Aussie Dollar: “Official” Reserve Currency Status in 2013?

While Reserve Bank of Australia (RBA) governor Glenn Stevens views the IMF decision as a “classification change,” we believe that increased tracking of the Australian dollar as a reserve currency could pave the way for an increasing allocation in investor portfolios. For 2013, we believe that many of the compelling reasons investors and sovereign wealth funds bought Australian debt in 2012 could continue to provide opportunities in the first half of 2013.

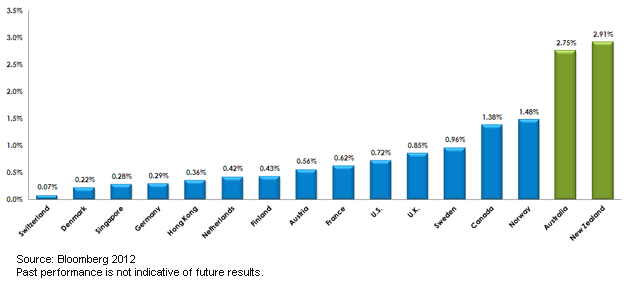

Over the previous calendar year, the WisdomTree Australia & New Zealand Debt Fund (AUNZ) performed well due to a combination of interest rate cuts, higher income potential and positive currency performance against the U.S. dollar. In 2012, the Australian and the New Zealand dollar appreciated against the U.S. dollar by 1.82% and 6.64%, respectively.2 Last September, many market pundits predicted that the Aussie dollar was overvalued, citing continuing concerns about China’s economic outlook. To support economic growth, the RBA cut interest rates by 1.25% over the course of the past year. In the face of these interest rate cuts, the Aussie dollar actually strengthened, a somewhat unexpected result. With better-than-expected economic data continuing to trickle out of China, market sentiment, as well as asset prices, could continue to rise. As ominous clouds surrounding China continue to dissipate, we believe that prospects for the Australian economy could continue to improve along with many other Asian countries. As the largest market for Australia’s commodity wealth, China was also Australia’s largest overall trading partner in 2011.3 Ultimately, we believe this improvement in the economic outlook could provide a catalyst for a rise in bond prices and investor returns.

1Sources: WisdomTree, Bloomberg, 2012.

2Source: Bloomberg, 2012

3 Australian Department of Foreign Affairs and Trade, October 2012.

While Reserve Bank of Australia (RBA) governor Glenn Stevens views the IMF decision as a “classification change,” we believe that increased tracking of the Australian dollar as a reserve currency could pave the way for an increasing allocation in investor portfolios. For 2013, we believe that many of the compelling reasons investors and sovereign wealth funds bought Australian debt in 2012 could continue to provide opportunities in the first half of 2013.

Over the previous calendar year, the WisdomTree Australia & New Zealand Debt Fund (AUNZ) performed well due to a combination of interest rate cuts, higher income potential and positive currency performance against the U.S. dollar. In 2012, the Australian and the New Zealand dollar appreciated against the U.S. dollar by 1.82% and 6.64%, respectively.2 Last September, many market pundits predicted that the Aussie dollar was overvalued, citing continuing concerns about China’s economic outlook. To support economic growth, the RBA cut interest rates by 1.25% over the course of the past year. In the face of these interest rate cuts, the Aussie dollar actually strengthened, a somewhat unexpected result. With better-than-expected economic data continuing to trickle out of China, market sentiment, as well as asset prices, could continue to rise. As ominous clouds surrounding China continue to dissipate, we believe that prospects for the Australian economy could continue to improve along with many other Asian countries. As the largest market for Australia’s commodity wealth, China was also Australia’s largest overall trading partner in 2011.3 Ultimately, we believe this improvement in the economic outlook could provide a catalyst for a rise in bond prices and investor returns.

1Sources: WisdomTree, Bloomberg, 2012.

2Source: Bloomberg, 2012

3 Australian Department of Foreign Affairs and Trade, October 2012.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. The Fund focuses its investments in Australia and New Zealand, thereby increasing the impact of events and developments in Australia and New Zealand, which can adversely affect performance. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Unlike typical exchange-traded funds, there is no index that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objective will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gains distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.