In 2006, WisdomTree launched with a big idea and an impressive mission — to create a better way to invest.

We believed investors shouldn’t have to choose between cost efficiency and performance potential, so we developed the first family of ETFs designed to deliver both. Our strategies combine the promise of active management, such as the potential of outperformance against a benchmark, with the benefits of passive management to create ETFs built for performance. WisdomTree has launched many first-to-market ETFs and pioneered alternative weighting methods commonly referred to as “smart beta.” But our ETFs are not beta, smart or otherwise—they are an investment innovation we call "Modern Alpha®".

RELATED LINKS

What Is Modern Alpha®?

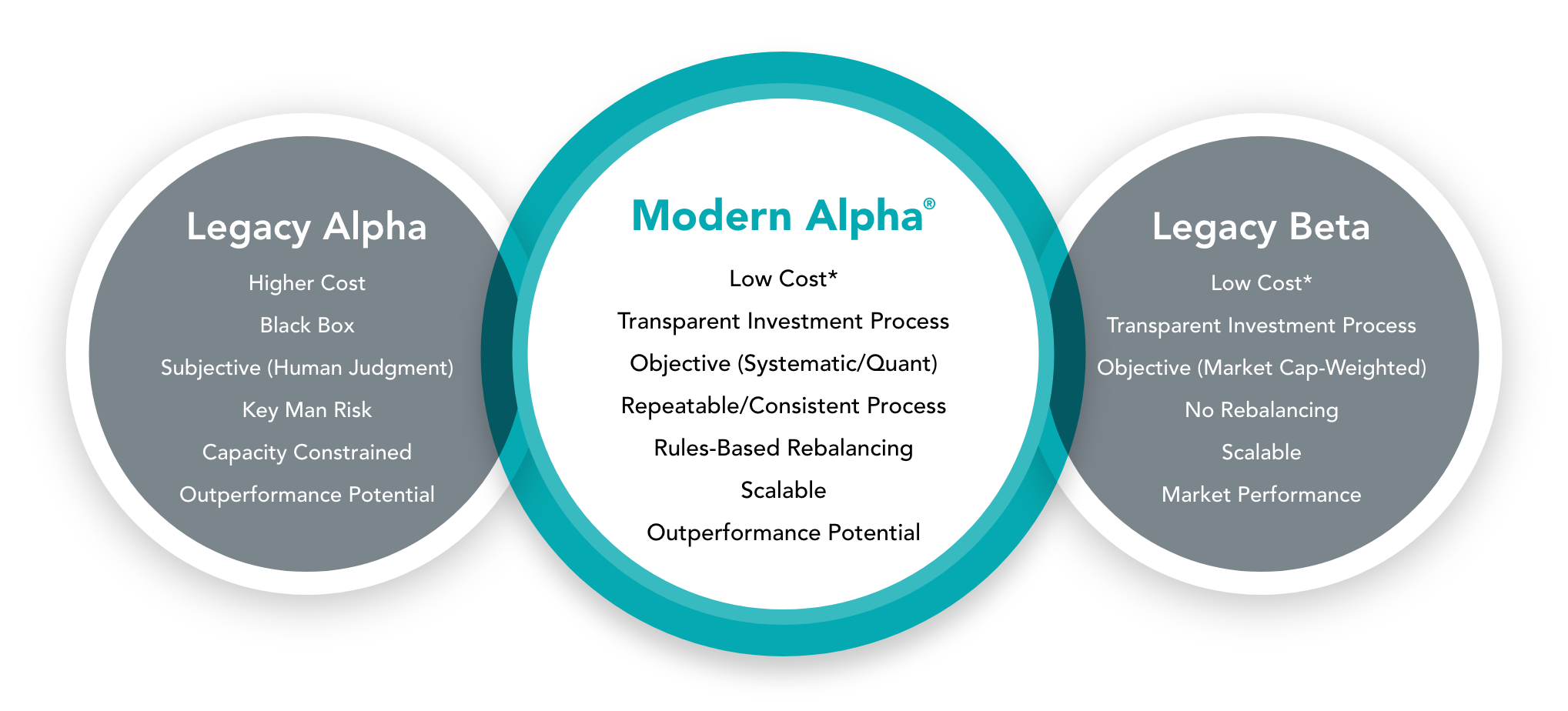

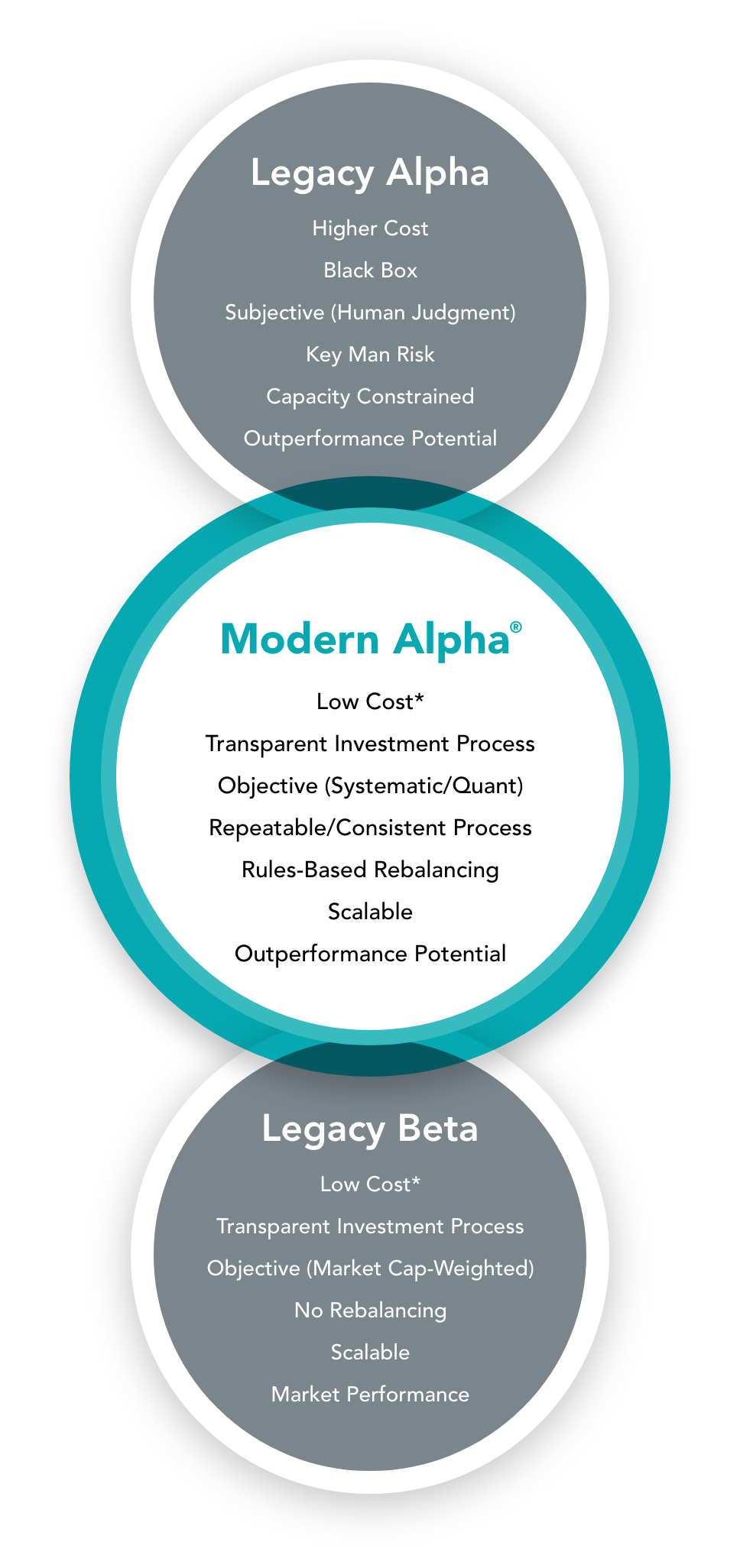

At WisdomTree, we believe investors shouldn’t have to choose between cost efficiency and performance potential. Modern Alpha® combines the outperformance potential of active management with the benefits of passive management—to offer investors cost-effective funds that are built for performance.

The traditional active management, or “legacy alpha” can often carry higher cost, less transparency in your portfolio and the risk of human judgment. But it can also mean an outperformance potential. The traditional passive investing, or “legacy beta” usually offers lower cost, and more transparency and objectivity. But it doesn’t give investors the opportunity to potentially outperform the market. Modern Alpha® combines the positives of each of the legacy investment approaches to enhance the investment experience.

The Benefits of Modern Alpha®

In an environment where investors demand more value for their money, where regulations increasingly concern investors best interests, and where fee pressure is growing, ETFs offer a number of advantages including lower fees, zero investment minimums, greater transparency, and more. Of course, not all ETFs are created equal.

WisdomTree’s Modern Alpha® ETFs offer additional advantages, including the potential for:

- Enhanced portfolio returns

- Increased dividend income

- Reduced portfolio volatility and risk

- More efficient exposure to risk premiums

Our Modern Alpha® Family

About WisdomTree

WisdomTree is a global financial innovator, empowering investors to shape their future and supporting financial professionals to better serve their clients and grow their businesses.