Clarifying Confusion: American Depository Receipts (ADRs) Have Currency Risk Despite Trading in the U.S.

Many assume that because ADRs trade in U.S. dollars in the United States, they eliminate currency risk. Because of the way ADRs are structured, they still contain currency risk, as we illustrated. In the example we used, currency helped investors in the ADRs. But currency can also take away from returns to investors in ADRs or other international equities. For those looking to hedge the currency risk within their foreign stocks, ADRs are no substitute for strategies that actually employ a specific currency-hedging program.

1Source: MSCI.

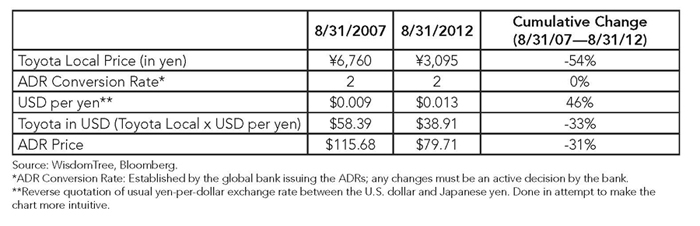

2Sources: MSCI, Bloomberg. The Toyota price in U.S. dollars equals the local price multiplied by the number of U.S. dollars per yen. This converts local price into U.S. dollar terms.

Many assume that because ADRs trade in U.S. dollars in the United States, they eliminate currency risk. Because of the way ADRs are structured, they still contain currency risk, as we illustrated. In the example we used, currency helped investors in the ADRs. But currency can also take away from returns to investors in ADRs or other international equities. For those looking to hedge the currency risk within their foreign stocks, ADRs are no substitute for strategies that actually employ a specific currency-hedging program.

1Source: MSCI.

2Sources: MSCI, Bloomberg. The Toyota price in U.S. dollars equals the local price multiplied by the number of U.S. dollars per yen. This converts local price into U.S. dollar terms.Important Risks Related to this Article

Holdings of WisdomTree Funds are displayed daily at wisdomtree.com.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.