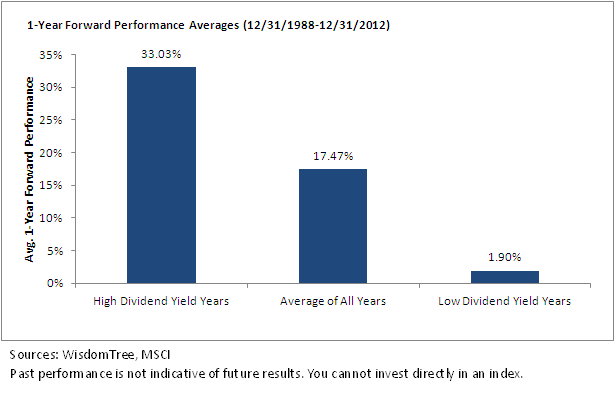

We have conducted a review of the calendar years since the MSCI Emerging Markets Index has been calculated, and have subdivided the years into two groups.

• “High Dividend Yield Years”: Years in which the starting trailing 12-month dividend yield was above the median trailing 12-month dividend yield for the MSCI Emerging Markets Index. The median trailing 12-month dividend yield was 2.25%.

• “Low Dividend Yield Years”: Years in which the starting trailing 12-month dividend yield was below the median trailing 12-month dividend yield for the MSCI Emerging Markets Index.

Based on the last 24 full calendar years of data on the MSCI Emerging Markets Index, the current trailing 12-month dividend yield—2.69% as of 1/31/2013—would rank as a low price point period. Higher trailing 12-month dividend yields indicate that a greater amount of aggregate dividends has been generated over the past 12 months relative to the current share price, while lower trailing 12-month dividend yields indicate the opposite.

• In the years following these higher trailing 12-month dividend yields3, the MSCI Emerging Markets Index had returns that averaged 33.03%4.

• During periods that ranked as more expensive for emerging markets, with lower trailing 12-month dividend yields, the average return over the 12 months that followed was just 1.90%.

• The average return for all 24 calendar years was 17.47%5.

This dramatic difference between “High Dividend Yield Years” and “Low Dividend Yield years,” to us, is a significant signal for the valuation prospects of these equities. Historical precedent has been supportive during High Dividend Yield Years such as we are witnessing today, but of course past performance is no guarantee of future results.

It is also worth noting that:

• Four of the five best yearly return periods for the MSCI Emerging Markets Index followed trailing 12-month dividend yields that ranked among the five highest of all 24 calendar year returns. Notably, at the 2008 year-end, the dividend yield on the MSCI Emerging Markets Index was 4.75% (the highest value) and the 12-month forward return of the index was 79.02% (the highest 12-month forward return).

• On the other hand, the lowest observed year-end trailing 12-month dividend yield for the MSCI Emerging Markets Index was observed on December 31, 1999, and it was followed by the second-worst of all 24 yearly returns studied, specifically -30.61%.

Conclusion

While there are many ways to view equity valuation, we believe WisdomTree’s approach provides a simple indication as to whether the MSCI Emerging Markets Index might be relatively more or less expensive when judged against its own historical record. As can be seen, index performance following less expensive valuations has been drastically different from performance that followed more expensive valuations, but of course past performance is no guarantee of future results.

For more information on the subject, read our research here.

1Emerging market equities: MSCI Emerging Markets Index for period 12/31/2011 to 12/31/2012; source: MSCI.

2Source: MSCI

3This refers to the 12 highest year-end trailing 12-month dividend yields falling above the median observation of 2.25% within the 24-calendar-year complete dataset. The median is the value within a dataset at which 50% of all observations occur above and 50% occur below.

4This average represents the average of 12 calendar years of performance for the MSCI Emerging Markets Index that specifically follow a trailing 12-month dividend yield included among the 12 highest values over the period. This is not an average annual value.

5The % represents a simple average of each of the 24 calendar years taken individually. This is not an average annual figure.

(For definitions of terms in this chart, please see our Glossary.)

We have conducted a review of the calendar years since the MSCI Emerging Markets Index has been calculated, and have subdivided the years into two groups.

• “High Dividend Yield Years”: Years in which the starting trailing 12-month dividend yield was above the median trailing 12-month dividend yield for the MSCI Emerging Markets Index. The median trailing 12-month dividend yield was 2.25%.

• “Low Dividend Yield Years”: Years in which the starting trailing 12-month dividend yield was below the median trailing 12-month dividend yield for the MSCI Emerging Markets Index.

Based on the last 24 full calendar years of data on the MSCI Emerging Markets Index, the current trailing 12-month dividend yield—2.69% as of 1/31/2013—would rank as a low price point period. Higher trailing 12-month dividend yields indicate that a greater amount of aggregate dividends has been generated over the past 12 months relative to the current share price, while lower trailing 12-month dividend yields indicate the opposite.

• In the years following these higher trailing 12-month dividend yields3, the MSCI Emerging Markets Index had returns that averaged 33.03%4.

• During periods that ranked as more expensive for emerging markets, with lower trailing 12-month dividend yields, the average return over the 12 months that followed was just 1.90%.

• The average return for all 24 calendar years was 17.47%5.

This dramatic difference between “High Dividend Yield Years” and “Low Dividend Yield years,” to us, is a significant signal for the valuation prospects of these equities. Historical precedent has been supportive during High Dividend Yield Years such as we are witnessing today, but of course past performance is no guarantee of future results.

It is also worth noting that:

• Four of the five best yearly return periods for the MSCI Emerging Markets Index followed trailing 12-month dividend yields that ranked among the five highest of all 24 calendar year returns. Notably, at the 2008 year-end, the dividend yield on the MSCI Emerging Markets Index was 4.75% (the highest value) and the 12-month forward return of the index was 79.02% (the highest 12-month forward return).

• On the other hand, the lowest observed year-end trailing 12-month dividend yield for the MSCI Emerging Markets Index was observed on December 31, 1999, and it was followed by the second-worst of all 24 yearly returns studied, specifically -30.61%.

Conclusion

While there are many ways to view equity valuation, we believe WisdomTree’s approach provides a simple indication as to whether the MSCI Emerging Markets Index might be relatively more or less expensive when judged against its own historical record. As can be seen, index performance following less expensive valuations has been drastically different from performance that followed more expensive valuations, but of course past performance is no guarantee of future results.

For more information on the subject, read our research here.

1Emerging market equities: MSCI Emerging Markets Index for period 12/31/2011 to 12/31/2012; source: MSCI.

2Source: MSCI

3This refers to the 12 highest year-end trailing 12-month dividend yields falling above the median observation of 2.25% within the 24-calendar-year complete dataset. The median is the value within a dataset at which 50% of all observations occur above and 50% occur below.

4This average represents the average of 12 calendar years of performance for the MSCI Emerging Markets Index that specifically follow a trailing 12-month dividend yield included among the 12 highest values over the period. This is not an average annual value.

5The % represents a simple average of each of the 24 calendar years taken individually. This is not an average annual figure.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.