Brace yourself for your third-quarter account statement in late October; you might be surprised to see some deductions that are separate from movements in the markets.

Even though plan participants received notice of greater fee disclosure back in August—account plans must now disclose fees they charge for distribution, marketing and other costs in addition to fund management expenses—this may not have seemed significant until applied to one’s very own 401(k) retirement plan. According to the Labor Department, there currently are an estimated 483,000 individual retirement account plans out there, covering roughly 72 million participants. 401(k) plan participants who do not use

exchange-traded funds (ETFs), and therefore have not had the benefit of transparent fees, are potentially in for a rude awakening.

By design, ETFs offer daily transparency of holdings

1 as well as transparency of fund management costs. More specifically, ETFs typically have only one, unitary share class and no

12b-1 fee structure. They do not carry any

bundled fees or

revenue sharing, so they are already aligned with the new requirements on fee disclosure. With ETFs, you always know what you own and what you paid for it. So, as far as your late-October account statements—no surprises.

Why do fees matter? Let me take you through a real-life example.

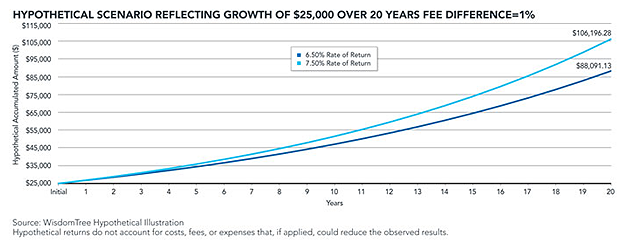

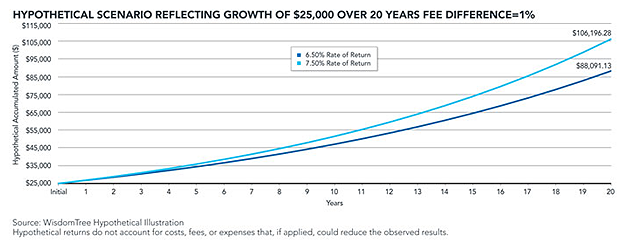

A difference of just 1% in total fees can have a significant impact on participant savings—an effect that increases over time. Let’s say your initial investment is $25,000. If we are comparing apples-to-apples, hypothetically, your return should be 7.5%, but because of the additional 1% in fees, the net return is 6.5%. In the higher-fee scenario, over the course of 20 years a $25,000 investment with a 6.5% return will grow to about $88,091.13. But in the lower-fee scenario, a $25,000 investment with a 7.5% return will grow to about $106,196.28 over the same amount of time.

Considering that retirement plans typically have long-term horizons, in just 20 years, a seemingly small 1% fee distinction can make all the difference.

Aside from full transparency of fees, I believe there are a host of important advantages that can make ETFs a great tool for retirement investors.

To learn more about using ETFs in a 401(k) plan, visit the WisdomTree website: www.wisdomtree.com/401k/

1Holdings are displayed daily on the company’s website.

Sean Kelly is a registered representative of ALPS Distributors, Inc.

Aside from full transparency of fees, I believe there are a host of important advantages that can make ETFs a great tool for retirement investors.

To learn more about using ETFs in a 401(k) plan, visit the WisdomTree website: www.wisdomtree.com/401k/

1Holdings are displayed daily on the company’s website.

Sean Kelly is a registered representative of ALPS Distributors, Inc.

Aside from full transparency of fees, I believe there are a host of important advantages that can make ETFs a great tool for retirement investors.

To learn more about using ETFs in a 401(k) plan, visit the WisdomTree website: www.wisdomtree.com/401k/

1Holdings are displayed daily on the company’s website.

Sean Kelly is a registered representative of ALPS Distributors, Inc.