India’s 2012 Performance Run Extending to Early 2013

When people think of India’s future economic growth, they tend to see the potential of India’s billion-plus people rising out of poverty and into a vibrant middle class. The investment thesis then focuses on all the consumption potential (especially for products originating from the Consumer Staples sector) they will likely unlock along the way. We believe that this is a good reason to be optimistic about India’s potential growth, especially over the longer term.

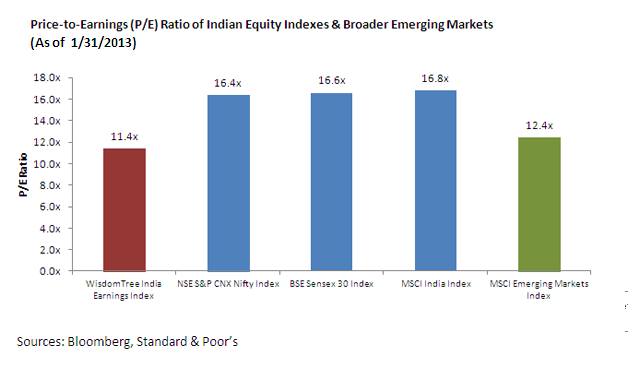

Yet this is not to say one must accept that, in thinking of India’s equities, every index measuring the performance of these shares is trading at premium prices compared to the broader emerging markets.4 WisdomTree created the India Earnings Index to help manage the valuation multiples of owning equities in India back in late 2007. The Index does so by weighting constituents by earnings, meaning that firms generating the greatest levels of profits receive the greatest weights.5

Compared to market capitalization weighting, this approach can have the effect of tilting the Index’s exposure away from companies with higher P/E ratios and focusing on those that have grown their earnings. Put simply, the Index naturally provides a disciplined focus on valuation in an equity market where we believe this is of the utmost importance.

Why consider the WisdomTree India Earnings Index?

The most common measures of India’s equity performance typically are either the Sensex or the National Stock Exchange S&P CNX Nifty Index (Nifty)—indexes that include 30 and 50 stocks, respectively. We believe these are very narrow slices of India’s markets.

India possesses a vibrant and deep equity market with many mid- and small-cap companies. The India Earnings Index contained 220 constituents as of January 31, 2013. We thus believe this Index—especially compared to the Sensex with its 30 or the Nifty with its 50 stocks—provides a more complete gauge of the equity performance of Indian firms.6

Another benefit of weighting by earnings is that it can help manage risk—and there can be little question that India is a developing country with lots of room to grow. Many firms within these equity markets—especially the smaller, more newly established ones—could be quite risky. For firms to gain eligibility in the WisdomTree India Earnings Index, they must demonstrate positive earnings on a cumulative basis over the four quarters prior to the annual Index screening date. In short, these companies must demonstrate a capability to be profitable.

Conclusion

I believe India is one of the most underappreciated and underinvested countries of the often-cited “BRIC” basket of countries. Given its large population, India has a great long-term growth story, and there are a number of potentially positive catalysts brewing from government reforms to monetary policies. This combination could have the potential to positively affect equity performance.

Data source is Bloomberg unless otherwise noted.

1Long-term growth refers to growth of earnings. Earnings growth expectations are an important driver of equity price movements, but if high expectations are ultimately not met, this could have the potential to indicate a difficult period ahead.

2India’s fundamental growth story relates to its large population (second only to China’s as of 12/31/2012), which is starting to increase its consumption.

3Refers to the Sensex, the NSE S&P CNX Nifty Index (Nifty) and the MSCI India Index, all of which are market capitalization weighted.

4Refers to how three widely noted market capitalization-weighted indexes of India’s equity performance exhibited higher P/E ratios than the MSCI Emerging Markets Index as of 1/31/2013.

5The WisdomTree India Earnings Index has constituents weighted by their core earnings streams. Standard & Poor’s constructed the core earnings measure in an attempt to capture earnings from ongoing business operations and mitigate the impact of extraordinary events. Core earnings per share are multiplied by shares outstanding, and each constituent is weighted by its proportional contribution to the total earnings of all firms within the Index. WisdomTree also adjusts constituent weights to account for foreign ownership restrictions in certain Indian firms. A firm that is limited by these restrictions would see its weight reduced below the level indicated by its contribution to the Index earnings stream.

6The MSCI India Index contained 73 constituents as of 1/31/2013. Source for all constituent data: Bloomberg.

When people think of India’s future economic growth, they tend to see the potential of India’s billion-plus people rising out of poverty and into a vibrant middle class. The investment thesis then focuses on all the consumption potential (especially for products originating from the Consumer Staples sector) they will likely unlock along the way. We believe that this is a good reason to be optimistic about India’s potential growth, especially over the longer term.

Yet this is not to say one must accept that, in thinking of India’s equities, every index measuring the performance of these shares is trading at premium prices compared to the broader emerging markets.4 WisdomTree created the India Earnings Index to help manage the valuation multiples of owning equities in India back in late 2007. The Index does so by weighting constituents by earnings, meaning that firms generating the greatest levels of profits receive the greatest weights.5

Compared to market capitalization weighting, this approach can have the effect of tilting the Index’s exposure away from companies with higher P/E ratios and focusing on those that have grown their earnings. Put simply, the Index naturally provides a disciplined focus on valuation in an equity market where we believe this is of the utmost importance.

Why consider the WisdomTree India Earnings Index?

The most common measures of India’s equity performance typically are either the Sensex or the National Stock Exchange S&P CNX Nifty Index (Nifty)—indexes that include 30 and 50 stocks, respectively. We believe these are very narrow slices of India’s markets.

India possesses a vibrant and deep equity market with many mid- and small-cap companies. The India Earnings Index contained 220 constituents as of January 31, 2013. We thus believe this Index—especially compared to the Sensex with its 30 or the Nifty with its 50 stocks—provides a more complete gauge of the equity performance of Indian firms.6

Another benefit of weighting by earnings is that it can help manage risk—and there can be little question that India is a developing country with lots of room to grow. Many firms within these equity markets—especially the smaller, more newly established ones—could be quite risky. For firms to gain eligibility in the WisdomTree India Earnings Index, they must demonstrate positive earnings on a cumulative basis over the four quarters prior to the annual Index screening date. In short, these companies must demonstrate a capability to be profitable.

Conclusion

I believe India is one of the most underappreciated and underinvested countries of the often-cited “BRIC” basket of countries. Given its large population, India has a great long-term growth story, and there are a number of potentially positive catalysts brewing from government reforms to monetary policies. This combination could have the potential to positively affect equity performance.

Data source is Bloomberg unless otherwise noted.

1Long-term growth refers to growth of earnings. Earnings growth expectations are an important driver of equity price movements, but if high expectations are ultimately not met, this could have the potential to indicate a difficult period ahead.

2India’s fundamental growth story relates to its large population (second only to China’s as of 12/31/2012), which is starting to increase its consumption.

3Refers to the Sensex, the NSE S&P CNX Nifty Index (Nifty) and the MSCI India Index, all of which are market capitalization weighted.

4Refers to how three widely noted market capitalization-weighted indexes of India’s equity performance exhibited higher P/E ratios than the MSCI Emerging Markets Index as of 1/31/2013.

5The WisdomTree India Earnings Index has constituents weighted by their core earnings streams. Standard & Poor’s constructed the core earnings measure in an attempt to capture earnings from ongoing business operations and mitigate the impact of extraordinary events. Core earnings per share are multiplied by shares outstanding, and each constituent is weighted by its proportional contribution to the total earnings of all firms within the Index. WisdomTree also adjusts constituent weights to account for foreign ownership restrictions in certain Indian firms. A firm that is limited by these restrictions would see its weight reduced below the level indicated by its contribution to the Index earnings stream.

6The MSCI India Index contained 73 constituents as of 1/31/2013. Source for all constituent data: Bloomberg.

Important Risks Related to this Article

Past performance is not indicative of future results. You cannot invest directly in an index. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in India thereby increase the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.