Taking the Euro Out of Europe Has Reduced Risk

(For definitions of terms in this chart, please see our Glossary.)

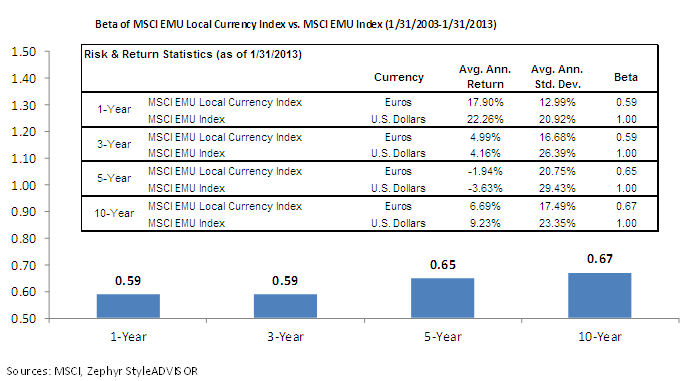

• Removing euro risk from the equation lowers the beta of the MSCI EMU Local Currency Index by 33%–35% over the 5- and 10-year periods and by over 40% over the 1- and 3-year periods ending January 31, 2013.

• The standard deviation, or risk, of the MSCI EMU Local Currency Index was just 12.99% over the last 1-year period, but the risk of the MSCI EMU Index exceeded last year’s by almost 21%.

• Even on a 10-year basis, volatility of the MSCI EMU Local Currency Index was lower (17.49%) than that of the MSCI EMU Index (23.35%).

One might counter that currency risk is worth it if it provides additional benefits in the form of higher expected returns. But I find no evidence that assuming currency risk has done any such thing. And why should it? There is no theoretical model I know of that would suggest the euro should always appreciate against the dollar. There will be times when euro exposure increases returns to European equities and times when euro weakness subtracts from returns for U.S. investors. What has tended to happen is that the euro’s fluctuations have created additional volatility for European equity indexes priced in dollars—as we saw in the major periods illustrated earlier.

I thus have been advocating that those who want to target European equities consider one of two strategies:

1) Hedge your euro exposure, as this can potentially lower the overall risk to European equities.

2) Consider a 50% euro hedged/50% euro unhedged exposure to help minimize your regret of being on the wrong side of a currency decision. I wrote about this 50/50 framework in an earlier blog.

Which Currency Exposures May Make Sense

One rationale for assuming currency risk in foreign equities that I often hear is that investors want diversification in the event of a weakening U.S. dollar. I believe this is a worthwhile goal, but why not target more directly currencies with the strongest potential fundamental prospects? Those currencies come from countries with faster economic growth, higher real interest rates, younger populations and lower levels of government debt. In my view, the euro does not qualify as one of these fundamentally strong currencies, but many emerging market currencies currently do.

Minimal Cost of Hedging the Euro Due to Small Interest Rate Differences

The cost of hedging currencies for U.S. investors is most directly impacted by the local interest rate of that market compared to the U.S. interest rate. Brazil, for instance, has a high cost of hedging the real—given the currently very high interest rates in Brazil compared to U.S. interest rates.

But interest rates in Europe and the United States are currently at very similar levels. This fact contributes to a lower cost of hedging the euro’s movements against the U.S. dollar.

Conclusion

Currency hedging strategies have come in focus in 2013 as the Japanese yen has weakened substantially and Japan’s equities have appreciated almost in lockstep with the yen’s depreciation. In a number of other markets, such as Europe, hedging currency has a different, yet equally important, motivating factor: it helps reduce volatility. The euro is a prime candidate for hedging, in my view, given all the uncertainty that still surrounds the eurozone.

To learn more about the WisdomTree Europe Hedged Equity Fund (HEDJ), click here.

Take the euro out of Europe (Video)

1Risk: Standard deviation, which measures the dispersions of actual returns about an average return during a specified period. Higher values indicate a higher chance of being further away from that average value. Risk, volatility and standard deviation are used throughout this piece to mean the same thing.

2For U.S. investors in international equities, the standard deviation of the underlying equity, as well as the standard deviation of the currency, contributes to the total standard deviation for the investment.

(For definitions of terms in this chart, please see our Glossary.)

• Removing euro risk from the equation lowers the beta of the MSCI EMU Local Currency Index by 33%–35% over the 5- and 10-year periods and by over 40% over the 1- and 3-year periods ending January 31, 2013.

• The standard deviation, or risk, of the MSCI EMU Local Currency Index was just 12.99% over the last 1-year period, but the risk of the MSCI EMU Index exceeded last year’s by almost 21%.

• Even on a 10-year basis, volatility of the MSCI EMU Local Currency Index was lower (17.49%) than that of the MSCI EMU Index (23.35%).

One might counter that currency risk is worth it if it provides additional benefits in the form of higher expected returns. But I find no evidence that assuming currency risk has done any such thing. And why should it? There is no theoretical model I know of that would suggest the euro should always appreciate against the dollar. There will be times when euro exposure increases returns to European equities and times when euro weakness subtracts from returns for U.S. investors. What has tended to happen is that the euro’s fluctuations have created additional volatility for European equity indexes priced in dollars—as we saw in the major periods illustrated earlier.

I thus have been advocating that those who want to target European equities consider one of two strategies:

1) Hedge your euro exposure, as this can potentially lower the overall risk to European equities.

2) Consider a 50% euro hedged/50% euro unhedged exposure to help minimize your regret of being on the wrong side of a currency decision. I wrote about this 50/50 framework in an earlier blog.

Which Currency Exposures May Make Sense

One rationale for assuming currency risk in foreign equities that I often hear is that investors want diversification in the event of a weakening U.S. dollar. I believe this is a worthwhile goal, but why not target more directly currencies with the strongest potential fundamental prospects? Those currencies come from countries with faster economic growth, higher real interest rates, younger populations and lower levels of government debt. In my view, the euro does not qualify as one of these fundamentally strong currencies, but many emerging market currencies currently do.

Minimal Cost of Hedging the Euro Due to Small Interest Rate Differences

The cost of hedging currencies for U.S. investors is most directly impacted by the local interest rate of that market compared to the U.S. interest rate. Brazil, for instance, has a high cost of hedging the real—given the currently very high interest rates in Brazil compared to U.S. interest rates.

But interest rates in Europe and the United States are currently at very similar levels. This fact contributes to a lower cost of hedging the euro’s movements against the U.S. dollar.

Conclusion

Currency hedging strategies have come in focus in 2013 as the Japanese yen has weakened substantially and Japan’s equities have appreciated almost in lockstep with the yen’s depreciation. In a number of other markets, such as Europe, hedging currency has a different, yet equally important, motivating factor: it helps reduce volatility. The euro is a prime candidate for hedging, in my view, given all the uncertainty that still surrounds the eurozone.

To learn more about the WisdomTree Europe Hedged Equity Fund (HEDJ), click here.

Take the euro out of Europe (Video)

1Risk: Standard deviation, which measures the dispersions of actual returns about an average return during a specified period. Higher values indicate a higher chance of being further away from that average value. Risk, volatility and standard deviation are used throughout this piece to mean the same thing.

2For U.S. investors in international equities, the standard deviation of the underlying equity, as well as the standard deviation of the currency, contributes to the total standard deviation for the investment.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.