Gaining Exposure to Emerging Market Credit Risk

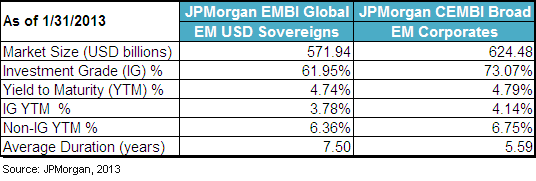

(For definitions of terms in this chart, please see our Glossary.)

In an environment where many bond investors are worried about a rise in U.S. interest rates, EM USD sovereigns have a comparable interest rate sensitivity to a 10-year U.S. Treasury Note. Since all dollar-denominated bonds with credit risk trade at a “spread”5 relative to “riskless” U.S. Treasuries, we believe that EM corporate bonds are more attractive in this environment due to their shorter duration. If rates do drift higher, EM corporates could provide a greater income cushion and lower rate sensitivity than EM USD Sovereigns. With expectations for further declines in Treasury yields limited, returns for EM USD debt are likely going to be driven by their income component (bond yields) and any changes in credit spreads (principal returns from decreases in credit risk), both of which favor EM corporates over USD sovereigns.

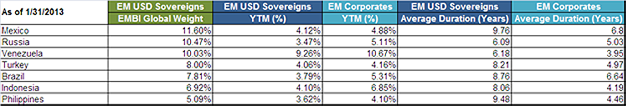

Taking a look at the top seven geographic exposures in the JPMorgan Emerging Market Bond Index – Global (EMBI Global), we see that nearly half (49.9%) of the portfolio comprises countries with a yield to maturity of around 4%. The only outlier, Venezuela, boasts a yield of over 9%. Not surprisingly, this is also the largest non-investment grade issuer and largest contributor to index yield in the EM USD sovereign universe. As a result of market capitalization-weighted bond investing, Venezuela, the 34th-largest economy in the world, has a significantly higher weighting than Brazil6, the 6th-largest economy in the world7. By focusing solely on market presence instead of economic fundamentals, market capitalization-based indexes have typically rewarded the countries that issue the largest amount of debt, regardless of their capacity to pay.

(For definitions of terms in this chart, please see our Glossary.)

In an environment where many bond investors are worried about a rise in U.S. interest rates, EM USD sovereigns have a comparable interest rate sensitivity to a 10-year U.S. Treasury Note. Since all dollar-denominated bonds with credit risk trade at a “spread”5 relative to “riskless” U.S. Treasuries, we believe that EM corporate bonds are more attractive in this environment due to their shorter duration. If rates do drift higher, EM corporates could provide a greater income cushion and lower rate sensitivity than EM USD Sovereigns. With expectations for further declines in Treasury yields limited, returns for EM USD debt are likely going to be driven by their income component (bond yields) and any changes in credit spreads (principal returns from decreases in credit risk), both of which favor EM corporates over USD sovereigns.

Taking a look at the top seven geographic exposures in the JPMorgan Emerging Market Bond Index – Global (EMBI Global), we see that nearly half (49.9%) of the portfolio comprises countries with a yield to maturity of around 4%. The only outlier, Venezuela, boasts a yield of over 9%. Not surprisingly, this is also the largest non-investment grade issuer and largest contributor to index yield in the EM USD sovereign universe. As a result of market capitalization-weighted bond investing, Venezuela, the 34th-largest economy in the world, has a significantly higher weighting than Brazil6, the 6th-largest economy in the world7. By focusing solely on market presence instead of economic fundamentals, market capitalization-based indexes have typically rewarded the countries that issue the largest amount of debt, regardless of their capacity to pay.

Ultimately, the key takeaway from the table above is simply that corporate debt in emerging markets can be used as a means of enhancing yield while at the same time reducing interest rate risk when compared to an EM sovereign-focused portfolio. However, similar to corporate issuers in the United States, it is virtually impossible for corporate bonds to trade at lower yields than sovereigns8. But in an environment where investors are attempting to generate additional income, we believe that there is value in investing in select corporate names in certain emerging market countries. As mentioned previously, we believe that the factors that led to EM USD sovereign outperformance may be waning. In our view, EM corporate bonds offer the next wave of opportunities in EM fixed income. For example, in Russia, currently the 2nd-largest geographic exposure in the WisdomTree Emerging Markets Corporate Bond Fund, investing in corporate bonds as opposed to government debt resulted in a 1.64% increase in yield, with less interest rate risk as of February 15, 2013. However, emerging market investing is not without risks. But when a fundamentally driven research process is combined with active management, we believe that EM corporate credit can provide attractive levels of income.

In an investment environment where investors are constantly questioning whether they are being adequately compensated for the amount of credit risk they are assuming, they are simultaneously confronting the prospect of higher long-term interest rates. We believe EM corporate debt could provide an attractive solution to this dilemma. By enhancing yield potential and overall credit quality, while at the same time reducing interest rate risk, EM corporate bonds could provide attractive total returns compared to EM USD sovereign debt in 2013.

Hear WisdomTree’s Bruce Lavine and Western’s portfolio manager Matt Duda discuss emerging markets corporate bonds in this podcast.

1Represented by the JPMorgan Corporate Emerging Markets Bond Index – Broad (CEMBI Broad); the index tracks total returns for U.S. dollar-denominated emerging market corporate bonds.

2Represented by the JPMorgan Emerging Markets Bond Index – Global (EMBI Global); the index tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities, including Brady bonds, loans and eurobonds. You cannot invest directly in an index.

3Credit ratings subject to change.

4JPMorgan, January 31, 2013.

5Also referred to as the “credit spread.”

6Brazil predominantly finances its government through debt issued in Brazilian real instead of U.S. dollars.

7IMF, October 2012.

8Select AAA rated corporate bonds have traded at lower yields than U.S. Treasuries. In essence, the market believed certain companies are more credit-worthy than the U.S. government.

Ultimately, the key takeaway from the table above is simply that corporate debt in emerging markets can be used as a means of enhancing yield while at the same time reducing interest rate risk when compared to an EM sovereign-focused portfolio. However, similar to corporate issuers in the United States, it is virtually impossible for corporate bonds to trade at lower yields than sovereigns8. But in an environment where investors are attempting to generate additional income, we believe that there is value in investing in select corporate names in certain emerging market countries. As mentioned previously, we believe that the factors that led to EM USD sovereign outperformance may be waning. In our view, EM corporate bonds offer the next wave of opportunities in EM fixed income. For example, in Russia, currently the 2nd-largest geographic exposure in the WisdomTree Emerging Markets Corporate Bond Fund, investing in corporate bonds as opposed to government debt resulted in a 1.64% increase in yield, with less interest rate risk as of February 15, 2013. However, emerging market investing is not without risks. But when a fundamentally driven research process is combined with active management, we believe that EM corporate credit can provide attractive levels of income.

In an investment environment where investors are constantly questioning whether they are being adequately compensated for the amount of credit risk they are assuming, they are simultaneously confronting the prospect of higher long-term interest rates. We believe EM corporate debt could provide an attractive solution to this dilemma. By enhancing yield potential and overall credit quality, while at the same time reducing interest rate risk, EM corporate bonds could provide attractive total returns compared to EM USD sovereign debt in 2013.

Hear WisdomTree’s Bruce Lavine and Western’s portfolio manager Matt Duda discuss emerging markets corporate bonds in this podcast.

1Represented by the JPMorgan Corporate Emerging Markets Bond Index – Broad (CEMBI Broad); the index tracks total returns for U.S. dollar-denominated emerging market corporate bonds.

2Represented by the JPMorgan Emerging Markets Bond Index – Global (EMBI Global); the index tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities, including Brady bonds, loans and eurobonds. You cannot invest directly in an index.

3Credit ratings subject to change.

4JPMorgan, January 31, 2013.

5Also referred to as the “credit spread.”

6Brazil predominantly finances its government through debt issued in Brazilian real instead of U.S. dollars.

7IMF, October 2012.

8Select AAA rated corporate bonds have traded at lower yields than U.S. Treasuries. In essence, the market believed certain companies are more credit-worthy than the U.S. government.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Unlike typical exchange-traded funds, there is no index that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objective will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.