ETF Basics Part 2: Understanding the Differences between ETFs vs Mutual Funds

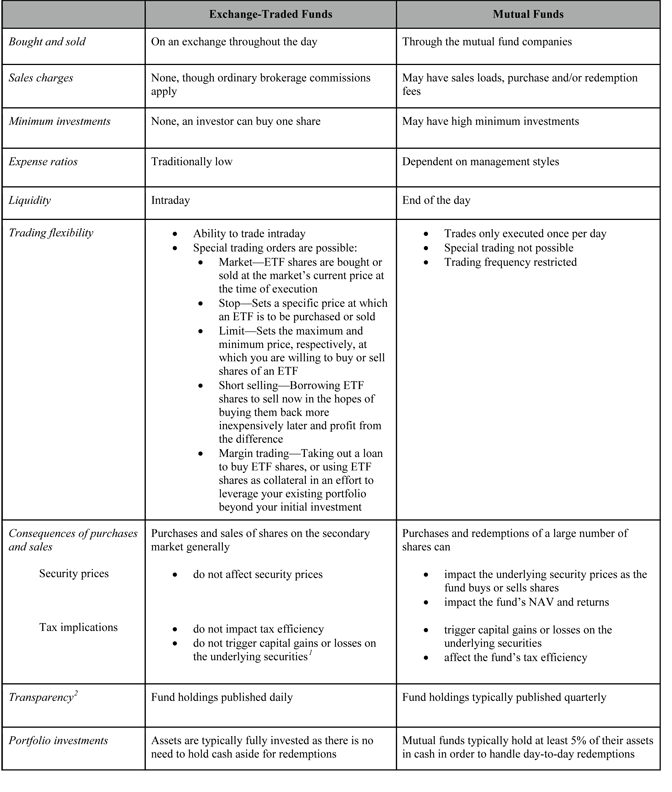

As the table illustrates, ETFs offer a number of benefits that can make them extremely effective in helping investors reach specific long-term goals. Additionally, as with mutual funds, ETFs come in every style and asset class in the investment rainbow. They can be used to complement mutual funds in an existing asset allocation, to replace mutual funds—or for an entire portfolio.

Learn more about how WisdomTree builds its unique ETFs.

1Investors will be affected by tax consequences triggered by capital gains.

2Holdings are displayed daily on the website.

As the table illustrates, ETFs offer a number of benefits that can make them extremely effective in helping investors reach specific long-term goals. Additionally, as with mutual funds, ETFs come in every style and asset class in the investment rainbow. They can be used to complement mutual funds in an existing asset allocation, to replace mutual funds—or for an entire portfolio.

Learn more about how WisdomTree builds its unique ETFs.

1Investors will be affected by tax consequences triggered by capital gains.

2Holdings are displayed daily on the website.Important Risks Related to this Article

Neither WisdomTree Investments, Inc., nor its affiliates, nor ALPS Distributors, Inc., and its affiliates, provide tax advice. Information provided herein should not be considered tax advice. Investors seeking tax advice should consult an independent tax advisor.