Could India Finally Be Turning the Corner?

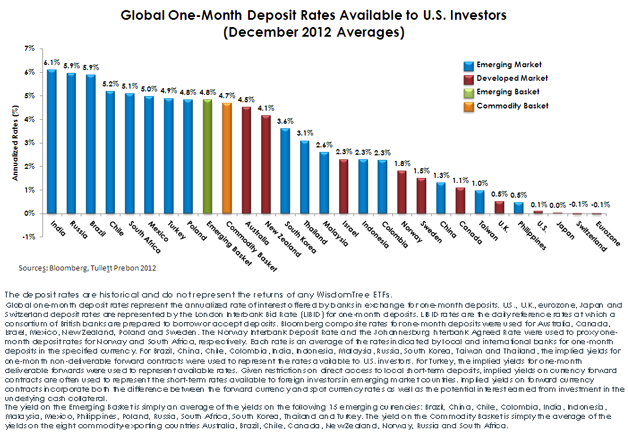

Even among its emerging market contemporaries, India, after largely holding rates steady in the previous two years, now sports an attractive level of carry over most other currencies. Specifically, the WisdomTree Indian Rupee Fund (ICN) has a 5.98% embedded income yield as of December 31, 2012. (For standardized performance, including the SEC 30-day yield for ICN click here.) The combination of exposure to local interest rates and movement in the rupee against the U.S. dollar could provide investors with an attractive rate of return in 2013. However, the health and the perception of risk assets in the global economy are crucial.

In 2013, flows could prove to be key. Should money continue to flow into the Indian debt and equity markets, the rupee could finally break its recent bout of underperformance. As our equity group has published in a recent blog, India has an attractive long-term growth story and is a country they consider underappreciated and undervalued.

As investor dollars flow into the country, they must be converted to rupees in order to buy locally denominated assets. While the currency is undervalued by nearly 62%2 on a purchasing power basis, we believe that the path of modest appreciation seems the most likely. Other potential upside surprises could develop as politicians position themselves for the 2014 elections. After a frustrating series of false starts and missteps, politicians may finally come together to push through structural reforms. We believe even minor steps in this direction could have a significant impact on investor sentiment and tolerance for risk.

While it is still far too early to call 2013 a victory for investors with exposure to India, a series of positive developments have primed the pump for positive performance. With some stimulative policy from the RBI and a generally positive outlook for emerging markets in Asia, we believe India has the potential to be a solid performer in 2013.

1Source: Bloomberg, as of 1/29/2013.

2Sources: World Bank, International Monetary Fund, WisdomTree, as of 12/31/2012.

Even among its emerging market contemporaries, India, after largely holding rates steady in the previous two years, now sports an attractive level of carry over most other currencies. Specifically, the WisdomTree Indian Rupee Fund (ICN) has a 5.98% embedded income yield as of December 31, 2012. (For standardized performance, including the SEC 30-day yield for ICN click here.) The combination of exposure to local interest rates and movement in the rupee against the U.S. dollar could provide investors with an attractive rate of return in 2013. However, the health and the perception of risk assets in the global economy are crucial.

In 2013, flows could prove to be key. Should money continue to flow into the Indian debt and equity markets, the rupee could finally break its recent bout of underperformance. As our equity group has published in a recent blog, India has an attractive long-term growth story and is a country they consider underappreciated and undervalued.

As investor dollars flow into the country, they must be converted to rupees in order to buy locally denominated assets. While the currency is undervalued by nearly 62%2 on a purchasing power basis, we believe that the path of modest appreciation seems the most likely. Other potential upside surprises could develop as politicians position themselves for the 2014 elections. After a frustrating series of false starts and missteps, politicians may finally come together to push through structural reforms. We believe even minor steps in this direction could have a significant impact on investor sentiment and tolerance for risk.

While it is still far too early to call 2013 a victory for investors with exposure to India, a series of positive developments have primed the pump for positive performance. With some stimulative policy from the RBI and a generally positive outlook for emerging markets in Asia, we believe India has the potential to be a solid performer in 2013.

1Source: Bloomberg, as of 1/29/2013.

2Sources: World Bank, International Monetary Fund, WisdomTree, as of 12/31/2012.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Unlike typical exchange-traded funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gains distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.